Small Banks and Credit Unions May Need Innovation to Stem Deposit Exodus

Small and regional banks are experiencing major fallout from the SVB meltdown as well as chasing higher rates on savings, as detailed last month by The Wall Street Journal. While the 25 largest U.S. banks captured $120 billion in deposits in the days following the West Coast bank’s collapse, all banks smaller than those huge financial institutions lost $108 billion. Additionally, money market funds have gained over $220 billion over this span.

Although the worst of the panic seems to have subsided, there are real fears about whether deposits will continue to fall for these smaller players in the sector. Not only would that call into question the survival of these financial institutions (FIs), but such a development could jeopardize lending in general, as banks and credit unions of all sizes need deposits to make loans.

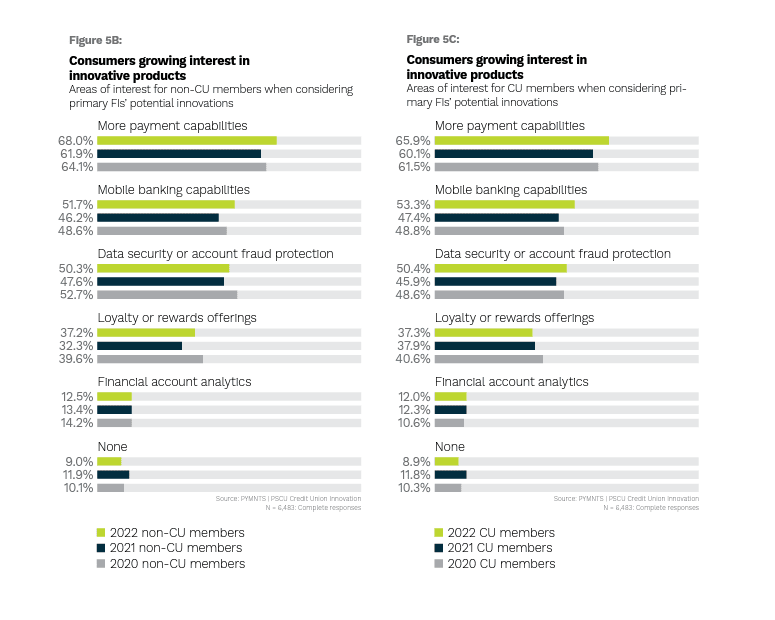

Smaller, regional banks and credit unions lack the power to change national sentiment, meaning they are somewhat at the mercy of the market at large. Fortunately for smaller sector players, consumers are vocal about what they want — and they have a growing interest in digital innovations offered by their primary FI, as noted in the PYMNTS collaboration with PSCU, “Credit Union Innovation: The Race to Meet Customer Demand.”

As noted, both credit union members and non-credit union members want similar features at near-identical rates from their primary FIs, including personal finance analytics and data security innovations.

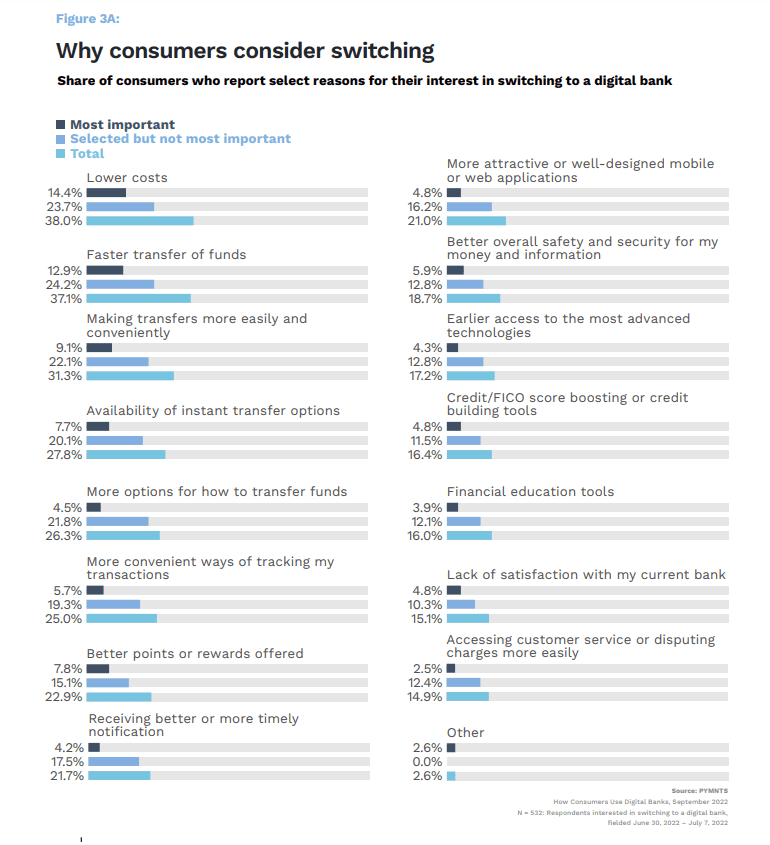

In even further detail, consumers surveyed for the PYMNTS collaboration with Amount, “Bundled Banking Products,” describe what features would make them switch primary FIs. While the specific focus here is on digital banks, one could extrapolate that there may have been similar results for any FI offering similar innovations.

Smaller banks and credit unions considering using customer-facing innovations as part of a greater loyalty strategy have many options in how to undertake this effort. While all depend on a modernized system to be effective, methods may include data readiness, promotions and seamless money mobility. Which option and strategy may be most effective for individual FIs could be best served decided by the institution.

In order to stem any current or future deposit departures, smaller banks and credit unions may have to buck the cost-cutting trend and consider innovations investment. Without this pivot, these institutions may not have the necessary tools handy to keep customers coming back and maintain survival, should another crisis hit.

Get the study: Bundled Banking Products: Matching Product Offerings With Customer Demand