B2B Digitization Born out of Pandemic Necessity Still Yielding Unexpected Benefits

According to the latest “Business Payments Digitization: The Fast Track to Payments Systems Upgrades,” a PYMNTS and Corcentric collaboration, chief financial officers who have accelerated the payments modernization efforts that ramped up during the pandemic have found at least three unexpected benefits as a result.

Middle-market CFOs embarking on the digitization journey may find more benefits than they had in mind when they were prompted to begin, as well as unanticipated gains, according to a recent PYMTS survey.

Results were reported in the latest edition of “Business Payments Digitization: The Fast Track to Payments Systems Upgrades.”

Get the report: Business Payments Digitization: The Fast Track to Payments Systems Upgrades

Exceeding Expectations

Results from digitization efforts at the time the surveyed CFOs decided to accelerate these projects, generally at the inception of pandemic-related lockdowns in March 2020, exceeded expectations in a few key areas:

Efficiency: A full 61% of CFOs whose firms accelerated digitization of their payments systems did so to make their organizations more efficient, but 91% of them reported efficiency gains after digitizing their systems.

Cybersecurity: Thirty percent of CFOs who accelerated payment process digitization say they did so to have more secure processes for customers and vendors, but 61% reported that data security improved.

Working capital management: Forty-five percent of CFOs who accelerated payment process digitization say they did so to improve management of cash flows or working capital, but 84% pointed to improved management of working capital when the projects were completed.

Expense Reduction: Notably, just 17% of CFOs wanted to digitize to reduce expenses, but 62% say their costs lowered because of the digitization projects.

To say the least, these results are encouraging for companies contemplating starting their own payment process digitization journey but also heartening for those who have only just begun. Too often, investments in software overpromise and underdeliver, but in the case of business payment process digitization, just the opposite prevails.

Balance Sheet Boon

In fact, across the board, results generally matched expectations at the inception of digital transformation, a crucial result given the magnitude of its balance sheet impact.

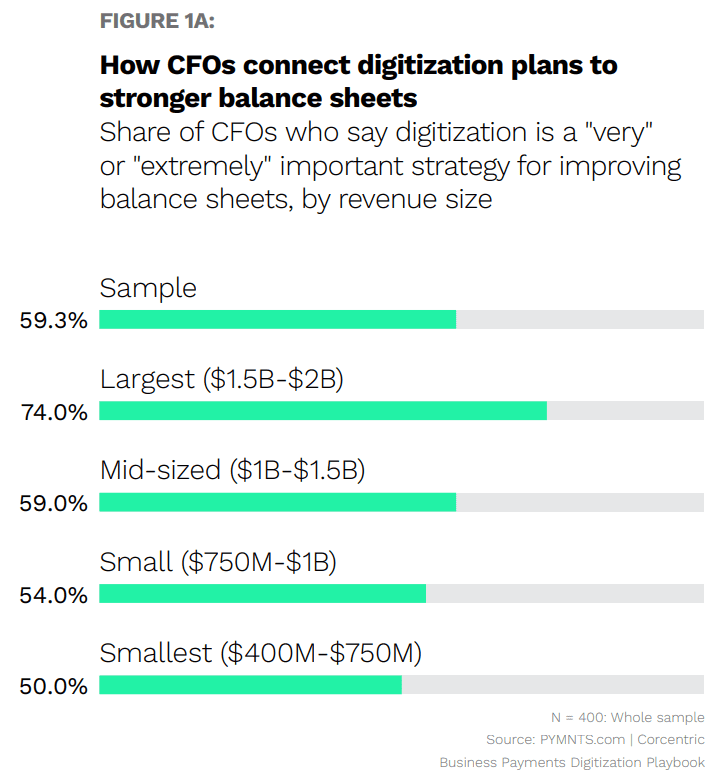

Nearly two-thirds of CFOs say digitization is a “very” or “extremely” important strategy for improving their company’s balance sheet management. Their assessment is correlated with company size, with larger firms more enthusiastic than their smaller colleagues.

Virtually all CFOs regardless of company size recognize that moving quickly with digitization efforts is a best practice for companies seeking to improve their financial operations. Ninety-six percent of CFOs say improvements to accounts payable (AP) and accounts receivable (AR) management are “very” or “extremely” important for creating a healthy balance sheet.

In fact, that was one of the principal reasons CFOs cited for accelerating the digitization of payment processes.

Nearly 40% of surveyed CFOs accelerated their digital transformation to improve their balance sheets. Of the remainder, a third did so for other reasons.

Even amidst pandemic and other pressures to prioritize digitization, some firms did not do so.

Thirteen percent said they didn’t need to because they were ahead of the game, having had the foresight to digitize before the pandemic. Yet nearly 18% didn’t accelerate the transformation for “other reasons.”

So although COVID was a compelling catalyst to automate payment processes, there is still much more work to do. Late adopters need to begin their journey, even with simple initial steps such as rationalizing legacy processes to make them automation-ready and staffing up with digital natives who can lead the process. Those who have made the leap need to continue to master the new technology — becoming power users who extract maximum value from their new platforms.