Instant Refunds? Consumers Say They’ll Pay for That

Overpayment disbursements are not the most common payouts nor the largest. In fact, just 7.1% of consumers report they received overpayment disbursements this year. The average overpayment disbursement is just $68, compared to $433 for the average disbursement. Still, many consumers want to receive these as instant refunds.

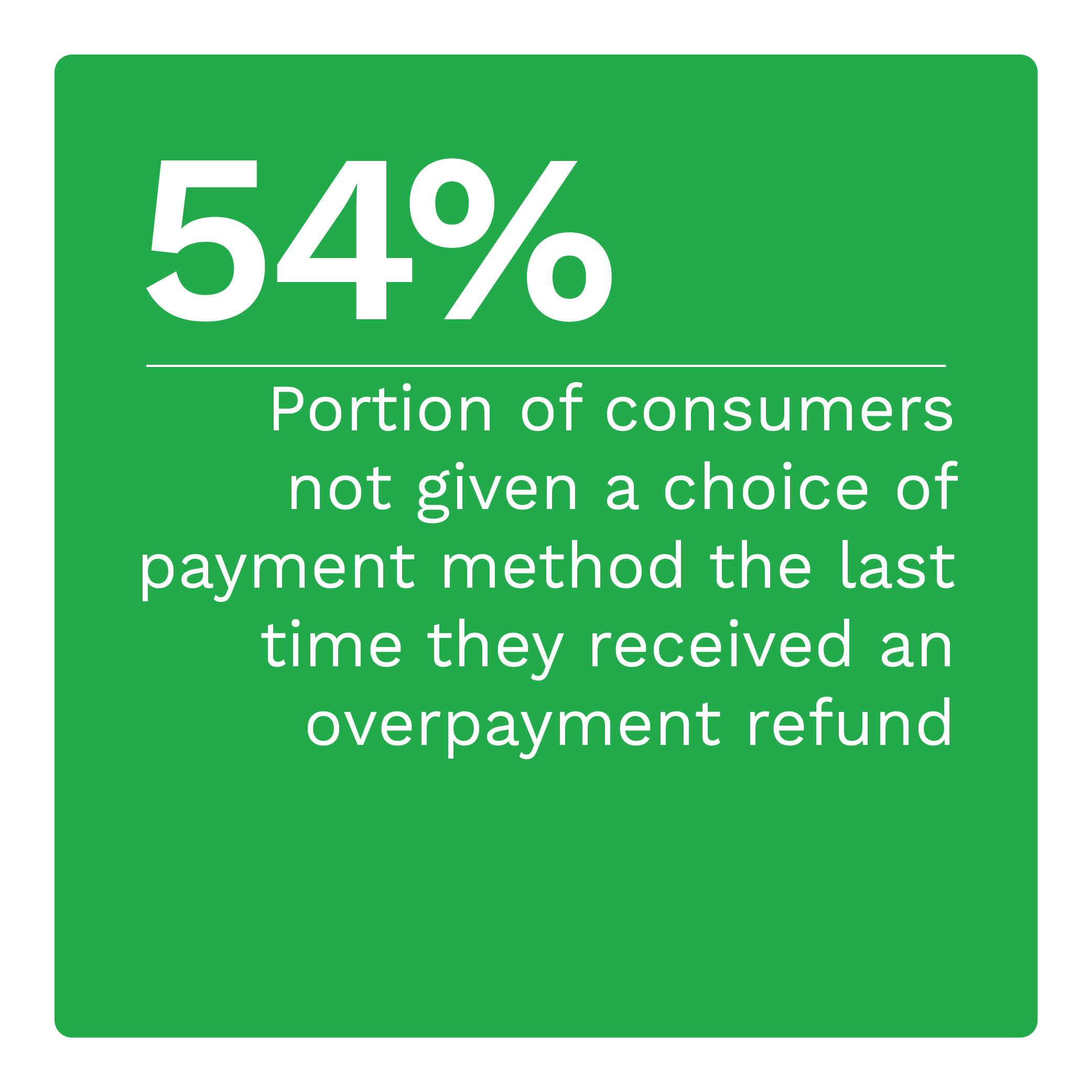

In fact, 4 in 5 consumers say they would choose an instant option for these refunds. Many would even pay for instant refunds. However, few have a choice in payment method. Merchants and other senders that do not process overpayment disbursements instantly are missing an opportunity to increase customer satisfaction and engagement.

These are some insights explored in “Generation Instant: How Instant Payments Help Consumers Receive Overpayment Disbursements Faster,” a PYMNTS Intelligence and Ingo Payments collaboration. This report is based on a census-balanced survey of 3,898 U.S. consumers conducted between Dec. 28, 2023, and Jan. 22, 2024, and explores consumers’ interest in receiving instant refunds, rebates and rewards.

Other findings from the report include:

11% more consumers use instant methods for overpayment refunds than the average disbursement.

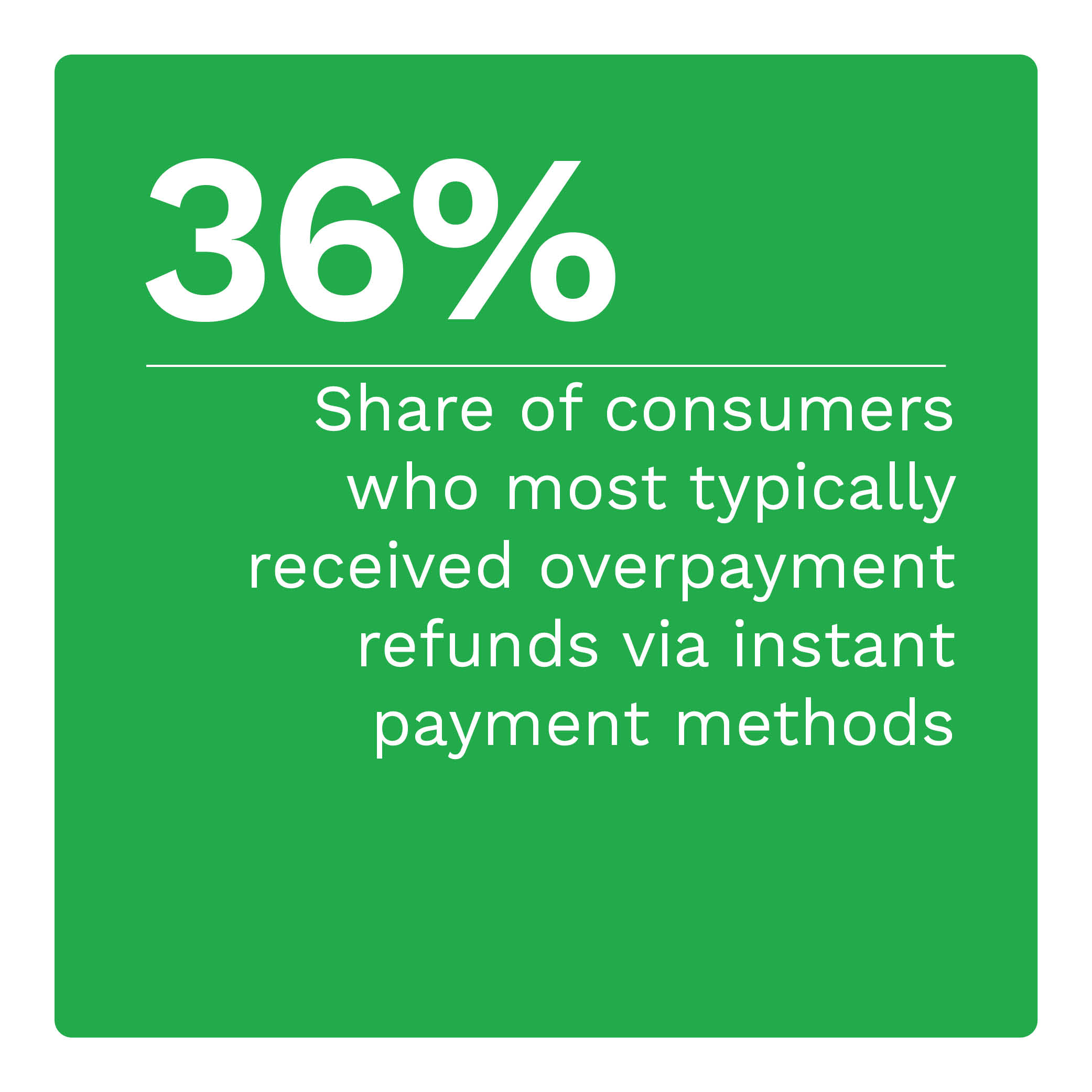

The number of senders using instant methods to send overpayment disbursements is rising. Among consumers who received disbursements for overpayments, 36% use instant payments as their main method of receiving them. This represents a 16% increase from last quarter. The report explores which instant payment options consumers use the most for overpayment disbursements.

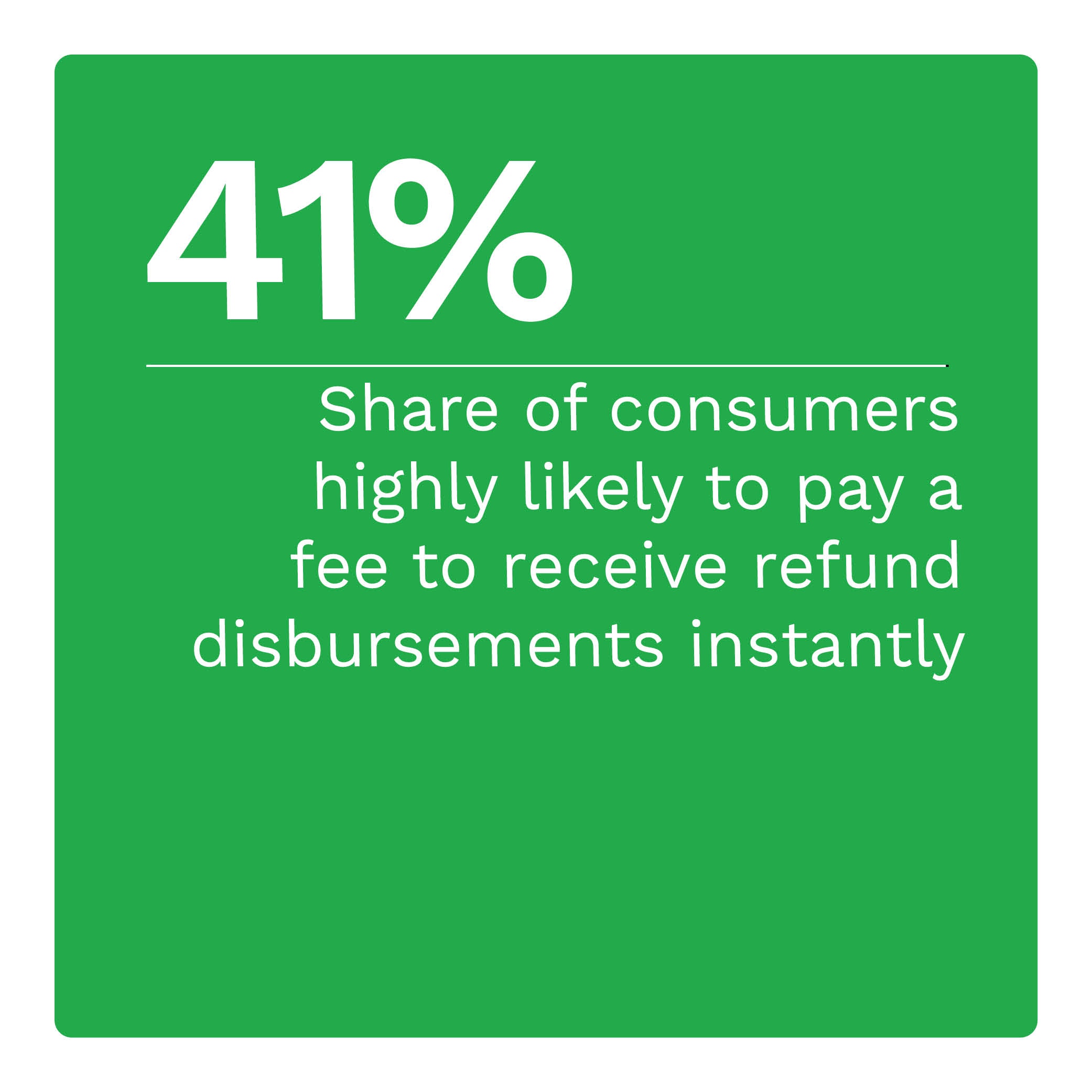

A sense of urgency translates to consumers’ increased willingness to pay a fee for instant.

Consumers are 39% more willing to pay a fee to receive a refund disbursement than the average disbursement. In fact, 41% of consumers who received instant refund-related disbursements were very or extremely willing to pay a fee. When they pay, they are more likely to prefer paying a percentage fee than the average receiver.

Budget-conscious consumers want overpayment refunds sooner rather than later. Merchants and other senders looking to retain and attract customers should consider providing an instant overpayment disbursement option. Download the report to learn why consumers use instant pay to receive faster refunds.