Nearly 8% of Borrowers Who Have Not Repaid Student Loans Say They Never Will

When it comes to student loans, it’s been three-plus years of paused repayment, a span in which many consumers have seen their financial lifestyle upended due to macroeconomic factors such as inflation, rising interest rates and mass layoffs.

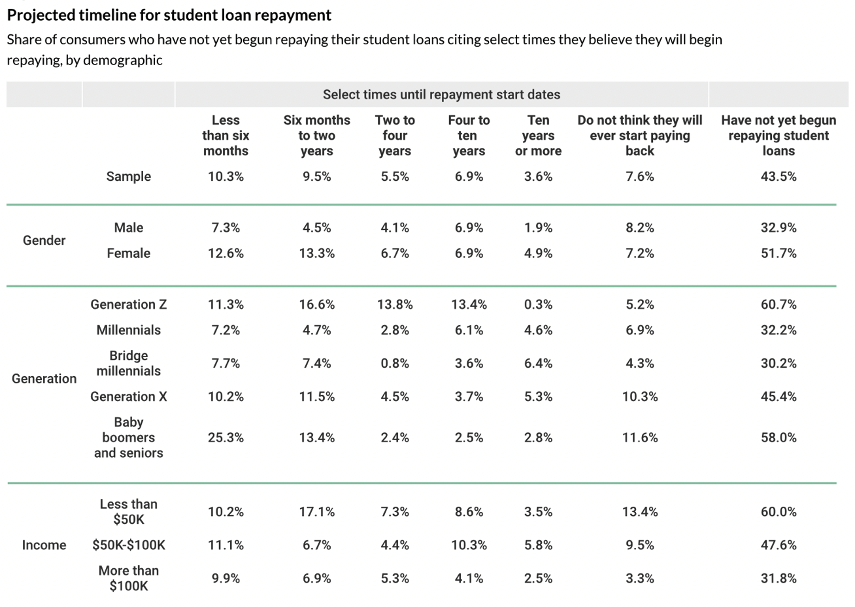

Given these headwinds, some simply may not be able to afford to pay back their loans, and data shows that 7.6% do not believe they will pay them back — now or ever. The rate of consumers sharing this position is detailed in PYMNTS’ July “Consumer Inflation Sentiment” report.

One takeaway is that older generations are particularly likely to not expect to repay their loans. The higher rate of Generation X consumers and baby boomers and seniors not planning to pay these loans back, at 10% and 12%, respectively, may at first seem surprising, as it is nearly or more than double the rate of millennials (at 7%), bridge millennials (at 4%) and Generation Z (at 5%) sharing this sentiment.

The older generations’ outsized share may be due to part or all of the student loans and instead act as initial parental or other guardian co-signers for these loans. They may expect children or others they co-signed for to assume the debt and absolve the older co-signing consumer from that responsibility.

Another reason for this development may be that these consumers have opted to return to school later in life themselves in support of a career or other life change, adding to their loan debt — but perhaps not yet paying the dividends via a higher salary that would help them feel comfortable repaying. After all, a co-signing situation is not always the case, as income-driven repayment plans may extend amortization schedules to 20 or 25 years.

Not paying back loans — whether you’re a primary borrower or co-signer — can have serious consequences. While particular parameters depend on loan terms, declining to pay off a private or federal loan almost certainly leads to default, and although federal loans may be willing to institute an extended payment plan, private loans could be another matter.

“Private student loans often go into default as soon as you miss three monthly payments (90 days),” according to the Consumer Financial Protection Bureau. “You can also default on a private student loan if you declare bankruptcy, default on another loan, or die. Private lenders may attempt to collect on your debt directly, or they may hire collection agencies to try to collect on your debt. In addition, they may take you to court.”

While most consumers carrying student debt either intend to pay on these loans or are doing so already, the July Consumer Inflation Sentiment report noted that 36% of consumers with student loans are concerned about their ability to take on the additional payments while still covering their current ones. Therefore, some of these repayment refusals may be because these consumers simply cannot add student loan payments to their budgets without going completely underwater financially. This could explain why more than 13% of consumers earning less than $50,000 per year have no plans to pay back their student loans; lower incomes mean less wiggle room, even for obligations.

These and other consumers are concerned about their ability to get by in the fall when repayments resume. While no indications yet hint at them doing so, as due dates near, retailers and others could see a spending pullback as debt holders prepare to take on the additional monthly payment.