Report: Merchants Overestimate Their Own Dispute-Resolution Skills

The online shopping surge of the past two years heightened the risk of credit card fraud and drove many merchants to invest more heavily in anti-fraud measures. Merchants tend to rely on a mix of proprietary and third-party tools to resolve transaction disputes and clamp down on fraud, but PYMNTS researchers found that many merchants have a skewed view of their systems’ effectiveness.

The online shopping surge of the past two years heightened the risk of credit card fraud and drove many merchants to invest more heavily in anti-fraud measures. Merchants tend to rely on a mix of proprietary and third-party tools to resolve transaction disputes and clamp down on fraud, but PYMNTS researchers found that many merchants have a skewed view of their systems’ effectiveness.

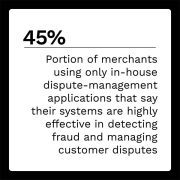

Merchants that rely primarily or exclusively on proprietary tools for resolving transaction disputes and preventing fraud tend to rate their in-house tools’ effectiveness very highly. Merchants who rely mainly on third-party tools tend to view them as less effective. Our data reveals that these chargeback and fraud prevention tools work very differently from merchants’ perceptions, however.

These are a few of the findings in Dispute-Prevention Solutions: Third-Party Tools Limit Dispute-Related Losses, a PYMNTS and Verifi collaboration examining the tools businesses use to manage disputed card transactions and their systems’ effectiveness at limiting losses from disputes and fraud. We surveyed 301 merchants in four business categories — retail, travel and leisure, entertainment and gaming and digital subscription services — from Dec. 7, 2021, to Jan. 7, 2022.

These are a few of the findings in Dispute-Prevention Solutions: Third-Party Tools Limit Dispute-Related Losses, a PYMNTS and Verifi collaboration examining the tools businesses use to manage disputed card transactions and their systems’ effectiveness at limiting losses from disputes and fraud. We surveyed 301 merchants in four business categories — retail, travel and leisure, entertainment and gaming and digital subscription services — from Dec. 7, 2021, to Jan. 7, 2022.

Some additional key findings include:

• Forty-six percent of merchants surveyed say they systematically overidentify fraud when it involves a suspicious transaction by a relative of the cardholder. Another 9.8% say they systematically underidentify fraud, and only 44% say their measurements of this kind of family-based fraud are accurate.

• Sixty-one percent of merchants surveyed who have had to deal with customer disputes have encountered family fraud, which involves a family member using the cardholder’s card. This type of dispute is brought to the merchant’s attention because of an issue that arose after the purchase, such as the customer’s dissatisfaction with the product or service, and it usually has very little to do with outright fraud.

• Fifty-six percent of businesses surveyed say third-party dispute-management tools provide a better experience for customers than their in-house applications and do a better job limiting the risk that the merchant will lose the customer. Additionally, 51% say third-party tools improve relationships with customers, and 44% say the tools help improve customers’ trust in the merchants.

Disputed card payments have long been one of the most challenging problems merchants have to address after a purchase has been made, primarily because the dispute may lead to a loss of revenue. If the dispute means a customer remains dissatisfied, the merchant may lose that customer forever.

Disputed card payments have long been one of the most challenging problems merchants have to address after a purchase has been made, primarily because the dispute may lead to a loss of revenue. If the dispute means a customer remains dissatisfied, the merchant may lose that customer forever.

While many merchants count on the effectiveness of their in-house tools to shield them from cardholders who attempt to abuse the dispute-resolution process, PYMNTS’ research has shown that third-party systems are more effective than what many merchants can implement by relying solely on their own resources. To have effective dispute resolution and fraud prevention processes, merchants must recognize when a third party has a better answer that will limit their losses from fraud and lower their overall costs.

To learn more about how merchants resolve cardholder disputes and combat fraud, download the report.