Study Shows Over 77% of Restaurant Orders Are Still Done The Old-Fashioned Way

One might think that food aggregators were a huge share of the restaurant market — almost four in 10 consumers PYMNTS surveyed had used them in the past 30 days — but aggregator-facilitated transactions still are a small share of restaurants’ revenues. With the anxiety of many business owners at an all-time high, many restaurants are looking for additional footholds and opportunities to reach more customers.

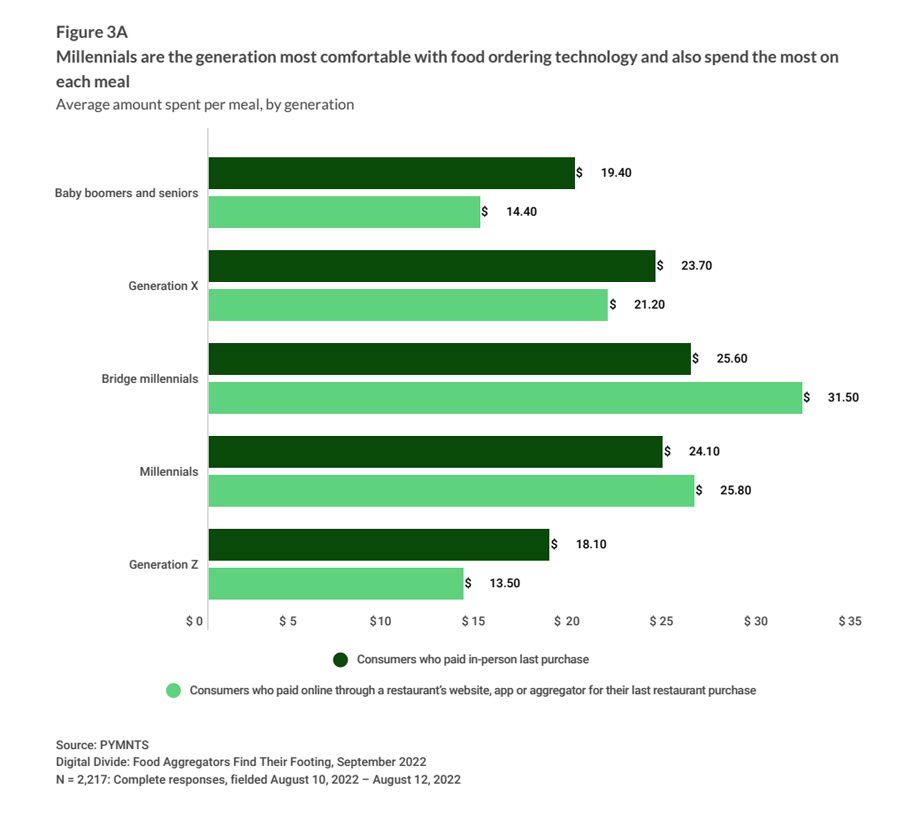

As they always have, younger consumers drive today’s restaurant trends. Over half of them use aggregators to order food. Millennial consumers spend more per order than other generations, and Generation Z prefers taking their meals to go instead of dining in restaurants. For restaurants seeking to expand their takeaway and delivery options, these trends allow them to reach groups of consumers that a dine-in-only restaurant might miss.

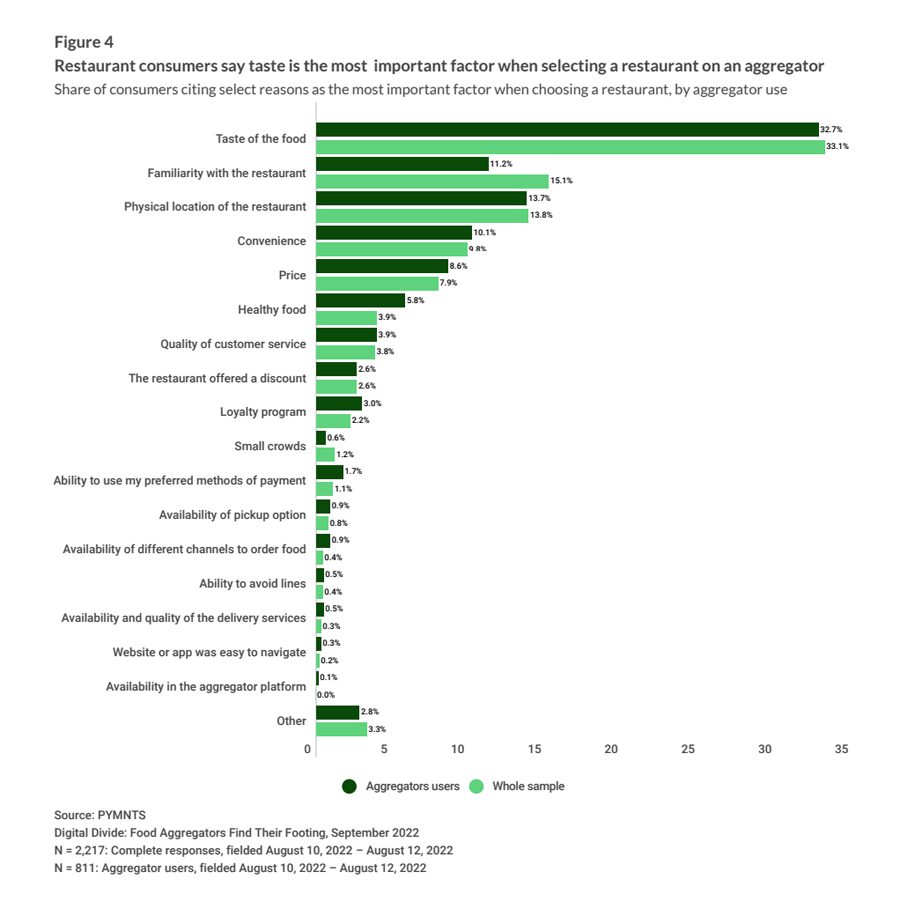

The most common reason consumers give for choosing a specific restaurant, however, is the food’s taste. This makes some of the factors that historically have mattered more, such as a restaurant’s location or branding, suddenly less important. This has led some savvy restaurateurs to create virtual brands that exist solely on apps, enabling them to reach new customers with different tastes and food preferences — one way these businesses can find their way forward.

The PYMNTS study examines the evolving relationship that consumers, restaurant owners and brands have with food aggregators, as well as changing attitudes about dining in restaurants. We surveyed 2,217 consumers between August 10, 2022 and August 12, 2022 to learn more about how they interact with aggregators and restaurant apps and websites, and how they decide whether to have meals delivered, to dine in a restaurant or to pick the meal up themselves and eat it elsewhere. This is what we learned.

1. Orders using delivery aggregators are a tiny share of restaurant transactions, even though an increasing number of consumers are using them to place orders. Almost four in 10 consumers used a food aggregator to place an order over the last six months, but aggregators accounted for only a marginal share of total food transactions in that same period.

Over the last year, the share of consumers who use aggregators to place restaurant orders fluctuated between 35% and 42%. Although 20% of orders placed in the month prior to our study were submitted digitally, aggregators represented only 2.5% of restaurant transactions. This is below the 10% completed through restaurant-specific apps or sites, and even below the 6.5% that were made through automated kiosks — and is far below the most common means of ordering food, which is still in person, with the consumer paying the cashier.

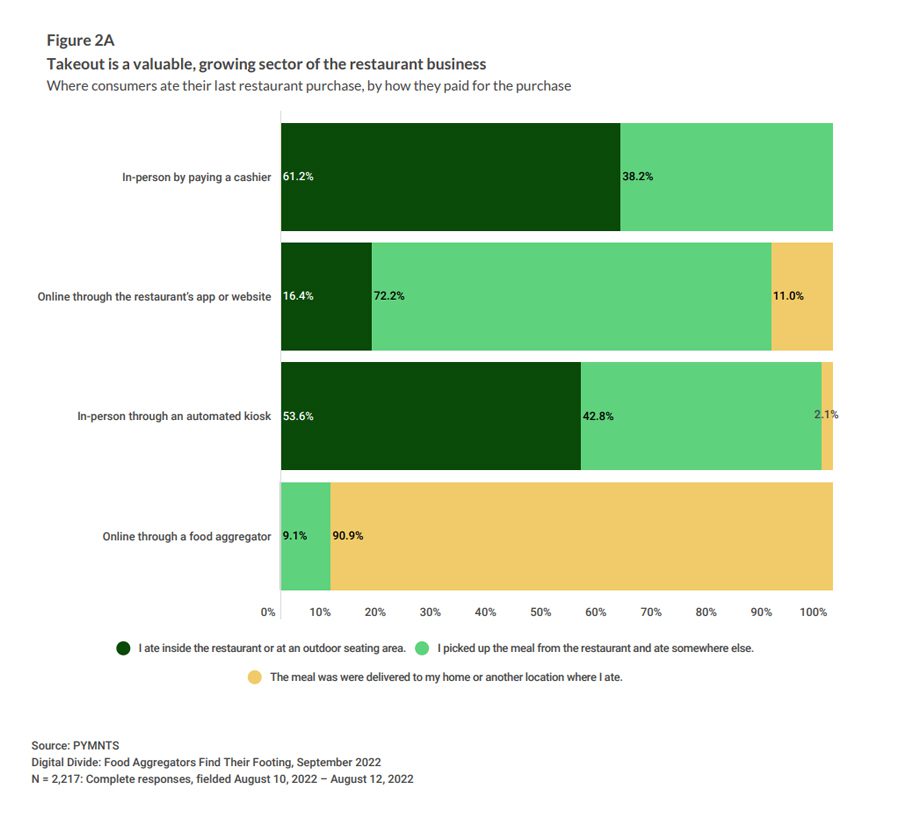

2. Nearly three-quarters of consumers using a restaurant’s app or website to order a meal pick it up from the restaurant, making the economics more appealing to the customer and the restaurant. Takeaway is a profitable and often overlooked part of a restaurant’s business.

Four in 10 restaurant purchases are picked up to be consumed elsewhere, a fulfillment alternative that is especially appealing to younger consumers. Only 40% of Gen Z consumed their last restaurant purchase inside the establishment — these consumers are far more likely to take the meal “to go” and eat it elsewhere. Seventy-two percent of consumers who order their meal using the restaurant’s app or website pick up the meal themselves and consume it elsewhere.

Ninety-one percent of purchases made through a food aggregator are delivered to the consumer, while just 9.1% are picked up by the consumer and consumed elsewhere.

The takeaway option is good for a restaurant’s bottom line, as it cuts high delivery costs out of the picture. Additionally, consumers who initially order takeaway meals may eventually order delivery via an app or dine in at the restaurant.

3. Aggregator use is most popular among tech-savvy consumers who want to get their food fast and are willing to spend up to an additional 25% to do so. Most of the price increase goes to the aggregator in the form of service fees.

Over 50% of younger consumers use aggregators to order food, as opposed to 36% of Generation X and 14% of baby boomers and seniors. Millennials and bridge millennials tend to spend more when buying food online than in person. The average millennial meal was $32 when purchased online and $25 when ordered in person. All other generations, including Gen Z, do exactly the opposite, spending more when they order in person than when ordering online.

Aggregators attract high-value orders even though most of the revenues accrue to the aggregator, not the restaurant. The average purchase via aggregators was $31 — exceeding both the average restaurant meal purchase by nearly 50% and the sample average by 45%. This is the widest gap in average expenditure seen in 2022, and more than twice the 16% gap observed in April. Delivery costs account for half of the average price differential between aggregators and first-party platforms, and meal prices show an 8% markup from aggregators.

It is also worth noting that the average aggregator user is more tech-savvy and prefers restaurants that integrate technology into the dining experience. Forty-seven percent of aggregator users utilized digital tools to assist their last on-premises purchase, compared to 31% of the sample average. The most commonly used features include: loyalty programs, cited by 45% of aggregator users; card-on-file transactions, cited by 42%; and contactless cards, cited by 40%.

About half of aggregator users say they believe restaurant technology, such as ordering kiosks and QR code menus, leads to better customer experiences, while just 37% of non-users agree.

4. Taste matters more to consumers than brand or price, granting restaurant owners the freedom to offer virtual brands outside of their core product.

One-third of consumers ranked taste as the most influential factor when choosing where to make their most recent restaurant purchase. Just 7.9% of average diners and 8.6% of aggregator users considered price over all other elements when choosing which restaurant to buy from. Fifteen percent cited familiarity with a restaurant as the top influence, a driver that drops to 11% among aggregator users, meaning these consumers are even more open to trying new brands and restaurants.

This provides restaurants with an excellent opportunity to offer virtual brands with offerings that might not otherwise fit their core product’s image. For example, a high-end restaurant that focuses on fine dining could offer a delivery-only brand that focuses on hamburgers or pub food. With today’s consumers — especially aggregator users — placing so much emphasis on the taste of the food over familiarity with a brand or the ability to use a loyalty program (a factor for 3% of aggregator users and 2% of the total group surveyed), this is becoming a more viable option.

Restaurants have never been an easy business, and the current environment adds myriad challenges. But delivery and takeaway offer new ways for restaurants to find their footing, expand their client base and make inroads with younger generations that may prove to be eager consumers for years to come. Since consumers care more about the quality and taste of their food than factors such as price or branding, this can be a great opportunity for restaurants to expand their reach and focus on what they do best: the food itself.

PYMNTS Research Methodology

Original research from PYMNTS, examines the evolving relationship between consumers, restaurants and brands with food aggregators. We surveyed 2,217 consumers in the U.S. between August 10, 2022 and August 12, 2022 about their experiences. The average age of our respondents was 48, 52% were female and 36% earned more than $100,000 annually.