Most Consumers Using Healthcare Payment Plans Have Faced Unexpected Bills

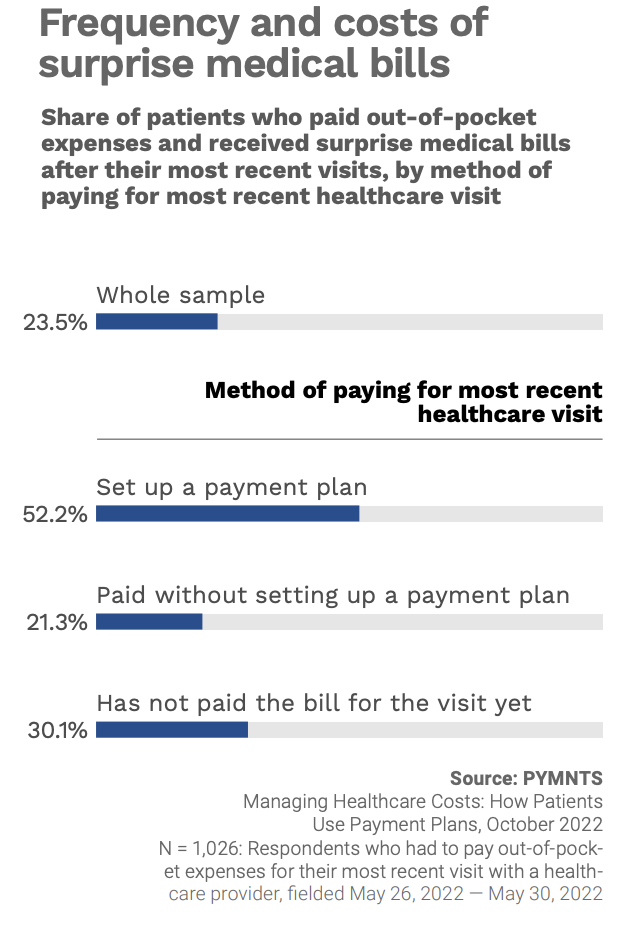

Consumers who use payment plans to cover their out-of-pocket healthcare costs are more than twice as likely as the overall population to be faced with unexpected bills.

This finding from PYMNTS’ study “Managing Healthcare Costs: How Patients Use Payment Plans” suggests that these surprise costs send consumers running to seek out more budget-friendly payment options.

For the study, which was created in collaboration with healthcare information technology company Experian Health, we surveyed nearly 2,500 U.S. consumers to explore how rising healthcare costs affect patient care and to understand how providers’ ability to offer payment plans affects patient satisfaction and care.

The findings revealed that patients are significantly likelier to take advantage of payment plan options if they receive a surprise bill, seizing on the chance to minimize the bill’s drain on their budget from paycheck to paycheck.

Fifty-two percent of those who had paid for their most recent healthcare visit with a payment plan reported having received an unexpected bill, greater than the 24% of the sample overall that said the same, and the 21% of those who paid without setting up a payment plan.

It also seems that being saddled with unexpected bills may prompt consumers to take their time figuring out how they will pay for their healthcare visit, considering the disproportionate share of unexpected bill recipients had not yet covered the cost. Thirty percent of those who had not yet paid for their visit reported that they received an unexpected bill, a share 28% higher than the whole sample.

“Receiving an unexpected bill for a doctor’s visit or medical procedure can be distressing, especially for less financially secure consumers,” the study found. “Our data shows that patients are more likely to use payment plans if they receive a surprise bill because the plans provide a means to fit payments into an individual’s current monthly budget without excessive disruption.”