Mobile Wallet Use Is Poised for Permanence and Grew From Pandemic Behavioral Changes

The next installment of PYMNTS’ mini-series based around consumer behavior that began during the pandemic focuses on mobile wallets.

Certain consumer preferences that are now part of everyday life only gained widespread popularity after the pandemic hit. Mobile wallets, for example, had been gaining popularity, particularly overseas, but went widespread after the health crisis upended norms. Trends concerning this financial platform have been tracked by PYMNTS and suggest that these tools are becoming a permanent part of consumers’ lives.

At one time, cash was king. In July 2018, 94% used it for everyday transactions. By August 2020, that number had dropped to 84%. As of April, it hovers around 81%, with 33% of those still using cash saying they carry it less than before.

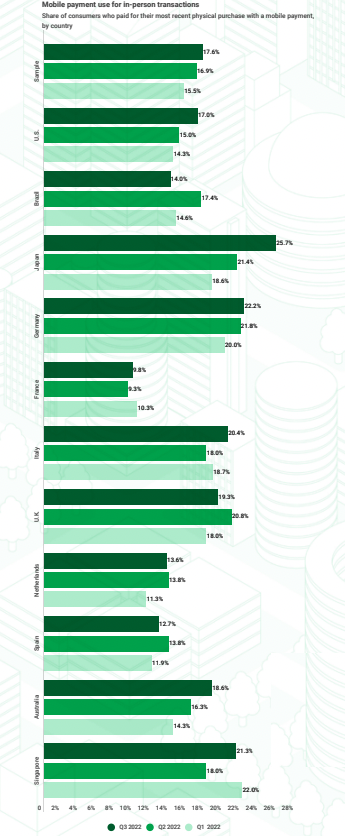

With inflation’s marked rise starting January 2021, along with uneven post-lockdown re-openings, mobile wallets’ ease across in-person and online channels began gaining popularity, particularly overseas. This rise in global use is illustrated in PYMNTS’ “How the World Does Digital: Different Paths to Digital Transformation.”

Worldwide, mobile wallet use in general continues to be on the rise. Overall, around 18% of globally surveyed consumers paid for their most recent physical purchase with a mobile device, up more than 0.5% in the third quarter of 2022 from the previous quarter. The greatest increase in in-store digital wallet use occurred in the United Kingdom, with the share of in-store shoppers paying via mobile wallet increasing 549% year over year. Among mobile wallets, Apple Pay grew the most at 397% between 2021 and 2022.

Stateside, mobile wallet growth has been more steadily incremental as its utility has slowly become accepted among U.S. consumers and mobile devices increasingly replace desktops to shop. By April, retail purchases made over mobile increased by 49% and grocery purchases had increased by 35% compared to December 2021. Consumers purchasing groceries and other retail items dropped 0.7 and four percentage points, respectively, during that same period.

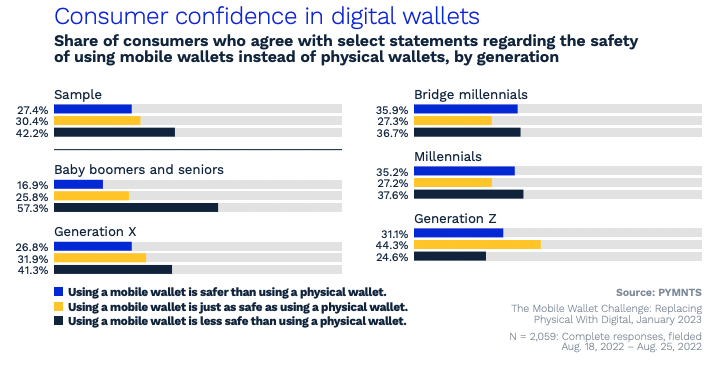

However, the rising trust in mobile wallets may indicate their rising popularity, as noted in “The Mobile Wallet Challenge: Replacing Physical With Digital,” a PYMNTS and ACI Worldwide collaboration.

Trust in the platform by generation has risen across demographics, with over one-quarter of all consumers believing a mobile wallet is safer than a physical wallet, and another 30% saying they are equally safe. Trust in mobile wallets, along with the convenience of pressing a button over the steps it takes to mail a physical check, is driving its use for bill pay. Eighty-nine percent of mobile bill pay users report satisfaction with the process. And despite some reported kinks, such as challenges contacting customer service and confirmation difficulties, customers seem to be willing to look past these inconveniences for long-term ease.

Trust in the platform by generation has risen across demographics, with over one-quarter of all consumers believing a mobile wallet is safer than a physical wallet, and another 30% saying they are equally safe. Trust in mobile wallets, along with the convenience of pressing a button over the steps it takes to mail a physical check, is driving its use for bill pay. Eighty-nine percent of mobile bill pay users report satisfaction with the process. And despite some reported kinks, such as challenges contacting customer service and confirmation difficulties, customers seem to be willing to look past these inconveniences for long-term ease.