Gig Economy and Gaming Push Instant Payments Forward

Ad hoc payments — non-recurring payments made outside of normal invoicing and payroll processes — are somewhat of a nuisance to enterprises. However, instant payment methods increasingly offer a way to streamline the process. Payers used instant rails for more than one-third of payments, a 28% increase in the last quarter alone.

Gig economy companies make an above-average share of ad hoc accounts payable (AP) payments. These firms also use instant methods the most. Senders report that these payments represent 35% of their ad hoc payment transactions. This share rises to 39% in the gig economy industry. Gaming firms follow closely behind, at 37%.

These are some of the findings explored in “Meeting the Demand for Instant Ad Hoc Payments,” a PYMNTS Intelligence and Ingo Payments collaboration. This report is based on a survey of 200 enterprise senders generating at least $50 million in annual revenues across the United States conducted between Jan. 5 and Jan. 25. It examines issuers use of instant payments for disbursements to SMBs and consumers. The report focuses on the following industry segments: hospitality, gaming, trucking and transportation, the gig economy (e.g., freelance workers) and property management.

Other findings from the report include the following.

The instant methods used to send ad hoc payments vary by firm size.

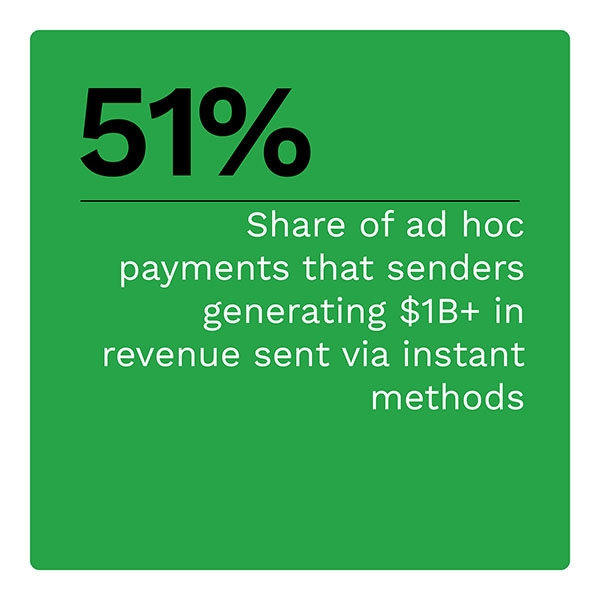

Push-to-card remains the most popular method among all enterprise senders. Nineteen percent of enterprises send ad hoc payments via debit card to a bank account. At 8.9%, Zelle ranks as the second-most common way firms send instant payments, followed by payment to a bank account via the RTP® Network at 4.7%. As sender size increases, however, the use of RTP rises, accounting for all growth in instant payments seen by larger payers.

The share of senders offering instant has risen since last quarter.

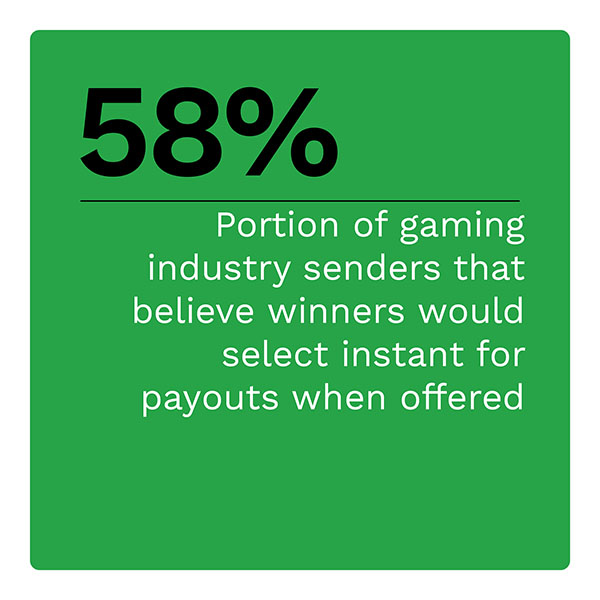

More senders of all firm sizes offer instant options, with 32% offering instant payments as one of many options and 12% only sending ad hoc payments via instant methods. The gig economy and gaming sectors lead here, too. Despite these increases, senders still underestimate SMBs’ and consumers’ desire to receive payments instantly.

The share of senders saying cost limits instant payment provision is down 30%.

Costs have been a barrier for enterprises adopting instant ad hoc payments, yet such concerns are waning. Just 9.4% of senders reporting challenges with sending ad hoc payments cite cost as their most experienced challenge, down from 22% last quarter. Other factors still make them less likely to offer instant options: 30% of senders cite difficulty correcting payment amount errors once sent as the top reason; 16% cite an increased risk of fraud or data theft as the top reason; and 13% cite delays in payment processing due to legacy IT infrastructure.

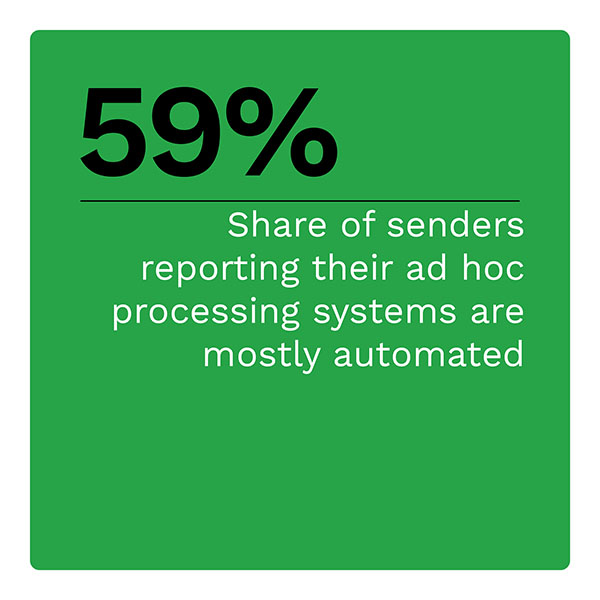

Data shows a strong correlation between the use of automated ad hoc processes and enterprise senders’ adoption of instant methods. As more enterprise senders automate their ad hoc processes, their interest in offering instant options will also increase.

Download the report to learn more about how enterprise senders are meeting the demand for instant ad hoc payments.