Young Consumers’ Insurance Purchasing Mantra: ‘Digital Convenience With a Human Touch’

Generation Z and millennial consumers have a high level of digital expectations that transcend multiple sectors, including retail, banking and healthcare.

These high digital demands are also making an impact on the insurance industry, as evidenced by research from PYMNTS Intelligence.

According to findings detailed in a joint PYMNTS-American Express study, although younger consumers are more likely to have auto and health insurance, more than 60% of Gen Z and millennial consumers plan to purchase one or more insurance types within the next 12 months, with nearly half looking to buy life insurance.

Additionally, instant disbursements for insurance claims are highly appealing to these younger consumers. PYMNTS Intelligence research showed that two-thirds of millennials would choose to receive their payouts instantly if they could, an indication that this digital-first approach is transforming the rules of customer engagement in the insurance industry.

When purchasing insurance, half of Gen Z and millennial consumers prefer the convenience of online platforms and tend to conduct their research on the internet and via social media.

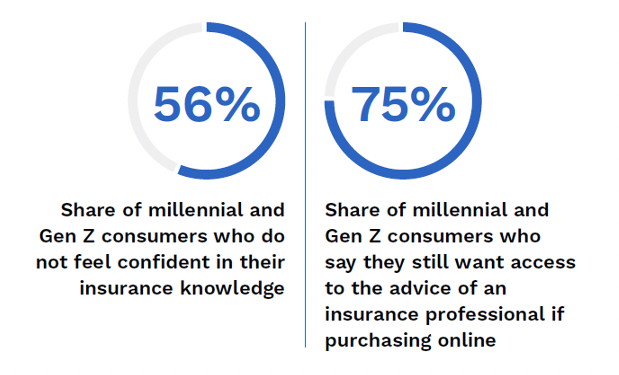

Despite their preference for online convenience, research revealed that Gen Z and millennial consumers still value the advice and expertise of financial professionals. While they may research and gather information online, nearly half of each demographic values the expertise of a financial expert when making their final insurance purchase decisions. This preference for collaboration stems from a lack of confidence in their knowledge of insurance products which drives their need for guidance and support to make informed choices about their insurance coverage.

Examining the data further shows that the rapid advancement of technology has widened the generation gap, particularly in terms of digital expectations. Younger consumers’ digital expectations are evolving faster than insurance processes, creating a notable gap between what insurers offer and what these customers want.

Against that backdrop, insurers need to rethink their strategies to attract and retain this new generation of insureds, including providing personalized, in-person interactions, mobile-friendly platforms, and seamless omnichannel offerings to meet the needs of Gen Z and millennial consumers.

Considering that over 75% of millennials and Gen Zers seek financial advice on social media, the insurance sector must harness these platforms to connect with and educate young consumers on their terms.