New Report: Small Merchants Found More Effective Than Enterprise Rivals in Resolving Credit Card Disputes

Fraudulent transaction disputes are an unwelcome fact of life for all merchants and can represent significant financial and administrative burdens. Our data shows that the largest merchants lose 0.51% of annual revenue in this way.

This problem has not gone unnoticed. Visa recently announced a change effective in the spring of 2023 to manage first-party fraud, also known as intentional misuse by cardholders. Merchants can supply information to prove the validity of a disputed transaction. If the purchase is proven to be legitimate and authorized by the cardholder, the dispute will be dismissed and not count against a merchant’s fraud ratio.

For Dispute-Prevention Solutions: The Bottom-Line Benefits Of Third-Party Solutions, a PYMNTS and Verifi collaboration, we surveyed 301 merchants that generated revenue from web-based and mobile apps in four business categories — retail, entertainment and gaming, travel and leisure and digital subscription services — from Dec. 7, 2021, to Jan. 7, 2022, about the tools they use to resolve disputed credit card transactions.

Key findings from the playbook include:

Key findings from the playbook include:

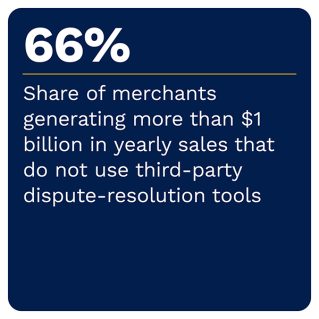

• Merchants with more than $1 billion in annual sales lose 0.51% of annual revenue to card transaction disputes. Large merchants that rely on proprietary dispute-management tools lose substantially more than the 0.38% of revenues given up to disputed card transactions by smaller merchants that use third-party tools.

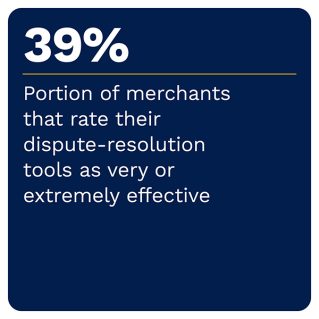

• Merchants that do not use third-party dispute-resolution tools have 0.61% of card transactions disputed. This share is significantly higher than the 0.39% of transactions disputed among merchants relying strictly upon third-party tools. This disparity underscores the value merchants can obtain by relying more on third-party rather than proprietary tools.

• Twenty-four percent of merchants with more than $1 billion in yearly sales saw the revenue lost to disputed transactions increase during the past year, an increase from the previous year. Thirty-three percent saw an increase in the number of transactions caught up in disputes.

• Twenty-four percent of merchants with more than $1 billion in yearly sales saw the revenue lost to disputed transactions increase during the past year, an increase from the previous year. Thirty-three percent saw an increase in the number of transactions caught up in disputes.

Merchants understand that they need effective tools to shield themselves from fraudulent card transactions and resolve customer disputes when they arise. When merchants recognize that they can achieve more effective solutions by relying on third-party tools, they can better control losses from fraudulent card transactions.

To learn more about how merchants use third-party tools to bolster their protections against fraudulent card disputes, download the playbook.