35% of US Consumers Would Welcome ‘Super App’ to Manage Finances

According to PYMNTS Intelligence, 95 million consumers would welcome a single mobile app to help manage their banking and shopping activities.

This is one key finding in the report “Consumer Interest in an Everyday App,” which surveyed 3,320 consumers in the United States and Australia to gauge their level of interest in using a single mobile app to manage all of their day-to-day activities.

In both countries, apps are already being deployed to manage an array of activities, with banking apps being the most popular, per the report. In a typical month, 64% of U.S. consumers and 78% of those in Australia use apps to manage their banking. More than half of respondents in each country also use mobile apps to track spending and shop for groceries.

This digital familiarity is likely the reason that 35% of U.S. consumers said they would be interested in using an everyday app, and 25% of their counterparts in Australia said the same. For U.S. consumers, the interest level varies according to age. U.S. millennials and bridge millennials showed particularly high levels of interest. Meanwhile, in Australia, Generation Z to Generation X respondents both showed the highest levels of interest.

Earnings are also a factor. In both countries, respondents earning higher incomes (those earning more than $100,000 annually as well as those earning between $50,000 and $100,000 per year) said they would be interested in using one comprehensive mobile app. Those earning less than $50,000 annually in each locale expressed less enthusiasm.

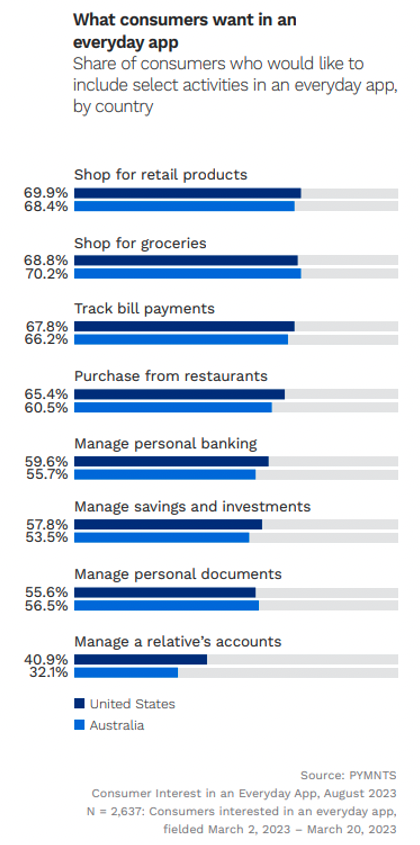

So, what would consumers want in this everyday app?

Respondents in both the U.S. and Australia showed a clear desire to consolidate their routine shopping and banking experiences into a single app. Roughly 7 in 10 in each country would like to use it to streamline their app-based retail and grocery shopping, with similar shares wanting to integrate bill tracking.

Additionally, most consumers in the U.S. and Australia want to manage their banking with an everyday mobile app, at 60% and 56%, respectively. Interest levels align across the two markets, although the U.S. leads slightly in most categories.