75% of Businesses Know They Need Better Digital Fraud Tools

Automated fraud-fighting systems have proven successful, although data suggests that firms planning in-house solutions may encounter unexpected headaches.

The B2B Payments Fraud Problem

One of the toughest challenges for firms trying to avoid falling victim to scams and bad actors is effectively authenticating another organization’s identity for business transactions. The January PYMNTS/nsKnox “B2B Fraud Tracker” noted that many businesses realize the need to modernize their current systems to battle the modern fraudster, but less than one-third plan to outsource this upgrading. This implies that most companies planning to make changes will do so in-house.

Internally developed solutions to large, overwhelming problems, such as the need for modernizing fraud-fighting systems, can be particularly tricky, as this type of solution development can severely drain resources and has no guarantee of success. Moreover, the risk of not meeting this challenge is high, as businesses lose an average of 3.5% of their revenue to fraud annually. Failure to authenticate properly can slash current revenue and lead businesses to miss future revenue opportunities, with 54% of retailers and 44% of manufacturers failing to accept new customers due to fraud concerns.

Although successful internal options are possible, some manufacturers, retailers and wholesale marketplaces may need partial or full assistance for fraud solutions to fully meet their needs. Firms just starting to look past reliance on card verification to validate customer identities could be ill-equipped to handle such a task. Businesses with lower tech budgets may find fixing issues like inadequate onboarding tools or lack of real-time verification data too burdensome to rectify on their own.

Data: How Firms Are Thinking of B2B Payments Fraud

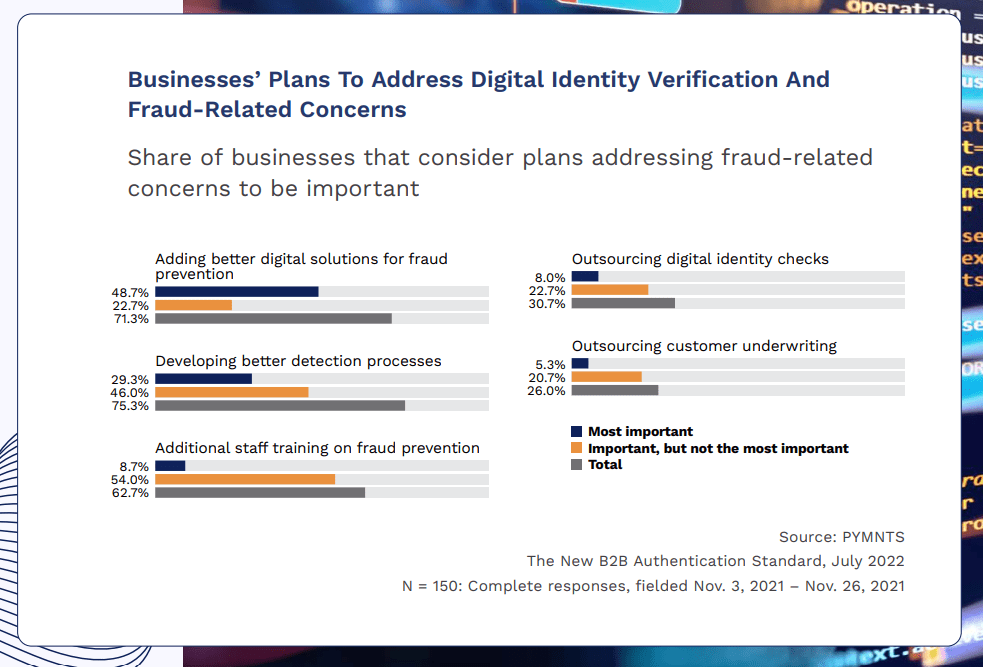

- 71% of businesses acknowledge the need for additional digital fraud solutions, and 49% cite the issue as most important to their fraud-related concerns. Organizations still relying on manual and reactive anti-fraud tools experience slower growth than those using proactive and automated solutions. Fraud-related growth limitations can include both direct theft by hackers and other bad actors and revenue loss from limiting the acceptance of new customers.

- 31% of businesses plan to outsource their identity checks, implying that most companies seek in-house solutions. While keeping things internal may help some budget-squeezed businesses in the short term, over time, the resources needed to effectively fight payments fraud in-house may be better spent addressing other core competencies that could increase revenue.

Controlling the Impact of B2B Payments Fraud

Retailers, manufacturers and wholesale marketplaces doing business with other businesses are primarily affected by this phenomenon, although authentication concerns can affect businesses in nearly all sectors that have not yet found a satisfactory solution. Also heavily impacted are the financial institutions and fraud solutions providers serving these organizations.

Christian Santaniello, senior vice president and head of commercial deposits and treasury management at Axos Bank, spoke with PYMNTS about the importance of an IT infrastructure assisting businesses in systems modernization. Santaniello also discussed how to incorporate real-time payments without falling victim to fraud, noting that third-party integrations were part of his FI’s process. “There are certain [situations where] just the idea of instant and irrevocable payments can be intimidating… We use a combination of in-house and partnership technologies that help establish controls around every aspect of the payment from the point [at which] the person or system is logging in until after the payment [is made].”

Having people on your team or partnership familiar with fraud detection is especially important, he said, because many schemes can be avoided through education. “We hear very little about these major payment rails being hacked or having security concerns. It’s more around scenarios where someone gets deceived into sending a payment to somebody they shouldn’t.”

Companies seeking to completely outsource their payment fraud-fighting might look to partner with such firms as Galileo, whose inter-business payments product is an all-in-one solution to provide overall payments support. Firms that want to outsource all payments may consider platforms like these for maximum ease. Another option may be going with an even more specialized firm. One such example is nKnox, which focuses exclusively on anti-fraud. Organizations seeking to maintain part of their payments modernization systems in-house may prefer specialized options like these. Regardless, any well-selected third-party partner could pay great dividends in the battle against fraud. Despite many firms’ plans to go it alone, there may well be strength in numbers.