Twenty-Three Percent of Consumers Want Instant Insurance Claims Payouts

Instant payments are finding firm footing as way to get insurance claims paid out quickly.

In the Insurance Disbursements Brief 2022, a PYMNTS and Ingo Money report, more than 2,400 consumers weighed in on the ways in which they’d want to be get their insurance payouts.

Just about a quarter of them — 23% — would want to be paid instantly, should that option be on offer.

The awareness of, and willingness to use, instant payment options has been on the rise. By the middle of last year, about a quarter of consumers received an instant claim payout — and the tally topped $277 billion in instant disbursements last year. That’s 20% of the total dollar amount sent out in 2022, and represents the highest percentage in years (and up from less than 9% in 2020).

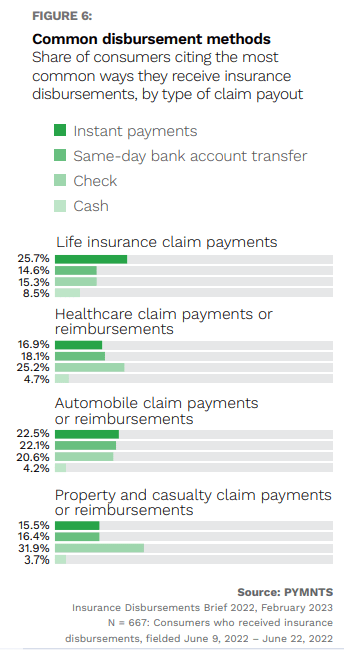

Healthcare claim payments and life insurance are among disbursements made as instant payments most often, but as the chart below details, there’s still room for improvement. Paper checks and even cash are stubbornly entrenched in all manner of payouts, at about a quarter of healthcare claim payouts and 15% of life insurance claims paid to holders.

For the payers/insurers, there’s the option to monetize speed and to move away from the paper channels. As many as 45% of consumers would be willing to pay a fee in order to get an instant health insurance payout.

That’s down a bit from 51% in 2021, when instant disbursements were less common. So there’s at least some recognition on the part of customers that instant payments are becoming mainstream, and they expect the option to be on offer an everyday part of doing business.

Should companies fail to offer instant payouts, they of course risk losing some customers who may opt to go elsewhere to get what they need.

Companies Incorporate Instant Into the Mix

And though a significant number of firms do indeed offer the option, there’s still room for improvement, as less than two-thirds — or 62% — of payments are accompanied with the option for consumers to pick and choose instant as an option.

Consumers were most likely to opt for instant methods for life insurance payouts. Consumers chose instant payment rails for 46% of all life insurance payouts in 2022. That tally is leagues above the 11% of consumers who chose to receive these disbursements via same-day bank account transfer.