The Data Point: 68% of B2B Firms in Retail, Manufacturing Unsatisfied With Fraud Solution

As goes the online marketplace, so goes fraud. Cybercrooks treat online marketplaces like great fishing spots, ceaselessly testing for vulnerabilities — and often finding them — to exploit.

Risk and Resilience: A Business Fraud and ID Theft Report, a PYMNTS and TreviPay collaboration, explores the fraud landscape in B2B marketplaces and eCommerce, with retailers, manufacturers and marketplaces each accounting for one-third of the survey sample.

What we find is B2B marketplaces in transition as they plumb the depths of the problem and seek to harden defenses and fine-tune fraud detection with proactive automation.

- 68% of marketplaces and organizations in the retail and manufacturing sectors are not very satisfied with the systems they use to detect fraudulent businesses

Automation of digital identity verification is one powerful solution used widely by companies that report being more satisfied with their anti-fraud platforms and tools.

PYMNTS research found that 68% of organizations that are “slightly” or “not at all” satisfied with their current anti-fraud approaches “report that the implementation of new, automated anti-fraud methods is their primary anti-fraud strategy,” which means they’re taking action.

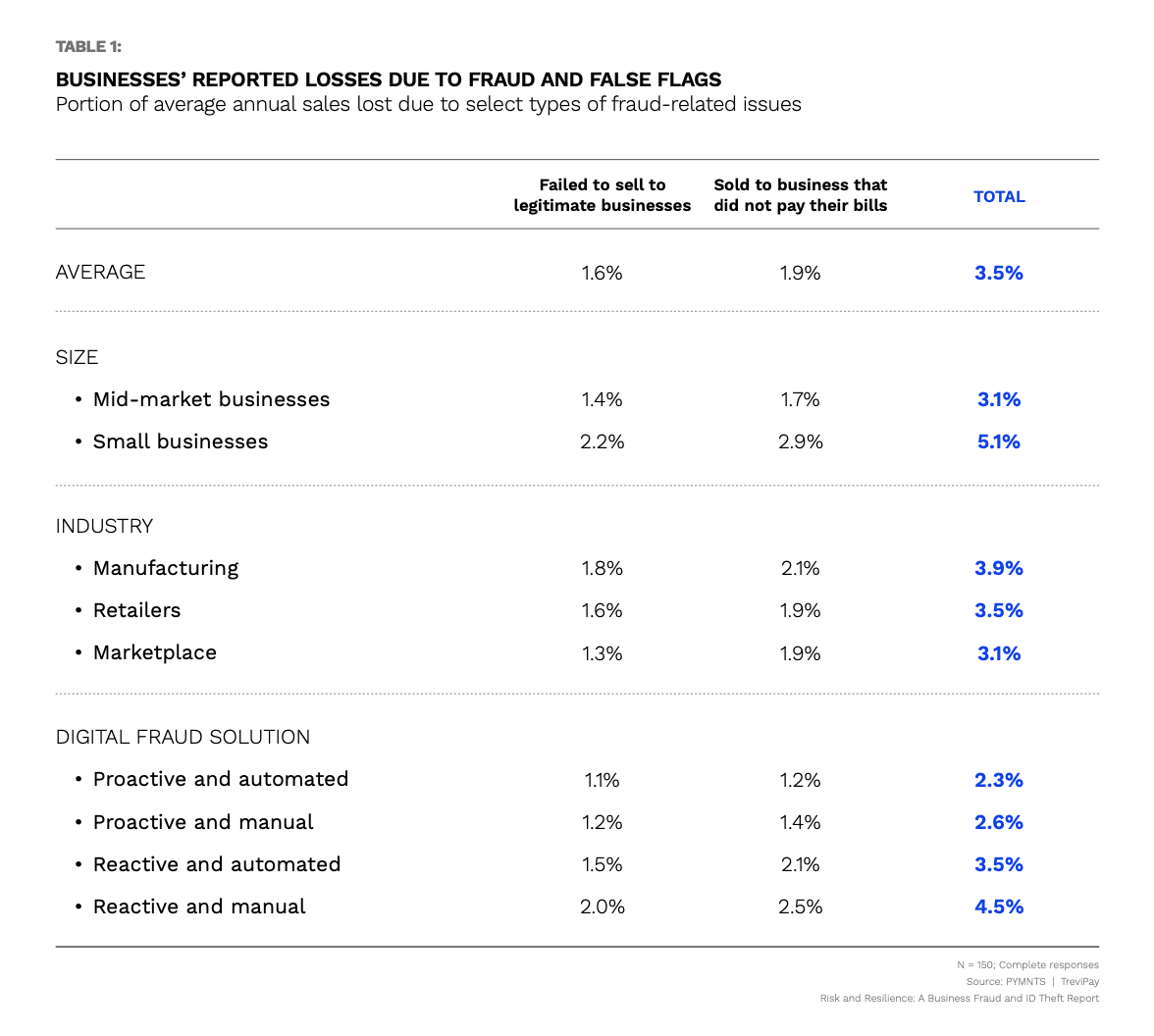

- 30% of businesses have lost 3.5% or more of their annual sales revenues to fraud

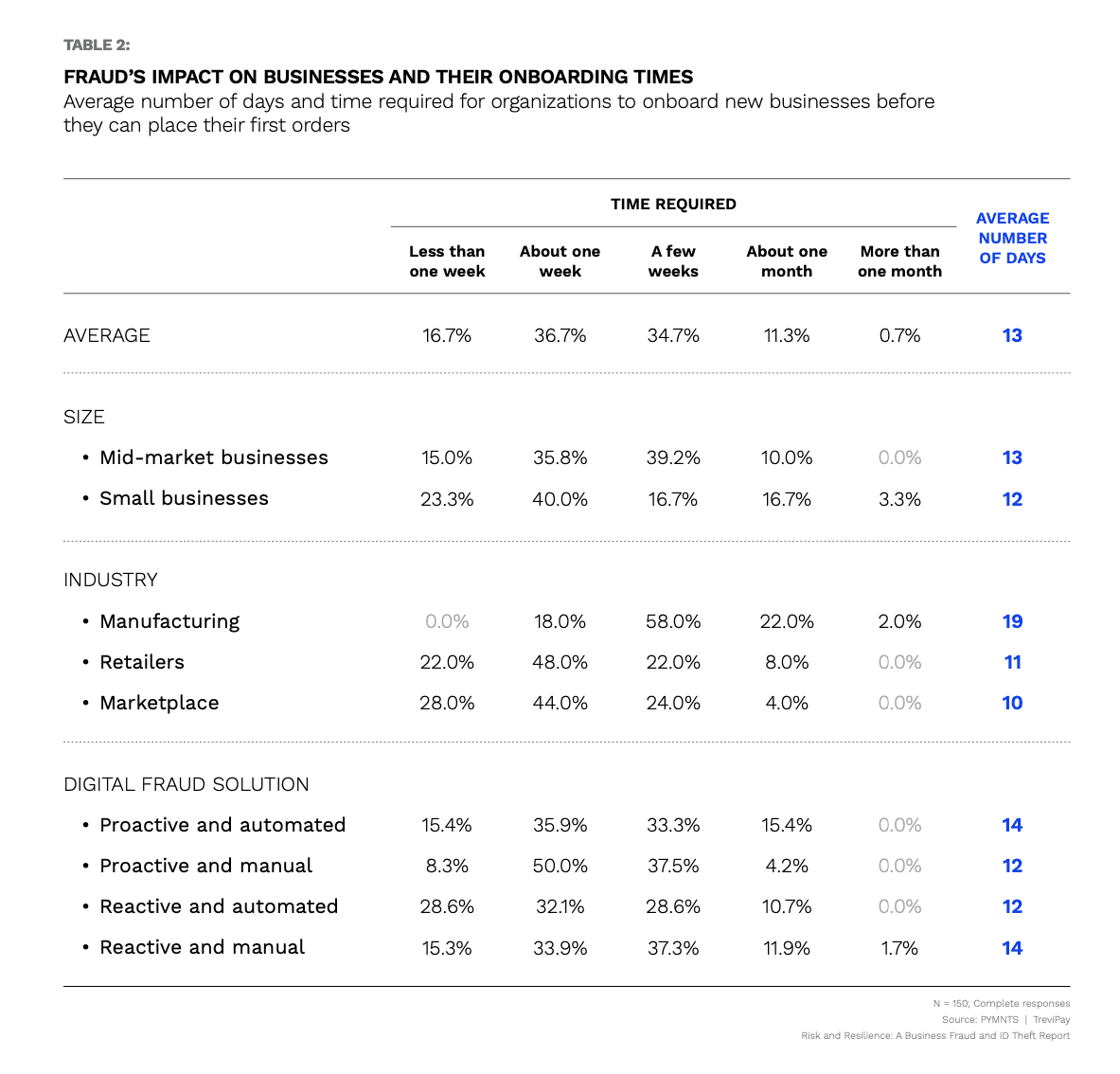

Fraud and false flag losses at B2B firms slow to adopt new anti-fraud measures cause pain, as nearly one-third reported at least 3.5% in sales lost to fraud, and that estimate could be low.

Per the study, “companies with the highest levels of fraud loss are also slow to onboard new customers/clients, compared to organizations with lower levels of fraud-related revenue loss. At least 30% of organizations that have lost more than 5% of their annual revenues to fraud take approximately one month or more to onboard new businesses.”

- 54% of retailers and 44% of manufacturers and marketplaces fail to accept new customers due to fraud concerns

Fraud fears are suppressing the growth of B2B firms without suitable protections in place.

As the study states, “54% of retailers and 44% of manufacturers and marketplaces fail to accept new customers due to fraud concerns. In addition, 54% of organizations implementing manual and reactive anti-fraud solutions fail to accept new customers due to fraud concerns, compared to 31% of those using automated and proactive technology.”

Meanwhile, larger marketplaces or those with more tech-forward approaches are embracing these systems, with 55% reporting they use automated alerts for transaction anomalies, 47% are using automated web monitoring and 34% are using automated underwriting systems.

See the study: Risk and Resilience: A Business Fraud and ID Theft Report