Merchants Using In-House Systems Miss 10% of Family Fraud Instances

Fraud is often hard to identify and resolve, and expensive, especially for large merchants using in-house solutions where fraudulent transaction dispute losses can total as high as 0.51% of revenue. There are more effective systems for dealing with fraud.

Examined in the study “Dispute-Prevention Solutions: The Bottom-Line Benefits Of Third-Party Solutions,” a PYMNTS and Verifi collaboration based on a survey of over 300 merchants in retail, entertainment and gaming, travel and leisure and digital subscription services, it becomes clear that purpose-built third-party platforms are better equipped to parse and fight fraud.

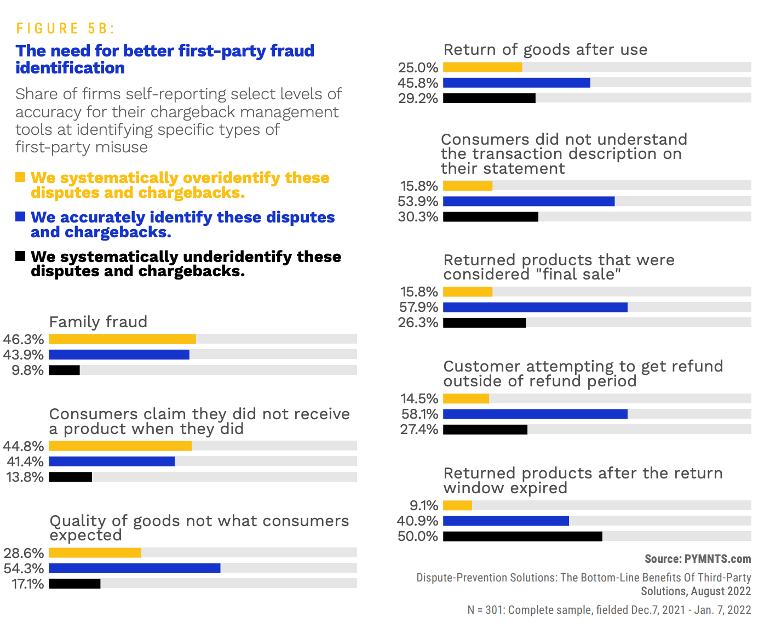

Discerning the true nature of fraud is one of the most difficult areas, with the study stating that 23% of merchants say they “systematically under-identify first-party misuse, which involves a fraudulent dispute for an intentional purchase,” while 27% of merchants say they overcount this type of fraud. “The data draws attention to how difficult it is to accurately track some significant sources of fraud, and it demonstrates the risks merchants face if they rely on tools that do not accurately track different fraud schemes.”

The study found that “merchants that rely strictly on third-party tools for dispute-resolution report losing an average of just 0.32% of revenues to disputed transactions. Because this percentage is well below the overall average of 0.43% in lost revenues and the 0.46% of revenues lost to disputes by merchants that rely solely on in-house tools, it indicates a distinct advantage available for all firms that choose to use third-party dispute resolution tools.”

A big part of the problem is identifying different types of fraud that require variations in how these instances are resolved. Family fraud is one example. We found that merchants accurately identify 44% of these instances of fraud “but have mistakenly identified legitimate purchases as fraudulent 46% of the time. Merchants miss 10% of family fraud instances.”

Another is consumers claiming they never received the product. The data shows that 45% of the time, “these complaints are flagged as fraudulent when they are, in fact, legitimate. Forty-one percent of the time, merchants accurately identify the fraud attempts. In 14% of instances, the fraud attempts escape the notice of the merchants’ dispute-prevention tools.”

The misidentification of fraud among large merchants using in-house tools offers a prime use case in how specialized third-party platforms offer a more accurate alternative.

Get your copy: Dispute-Prevention Solutions: The Bottom-Line Benefits Of Third-Party Solutions