Manufacturers Favor Digital Giants Over Banks to Deliver Real-Time Payments

The manufacturing sector is undergoing a significant transformation in its payment practices, with a growing emphasis on real-time payments.

In fact, instant payments have emerged as the leading method for business-to-business (B2B) transactions in the sector, with over 99% of manufacturers already utilizing real-time payments for their B2B transactions, surpassing other methods such as automatic clearing house (ACH) payments, wires, and checks. Overall, real-time payments account for 15% of outbound and 14% of inbound B2B transactions.

These are some of the findings detailed in “Corporate Changes in Payment Practices: A Deep Dive Into the Manufacturing Sector,” a report by PYMNTS Intelligence and The Clearing House. The study draws on insights from a survey of 125 manufacturing firms to examine the B2B payments landscape in the manufacturing sector and how real-time payments’ role is evolving in the space.

The study highlights that a significant share of manufacturers (86%) are either actively investing in real-time payment capabilities or have plans to do so within the next 12 months, with the speed and reliability of real-time payments cited as key factors driving this shift. Additionally, 91% of manufacturers cite better relationships with suppliers as a crucial reason to adopt real-time payments.

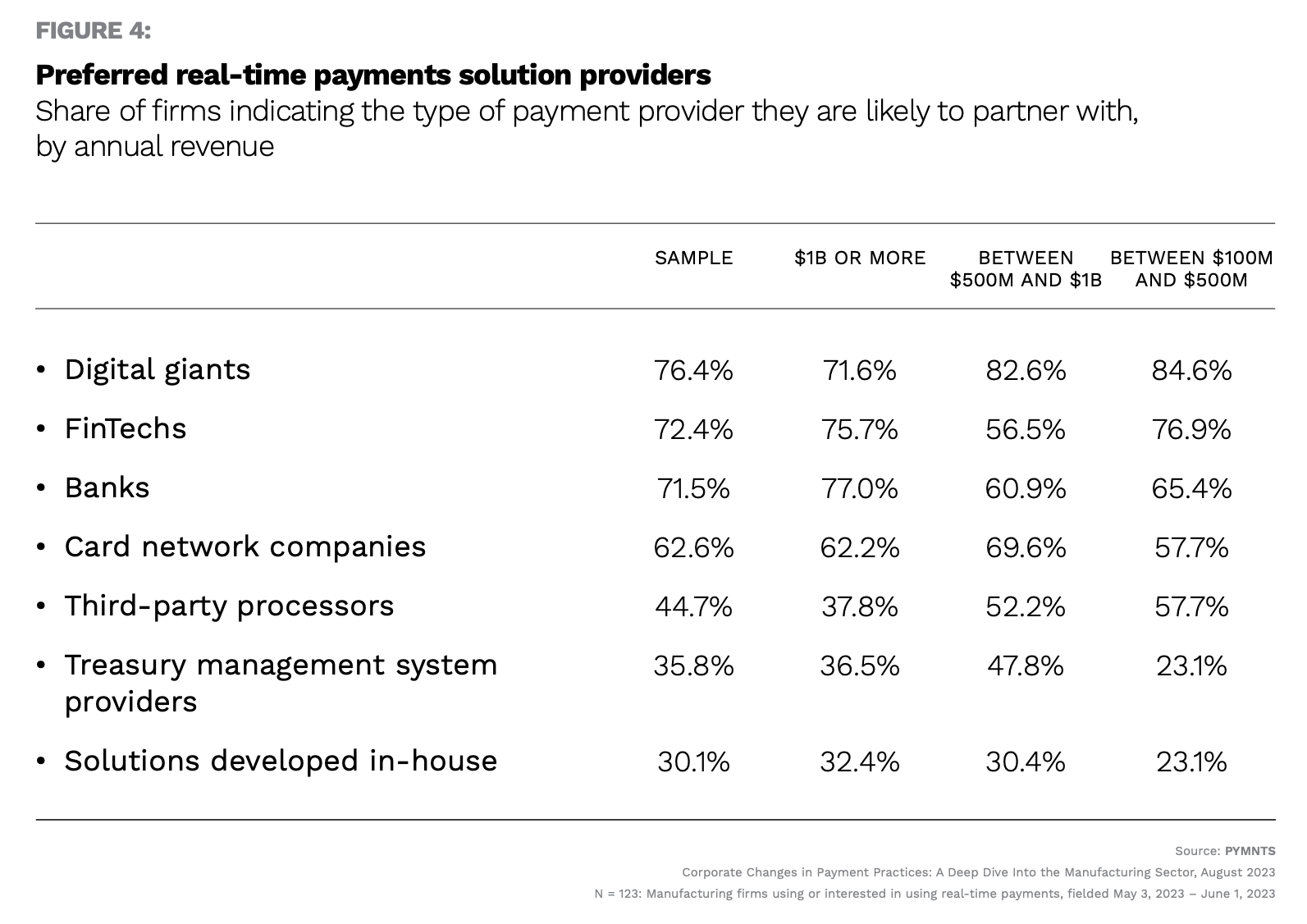

When it comes to enhancing their real-time payment capabilities, manufacturers are turning to partnerships with different types of payment providers. The survey reveals that 76% of manufacturers plan to partner with digital giants like PayPal, Square, or Stripe, which is slightly higher than the 72% likely to collaborate with FinTechs and banks.

Card network companies, third-party processors and treasury management system providers are other providers being considered by about 62%, 45% and 36% of manufacturers, respectively. “Meanwhile, 30% of all firms intend to develop and deploy their own real-time payment features, underscoring the extent to which manufacturers view partnerships with technology leaders as essential for real-time payments innovation,” the study further noted.

Manufacturers are also planning to reduce their usage of traditional payment methods. The survey indicates that 47% of companies plan to decrease their reliance on checks, while 38% expect to do the same with debit cards. Real-time payments and same-day ACH are the only payment methods for which both buyers and suppliers plan to substantially increase usage.

In summary, the manufacturing sector is swiftly adopting real-time payments as the primary method for B2B transactions, with firms actively investing or forging partnerships with various payment providers to enhance their real-time payment capabilities. Manufacturers yet to fully embrace this trend will need to consider accelerating implementation to remain competitive in the evolving B2B payments landscape.