The Data Point: 76% of Merchants Say Third-Party Dispute Resolution Is the Way to Go

With the surge of credit card transactions during the pandemic is the seemingly inescapable cascade of disputes and chargebacks that eat into profits and create back-office havoc.

Many companies still handle disputes and chargebacks in-house, while an increasing number are finding that third parties specializing in this area resolve matters faster and more satisfactorily than DIY systems and manual processing can compete with.

For the study “Dispute-Prevention Solutions: Protecting Profits And Customer Relationships With Third-Party Tools,” a PYMNTS and Verifi collaboration, we surveyed over 300 merchants that derived revenue from web-based and mobile apps in four categories to discern the state of dispute resolution at a time when businesses need to minimize the problem.

Data from PYMNTS “shows that third-party tools are more effective at helping merchants resolve disputed transactions,” the study states. “Merchants that use only third-party tools limit their losses to 0.32% of annual revenues compared to 0.46% of revenues lost by the merchants that rely strictly upon in-house systems.”

See it now: Dispute-Prevention Solutions: Protecting Profits And Customer Relationships With Third-Party Tools

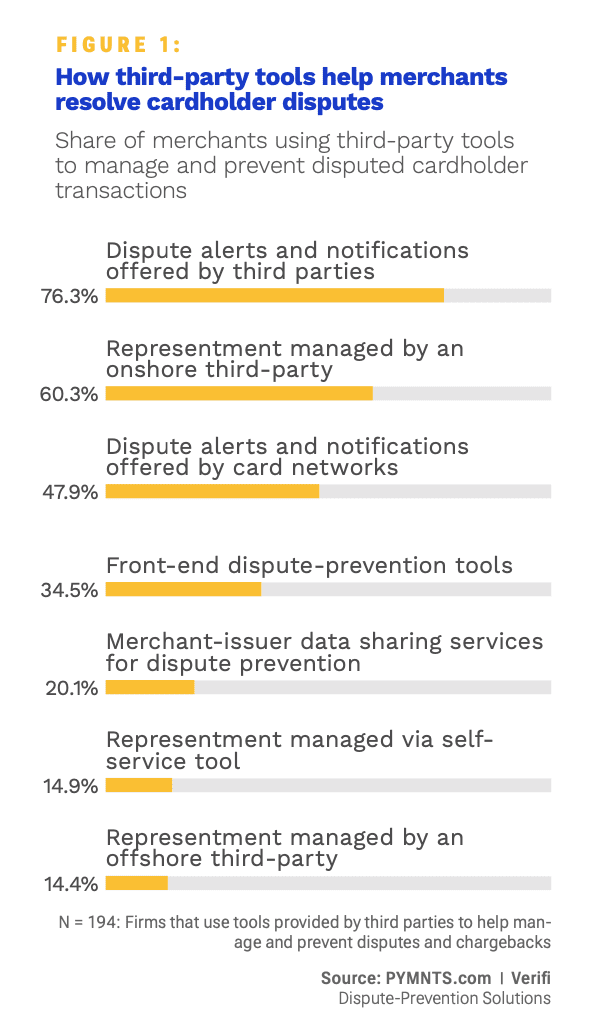

- 76% of merchants use third-party tools to alert or notify them about disputes

With more than three-quarters of merchants reporting that they use third-party tools to notify them when disputes occur, businesses are clearly getting the message that a better way exists.

Per the study, “The reliance on third-party tools is indicative of merchants’ awareness that vendors specializing in these solutions offer them the most effective tools for resolving cardholder disputes. Sixty percent of merchants use third parties to manage the representment of a disputed transaction to the merchant’s bank, while 48% of merchants use a card network’s service for notifying or alerting them about the cardholder dispute.”

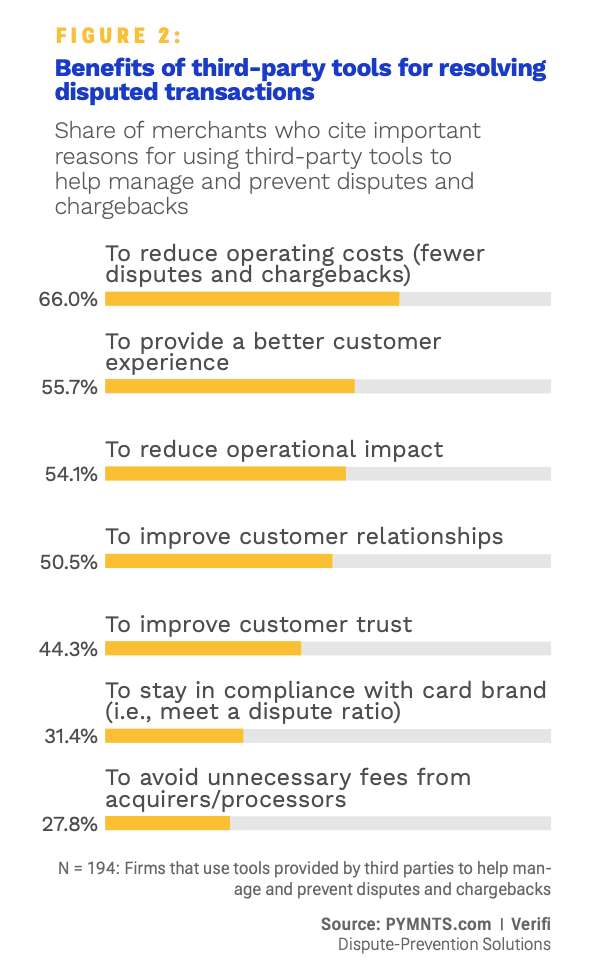

- 66% of merchants say they use third-party tools to cut their operating costs

Merchants using third-party dispute resolution are seeing other positive results as these tools are also proving highly effective at managing operating costs.

“Resolving cardholder disputes using third-party tools has a measurable impact to the bottom line,” per the study, as “66% of merchants report that these tools help cut their operating costs. Fifty-four percent of respondents say the tools help them reduce the effect that the disputed transactions have on their operations. Merchants also say the tools help them comply with a card network’s requirements such as controlling the dispute ratio, which 31% say is important.”

Read: Dispute-Prevention Solutions: Protecting Profits And Customer Relationships With Third-Party Tools