The Role of a Modern Clearing Bank in Scaling Global Payments

Global payments are complex, often slow and inevitably risky. Compliance and anti-fraud efforts can be lengthy, costly processes, and many businesses, financial institutions (FIs) and entrepreneurs simply assume that this state of affairs is a permanent one. Enter the modern clearing bank, a new kind of FI designed to accelerate innovation and streamline global payments for businesses and consumers.

“The Making Of A Modern Clearing Bank: A More Efficient Model For Payments Certainty And Managing Risk,” a PYMNTS and The Bank of London collaboration, we examine the long-standing need for global payments modernization and the role of the modern clearing bank in developing new options to streamline global transactions.

The Global Payments Ecosystem: Fractures and Inefficiencies

While the term “ecosystem” implies efficiency and balance, the global payments system is anything but, according to our research. While it functions, the inconsistency of payments experiences for businesses and consumers is obvious and long in existence.

The global payments ecosystem’s fractured nature is among its greatest weaknesses and a principal origin of its enduring inefficiencies. Different platforms, processing rails and intermediary FIs are needed for bank-to-bank messaging for transaction and user authentication as well as payments processing management. This may lead to variable processing times and overall inefficiency, especially at scale.

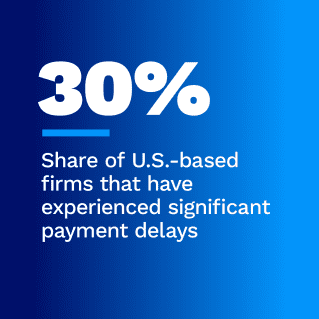

The fractured system is not simply an inconvenience, however. It can negatively impact a company’s revenues. Though payments serve as the engine of global commerce, and more than $150 trillion of cross-border transactions occur globally each year, as much as 30% of United States-based firms experience significant payment delays. New payments take an average of 32 days to clear.

While point solutions can remedy aspects of global payments, speeding up one problematic element of digital payments, such as customer onboarding, is not enough. There is a genuine need for a single solution for all types of global payments and disbursements: a modern clearing bank.

What Is Modern, Anyway?

Clearing banks have existed for decades, but modernizing them is a relatively new concept. While clearing banks essentially facilitate faster transactions between two FIs, their functions can be hit or miss, according to the playbook.

Using a clearing bank to authenticate and process transactions may help sending or receiving banks speed the processing of payments at volume, or it may slow down the process significantly, as recent research shows. Efficiency and speed that do not compromise security or compliance are core functions of clearing banks, not occasional features for the fortunate few.

A modern clearing bank is designed to make the global payments ecosystem work for every FI, business or entrepreneur, in terms of balance, efficiency and compliance. Modern clearing banks take the guesswork out of creating integrated compliance, anti-fraud and payments optimization strategy for clients by managing critical aspects of transaction processing in-house through a single service.

A Quick “Forever Fix”: How Modern Clearing Banks Transform the Way Transactions Are Processed

A modern clearing bank can speed transaction processing times while ensuring that compliance and risk management controls stay intact globally. A modern clearing bank works more like an agency than a traditional bank, empowering its clients to do what the legacy systems behind cross-border payments could not: access or develop unique, customized payments solutions that work seamlessly anywhere.

Those benefits can extend not just to FIs seeking to optimize their operations but also to retailers, brands, entrepreneurs or other entities managing global payments.

To learn more about the role of the modern clearing bank in transforming global business, download the report.