In Europe, for example, the demand for a single app that seamlessly integrates banking, shopping and personal activities, known as an everyday app, is rapidly growing.

According to a recent PYMNTS report, nearly half of consumers across key global markets prefer a single-service app for everyday commerce and shopping activities due to the greater efficiency and utility that it can bring to their digital lifestyles.

In Europe, where an overwhelming majority of consumers are plugged into apps in their daily lives, about 40% of consumers would prefer an all-in-one app that consolidates digital activities such as shopping and banking over separate apps, the study shows.

This appetite for everyday apps particularly strong among the lucrative millennial and high-income consumer segments. As the report noted, “on average, 42% of millennials and 40% of Gen Z consumers tend to be highly interested in adopting use of an all-in-one app, while 35% of high-income consumers were similarly interested, suggesting that affluence and age are considerable determinants in preference for an everyday app.”

Robust Security Features Are a Must-Have

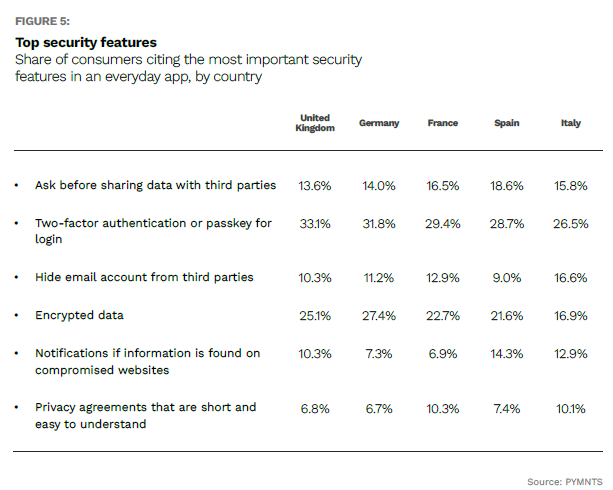

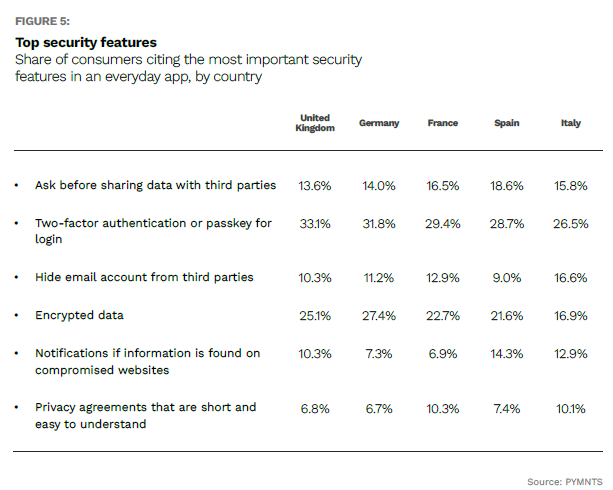

When it comes to choosing an everyday app, security is the most important factor for consumers in Europe, with a key emphasis on robust features such as two-factor authentication and data encryption.

Advertisement: Scroll to Continue

According to the study, nearly one-third of European consumers consider two-factor authentication as the most crucial security feature in an all-in-one app as it provides an additional layer of protection by requiring users to verify their identity through two different factors, such as a password and a unique code sent to their mobile device.

In the United Kingdom, for instance, this feature is particularly valued, with 33% of consumers emphasizing its importance. In Italy and Spain, 27% and 29% of consumers, respectively, also prioritize two-factor authentication.

Encrypted data, which ensures that sensitive information remains unreadable to unauthorized individuals, also emerged as a top security feature in an everyday app for approximately one-quarter of European consumers.

This desire for security comes as little surprise in a region like Europe, which is home to the EU’s General Data Protection Regulation (GDPR), considered one of the toughest data privacy laws in the world.

For Big Tech firms, navigating the legal quagmire of EU data sovereignty has come at a high cost, with a string of mega fines proving how far European authorities will go to protect its citizens’ data.

In May, for instance, Meta was hit with a landmark privacy fine of $1.3 billion for failing to protect European Facebook users’ data from U.S. surveillance practices. Prior to that, in January, the social media giant also came under fire for similar GDPR breaches, resulting in a $413 million fine from Ireland’s Data Protection Commission (DPC).

Overall, it goes without saying that security is a non-negotiable for Europeans, who tend to have a higher expectation of control over their data and value transparency in data-sharing practices.

Prioritizing this need for data protection in everyday apps will be crucial to meet the expectations of European consumers who are ready to embrace integrated digital solutions.