Combining Old and Newer Technologies Helps Banks Fight Rising Fraud

Fraud has surged at an unsettling pace in recent years, with young consumers and financially strained individuals being disproportionately targeted by bad actors.

This is one of the key findings in this month’s Embedded Finance Tracker®, titled “Fast Finance and the Fight Against Fraud,” which explores the new financial sector attack vectors and the new tactics being deployed to thwart advancing threats and restore consumer trust.

According to insights detailed in the report done jointly by PYMNTS Intelligence and Galileo, a significant 47% of retail banking consumers under the age of 40 have been a victim of some form of banking fraud, shining a spotlight on the vulnerability of young people in today’s digital age. Additionally, half of those who are financially overextended — having more debt than they can repay — have also fallen victim to fraud.

Financial institutions (FIs) and banks are fighting back against fraud by tapping advanced technologies like artificial intelligence (AI).

In terms of advantages, AI and machine learning (ML) technologies play a critical role in assisting FIs in identifying and assessing the common types of fraud they encounter. Additionally, these advanced technologies enable FIs to establish standardized and comprehensive insights into fraud, while enhancing their user authentication protocols to better detect unauthorized users earlier than expected.

Nine British banks have already taken the plunge by teaming with Mastercard to fight fraud via an AI solution that can predict fraud moves before they happen. Widespread adoption of this solution is expected to save 100 million pounds in fraud-related losses in the U.K.

Other banks are also intensifying their investments and implementations of machine learning (ML) and AI technologies to combat fraud in the coming year, as noted in a PYMNTS Intelligence-Hawk AI study.

For those that have made the shift, it appears to be yielding positive results. FIs that have already adopted AI and ML technologies in their fraud strategy have reported lower rates of fraudulent transactions and are less susceptible to an overall increase in fraud rates compared to those not leveraging these technologies, making this transition even more worthwhile.

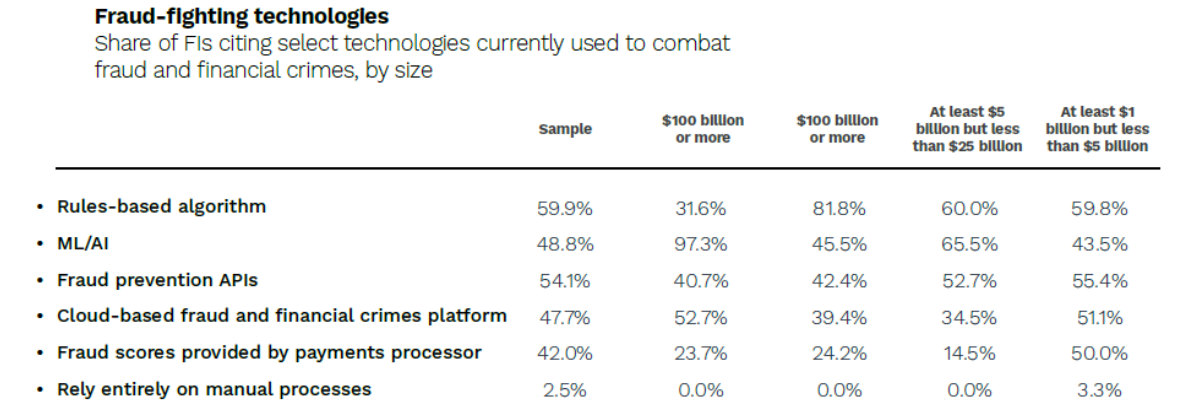

But “just going AI only is sometimes a bit of a too big step for most organizations,” Tobias Schweiger, CEO and co-founder of Hawk AI, recently told PYMNTS, emphasizing the need to uphold some form of the old-school rules-based processes which organizations have grown accustomed to over the years.

“We believe much more in a combination of the old world and the somewhat newer world of machine learning and AI, where the rules reflect the patterns that people want to stop or attend to and a second layer of ML and AI on top provides precision and agility,” he said.