Half of Banks Report New Urgency to Offer Embedded Biz Payments Innovation

Modernizing payments is a critical initiative for financial institutions (FIs) and corporations of all sizes. The benefits are wide-ranging: Successful modernization makes business-to-business (B2B) payments, cash management and invoice reconciliation less complex and easier to manage. It can also grant these entities access to supplier portals and real-time reporting on revenue flows.

Organizations encounter opportunities and challenges when looking to innovate and improve B2B payment processes, and PYMNTS finds that these can vary dramatically depending on organizational size. Just 37% of FIs overall say they have the experience and resources to effectively address B2B payments frictions on their own with no need to outsource the development of required solutions, for example, but this share increases to 93% among large FIs, those with more than $100 billion in assets.

This is just one of the findings that PYMNTS uncovered in “Meeting The Challenge Of Payments Modernization: How Organizational Size Influences Innovation,” a collaboration with FIS. Based on a survey of 311 executives working as head of treasury services or wholesale banking at large international banks, large national banks, regional banks, community banks and credit unions, this report examines how FIs and corporations of different sizes are working to modernize B2B payments, analyzes the varied challenges they face in addressing B2B payment frictions and explores how they continue to innovate to streamline B2B payments and cash management processes while developing embedded finance experiences.

More key findings from the study include:

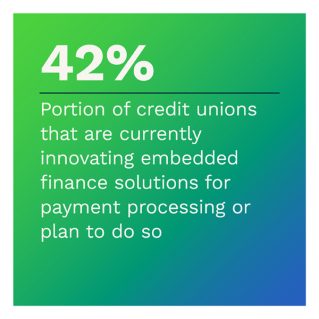

• Three-quar ters of FIs say their corporate customers experience money management frictions when making B2B payments, with smaller FIs more likely to say this. These are related to working capital management, spend management, real-time cash-flow management and real-time reporting. Close to 45% of regional banks, credit unions and community banks also find it difficult to provide their corporate customers with supplier portals. At the same time, more than two-thirds of them are working on or planning to work on providing these portals.

ters of FIs say their corporate customers experience money management frictions when making B2B payments, with smaller FIs more likely to say this. These are related to working capital management, spend management, real-time cash-flow management and real-time reporting. Close to 45% of regional banks, credit unions and community banks also find it difficult to provide their corporate customers with supplier portals. At the same time, more than two-thirds of them are working on or planning to work on providing these portals.

• One out of five FIs plan to develop in-house solutions to reduce B2B payments frictions. This share increases to 90% for FIs with more than $100 billion in assets. Just 37% of FIs believe that they have the experience and resources necessary to effectively address B2B payments frictions without outsourcing the development of required solutions. Among FIs with more than $100 billion in assets, this share increases to 93%.

• While perceiving new B2B payments solutions as useful is a  key motivator for the adoption of new digital solutions, a lack of human resources and institutional risk avoidance are the top hindrances to innovation. Thirty-two percent of credit union executives said that a lack of necessary human resources most hinders innovation. This share decreases to 12% for large international banks, which are most likely to identify the tendency to avoid risk as the most hindering factor.

key motivator for the adoption of new digital solutions, a lack of human resources and institutional risk avoidance are the top hindrances to innovation. Thirty-two percent of credit union executives said that a lack of necessary human resources most hinders innovation. This share decreases to 12% for large international banks, which are most likely to identify the tendency to avoid risk as the most hindering factor.

To learn more about how FIs of various sizes are innovating to streamline B2B payments for their corporate clients, download the report.