Report: Buy Buttons Cut Checkout Times to 68 Seconds, Boost Conversions

Following the progress of buy buttons in eCommerce since 2016, it’s clear from the latest PYMNTS research that merchants embedding this fast checkout option are benefiting on the bottom line while bettering customer experience as the technology improves.

For the 2022 Buy Button Report: Accelerating Checkout Optimization study, PYMNTS surveyed more than 800 top U.S. online retailers in 17 sectors, as well as 200 merchants offering buy now, pay later (BNPL) options, finding strong correlations between buy buttons and faster conversions.

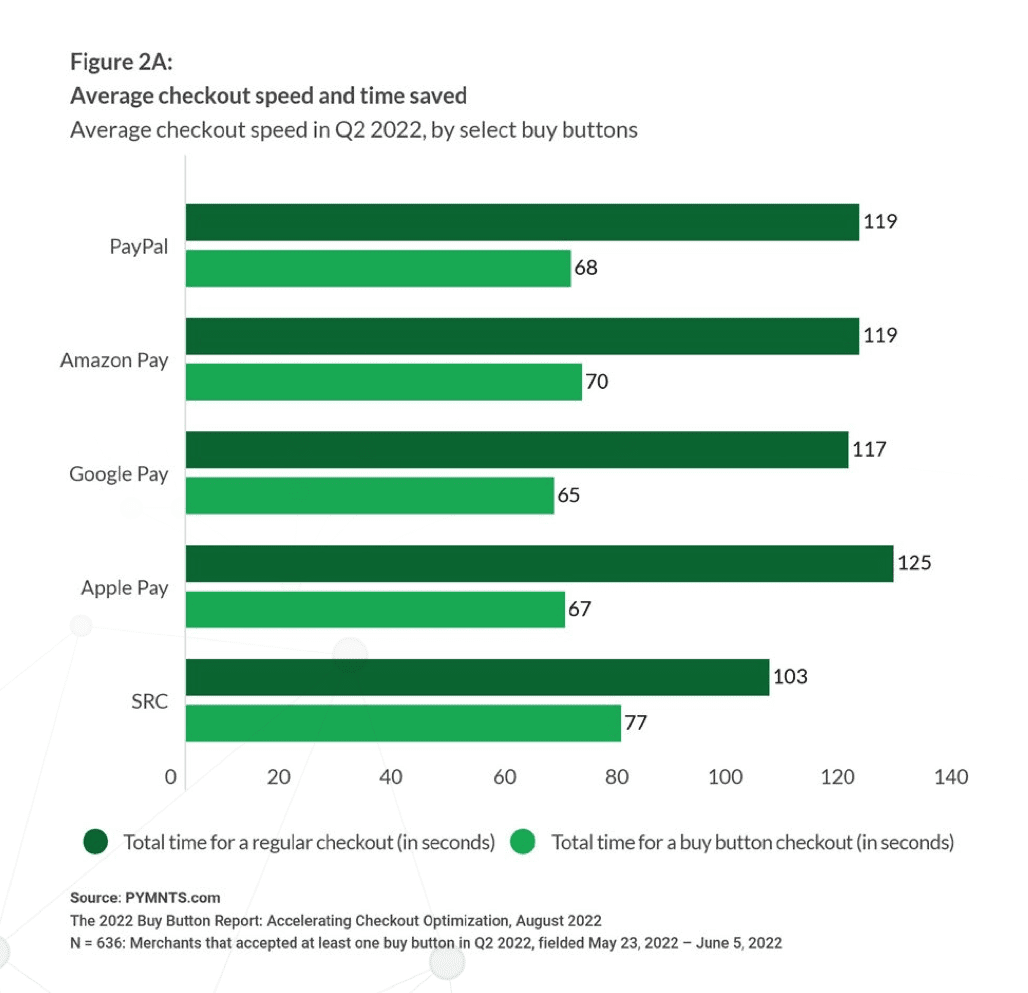

Among marquee findings is the fact that shoppers who skipped shopping carts altogether opting for the instant “buy” choice cut a collective 148 million hours — expressed another way, 6.1 million days — out of their shopping journeys annually. Buy button checkouts averaged 68 seconds in Q2 2022, making them 17% faster than in Q4 2020 by comparison.

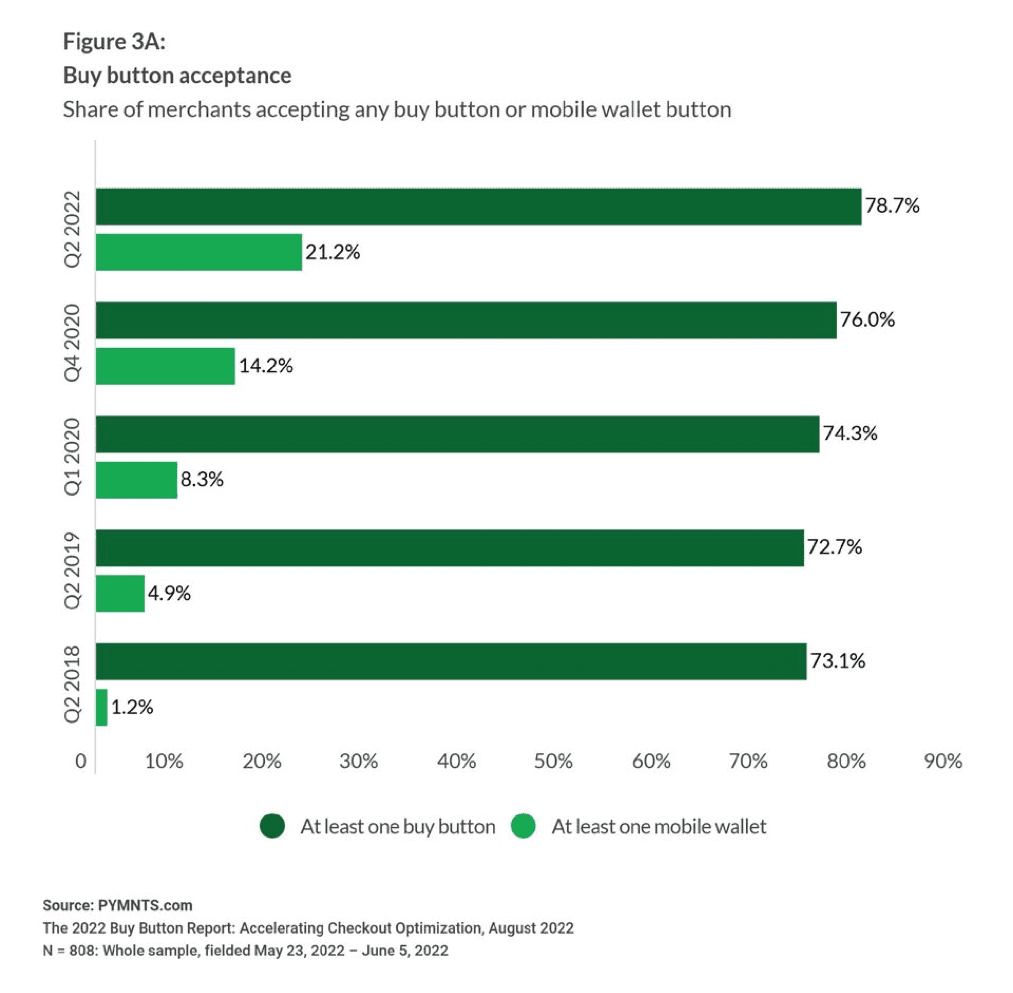

The reigning champ of buy button commerce is PayPal, with nearly 8 in 10 (79%) of merchants now offering PayPal or a competitor like Apple Pay, Google Pay and Amazon Pay, rivals that “significantly expanded their buy button availability since our Q4 2020 report.”

See it now: 2022 Buy Button: Accelerating Checkout Optimization

More Buy Buttons, More Buys

As mobile commerce takes a larger slice of ecommerce transactions, we found that since our 2020 study adoption of buy buttons in mobile shopping apps has increased by nearly half (49%).

“PayPal continues to dominate the eCommerce buy button space, with a 76% adoption rate across online merchants,” per the 2022 Buy Button Report. “Amazon Pay grew its footprint by 14% and comes in a distant second at 20% adoption. Fewer merchants offer Google Pay and Apple Pay, at 14% and 10% adoption, respectively, but both have surged in popularity since 2020. SRC lags well behind the rest and has seen adoption shrink noticeably since Q1 2020.”

Not only are these click-and-purchase options expanding across retailers in all categories, the number of buy button options offered by individual merchants continues to rise as well.

PYMNTS research found that 35% of online businesses featured two or more buy buttons in Q2 2022, up 28% over Q4 2020, with close to 10% (9.4%) of online merchants now supporting three or more buy buttons, increasing nearly four percentage points since Q4 2020.

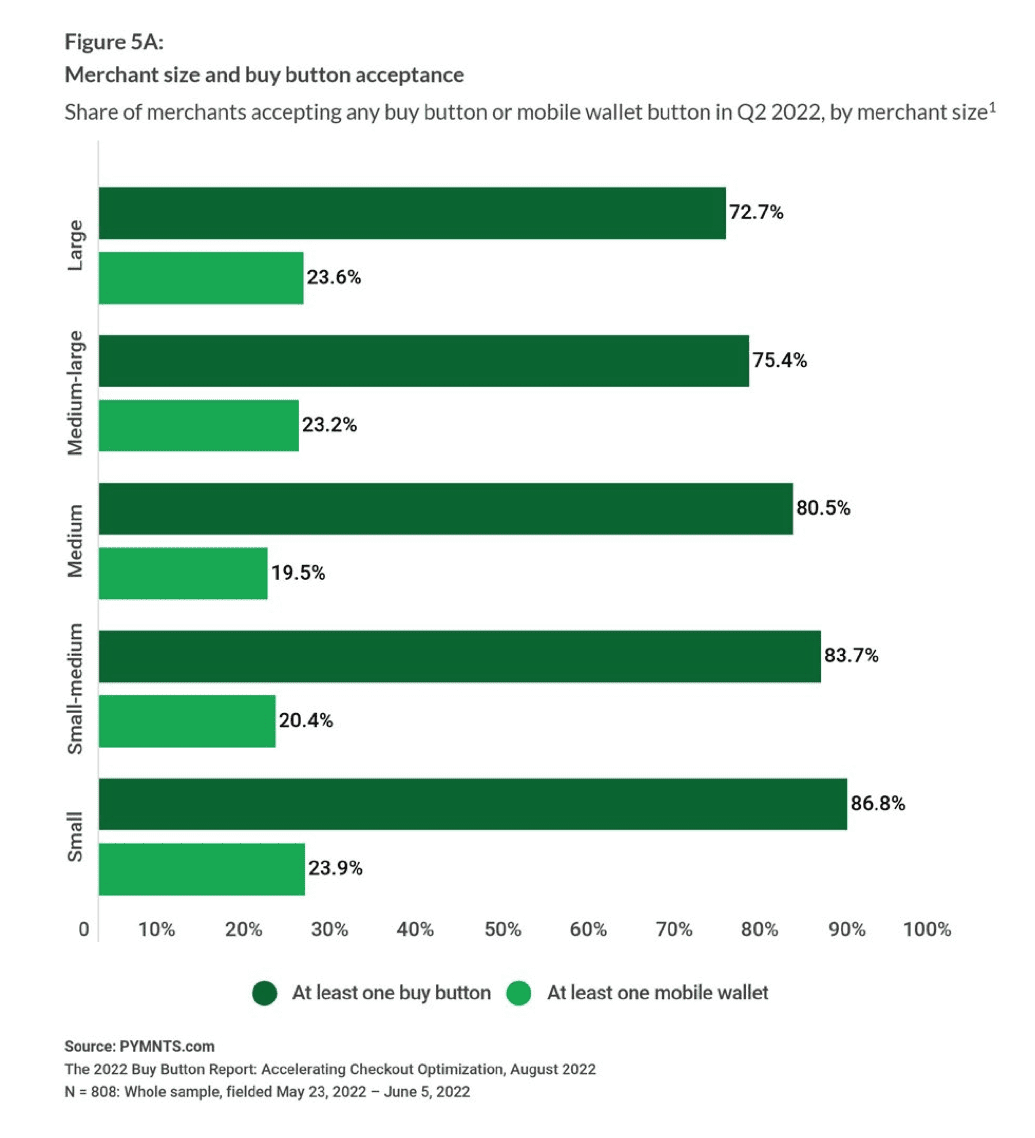

A fascinating finding in the 2022 Buy Button Report is the adoption of this checkout feature among small and medium-sized businesses (SMBs).

Defining eCommerce SMBs as those doing under $100 million in revenue annually, this group is enthusiastically embracing quick-converting click-to-buy options in higher numbers than their enterprise competitors, with 87% of this group offering buy buttons compared to 73% of larger operators.

“Small merchants are also more likely than large ones to offer PayPal, at 85% versus 71%, respectively,” the report noted. “The contrast is starker for Amazon Pay and Google Pay, which were featured at 27% and 18% of small eTailers, respectively, but were only present at just 4% of large merchants.” Apple Pay is the standout here, accepted by 22% of large merchants compared to just 8% of SMB ecommerce merchants.

An interesting though not unexpected finding is the coexistence of BNPL with buy buttons on ecommerce site checkouts, as “88% of eTailers now offer at least one BNPL option, with 82% providing one of PayPal’s BNPL options. Small to mid-sized merchants are more likely to offer BNPL than large ones,” the study notes.

Friction Remains a Factor

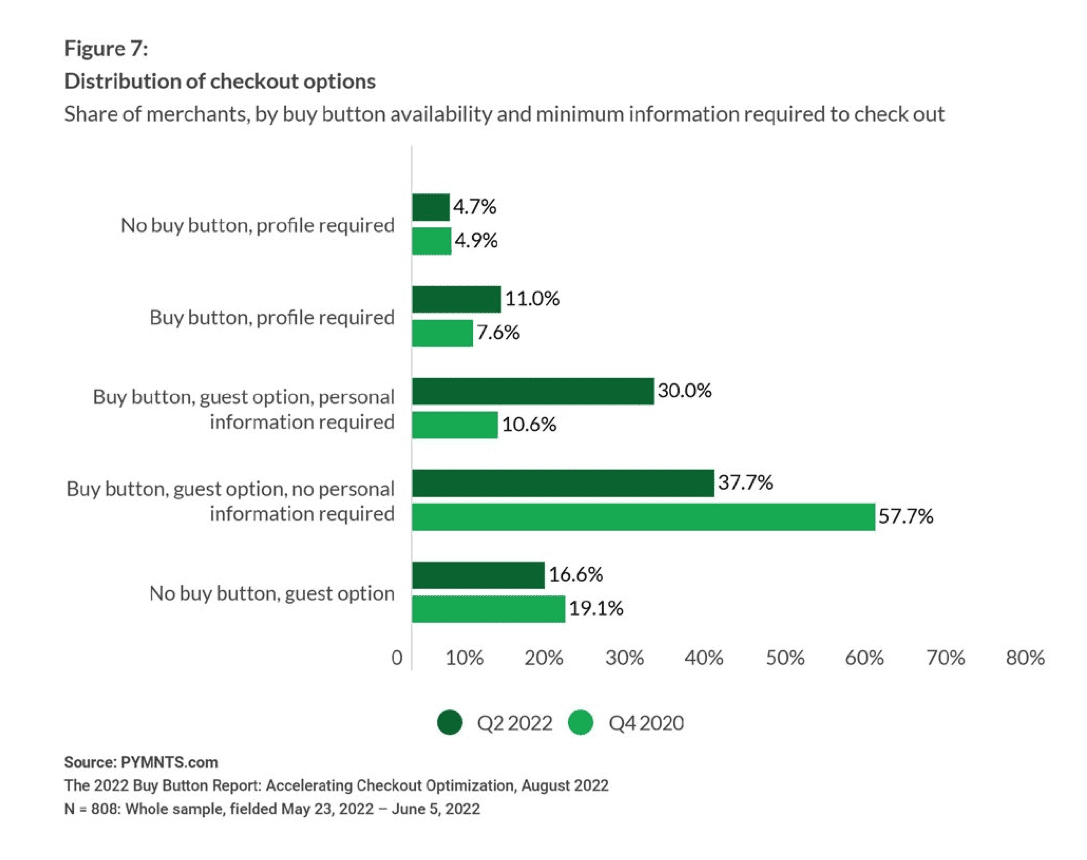

Proliferation of buy buttons is a having a major impact, as PYMNTS data shows checkouts using this method are 46% faster than other methods, “shaving nearly a full minute from the checkout process on average.” However, 31% of the online merchants surveyed require consumers to authenticate identity, adding friction and somewhat defeating the purpose.

Requiring entry of personal information is one of the final frontiers that buy buttons must overcome. The report observes that “In Q2 2022, online shoppers took an average of 1 minute, 22 seconds to complete online checkouts with merchants that require profiles and offer buy buttons, and 1 minute, 13 seconds for merchants allowing guest checkouts but requiring some personal information to use buy button options. These are 37% and 22% slower, respectively, than buy button checkouts” not requiring additional information, which average one minute.

Get your copy: 2022 Buy Button: Accelerating Checkout Optimization