Restaurants Outpace Aggregators 2-to-1 in Online Ordering

In the battle for digital orders, restaurants are way ahead of third-party aggregators.

By the Numbers

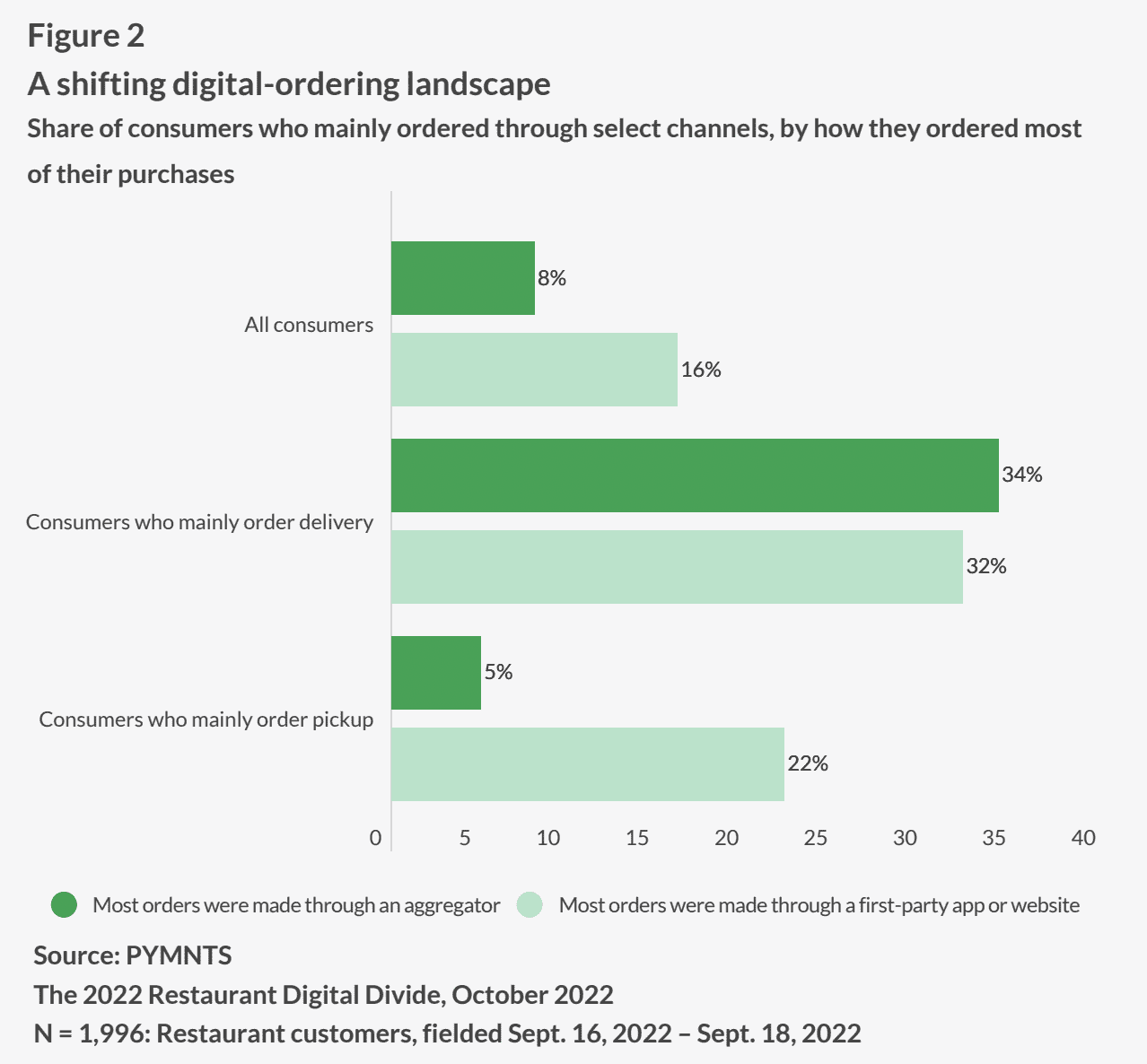

Research from this month’s edition of PYMNTS’ Restaurant Digital Divide report, “The 2022 Restaurant Digital Divide: Restaurant Apps And Websites In The Spotlight,” which draws from a census-balanced survey of nearly 2,000 U.S. consumers, finds that 16% of consumers primarily order food via restaurants’ direct ordering channels such as their website or their app. Meanwhile, only half that share (8%) stated that they mainly order food via third-party aggregator.

Get the study: The 2022 Restaurant Digital Divide: Restaurant Apps And Websites In The Spotlight

The Data in Action

This trend is no accident on restaurants’ part. In fact, brands are doing everything in their power to drive direct ordering, incentivizing mobile and web purchases with loyalty points and using the data from these transactions to personalize the experience and drive greater engagement.

Take quick-service restaurant (QSR) giant McDonald’s, for instance. On a call discussing the brand’s third-quarter 2022 financial results Thursday (Oct. 27), CFO Ian Borden noted that, following the MyMcDonald’s Rewards U.S. launch last year, digital customer frequency has been on the rise every quarter.

By this past quarter, the number of active customers on its app across its top six markets totaled more than 43 million, and “about two thirds” of those who have been active in the U.S. over the course of the year have engaged in the last three months.

“Each reward a customer redeems and each preference of customer shares on our app helps power our personal touch,” CEO Chris Kempczinski said on the call. “We are using this deeper understanding of our customers to create relevant content and offers through the channels they prefer. By tailoring messages, our customers feel more connected to McDonald’s, ultimately driving engagement and increasing frequency.”