How Half Of All Businesses Are Closing The Receivables Cash Flow Gap

As business-to-business (B2B) firms are looking to digital transformation to drive efficiencies, manual accounts receivable (AR) processes are becoming a thing of the past. The pain points inherent in legacy solutions are becoming even more exasperated by the pandemic, making it apparent that manual AR operations are no longer feasible in an accelerated virtual work environment. AR functions that were once conducted in physical workplaces must now be done remotely, posing unique challenges for the 49 percent of firms that continue to rely on manual processes. These challenges drive companies to adopt technologies that no longer hold them back from moving forward with their digital transformations.

The B2B Payments Innovation Readiness Playbook: The Business Case For Automating AR Processes, a PYMNTS and American Express collaboration, explores how automation technologies can help firms manage the unpredictable payments market and become more agile and responsive to change. The Playbook draws from a survey of 460 treasury executives from AR, billing, cash application, credit, collections and treasury management departments.

We surveyed executives from the advertising, technology, construction, energy and healthcare sectors, and respondents were evenly distributed among companies with annual revenues of less than $50 million, those with revenues between $50 million and $500 million and those with more than $500 million in yearly revenues.

The playbook examines the benefits of automating AR processes and provides a roadmap that can guide firms toward realizing the benefits of automation and identifies the investments that make the most sense for their organizations.

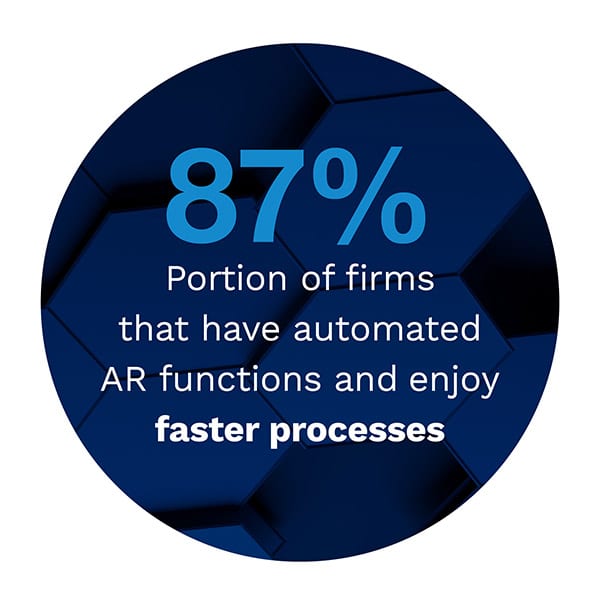

Our research indicates that 87 percent of firms with automated AR functions enjoy faster processes. Seventy-nine percent of businesses indicate that automation allows them to improve team efficiency, while 75 percent say that it helps them offer superior customer experiences.

There are noteworthy differences by sector in terms of the benefits of implementing AR automation. Energy, advertising and technology firms have experienced the greatest overall gains, for example. Energy firms have realized significant benefits: 95 percent report improvements in overall process speed and 88 percent cite optimized efficiency. Eighty-one percent of these firms note that AR automation has enhanced customer experiences, while 77 percent of technology and advertising companies say the same. Advertising and energy firms also are likelier to see improvements in their collection processes, with 71 percent of the former and 69 percent of the latter reporting that automation benefited them in th is regard, respectively.

is regard, respectively.

Improvement with days sales outstanding (DSO) is another key advantage of deploying AR automation, as they enable firms to better manage cash flows by accelerating the time between the delivery of goods or services and payment receipt. Energy and advertising firms have benefited by using automation in this area, with 88 percent of the former and 87 percent of the latter experiencing shorter DSO cycles.

These findings are just a few of the insights found in our research. To learn more about how automation can help firms improve their collection cycles and reduce average DSO, download the playbook.