Nearly 40% of Gen Z and Millennials Would Leave Banks Lacking Innovation

Potential customer loss could outweigh the cost of investing in payment methods that consumers demand.

Payment options matter to account holders across generations, but it is the younger demographics most willing to switch their current financial institution (FI) over a lack of innovation.

PYMNTS’ May collaboration with PSCU, “Credit Union Innovation,” found that 29% of account holders overall would consider switching to an FI offering innovative payment products.

Nearly one-third of account holders willing to go through the friction-filled effort of transferring FIs over lack of payment methods may be alarming enough for institutions that have so far delayed offering these options. However, a higher share of younger consumers agreed with the sentiment, with 38% of bridge millennials, 39% of millennials and 38% of Generation Z consumers saying they would consider switching.

Losing these potential lifetime customers now starting or in the middle of their financial journeys means that innovation-lacking FIs could face higher long-term profitability issues if these consumers switch. As difficult as it may be to maintain targeted customer retention rates in the current ultra-competitive environment, luring consumers back after they’ve already left may be near impossible.

The Options Consumers Currently Demand

The Options Consumers Currently Demand

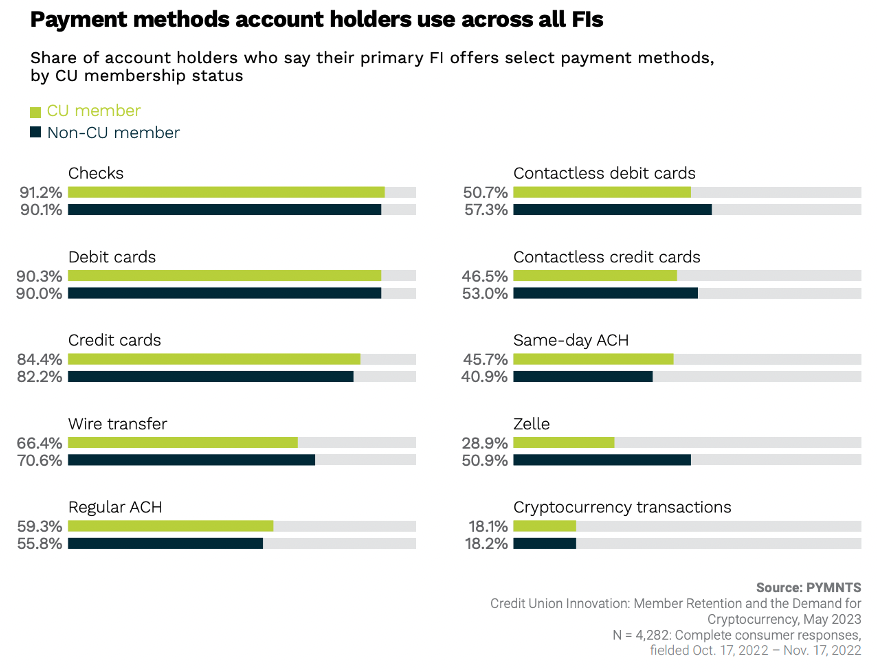

Many, if not most, popular payment methods have or are quickly becoming must-haves for FIs hoping to retain their customer base. For example, contactless credit cards are becoming more widely accepted by merchants and other businesses, but only 47% of credit union (CU) members and 53% of non-CU members said their FI offers the option.

For tech-forward customers, which includes the younger digital-native younger generations, not having this method available may be simply unacceptable. Additionally, lack of offering Zelle could lead to the same consumer sentiment for the 71% of CU members who said their FI doesn’t offer the globally popular payment method.

Tech innovations, especially when it comes to consumer-facing payment offerings, are quickly becoming table stakes for FIs as customers demand increased connectivity and more money mobility options. As a large slice of younger consumers have made clear, FIs not stepping up could be left behind.