Only 10% of Retailers Have Invested in Real-Time AP Payments

Only a slim minority of manufacturers and retailers are investing in real-time payments.

Joint research from PYMNTS and Corcentric, as detailed in the report titled “Payments Technology’s Future: Retailers. Manufacturers Seek Better Workflows,” shows that firms in these verticals are taking the time and spending the money to upgrade back-office functions.

But as to just where those efforts are concentrated — well, some areas are getting more attention than others, at least at present.

Better Cash Flow Visibility

Generally speaking, the efforts to improve accounts payable (AP) and accounts receivables (AR) pay dividends for enterprises. They’re able to garner better visibility into the day-to-day cash in and cash out activities, and to manage working capital more effectively.

The urgency to do is especially acute three years into a pandemic that has forced us all to go digital, and where supply chain disruptions have been widespread. Supply chain interruptions are especially difficult for retailers and manufacturers, who depend on the smooth movement of physical goods to keep top line momentum in place. Part of the smooth interaction is dependent on procurement, and on paying and getting paid in a timely fashion.

To that end, our research shows, for example, that a majority of retailers have already been investing in procurement applications — at 57%. That’s trailed a bit by the 53% of manufacturers who have done so. And in terms of the future plans of the CFOs we surveyed — more than 250 in all — about 23% of retailers and 34% of manufacturers plan to invest in improving those procurement functions. Elsewhere, 44% of manufacturers planning to improve working capital and credit systems, while 31% of retailers are in the planning stages of making investments in those same systems.

Drill down a bit, and there are several areas that have yet to capture a significant level of spending, and in fact may not capture much in the way of capital expenditures over the near term horizon.

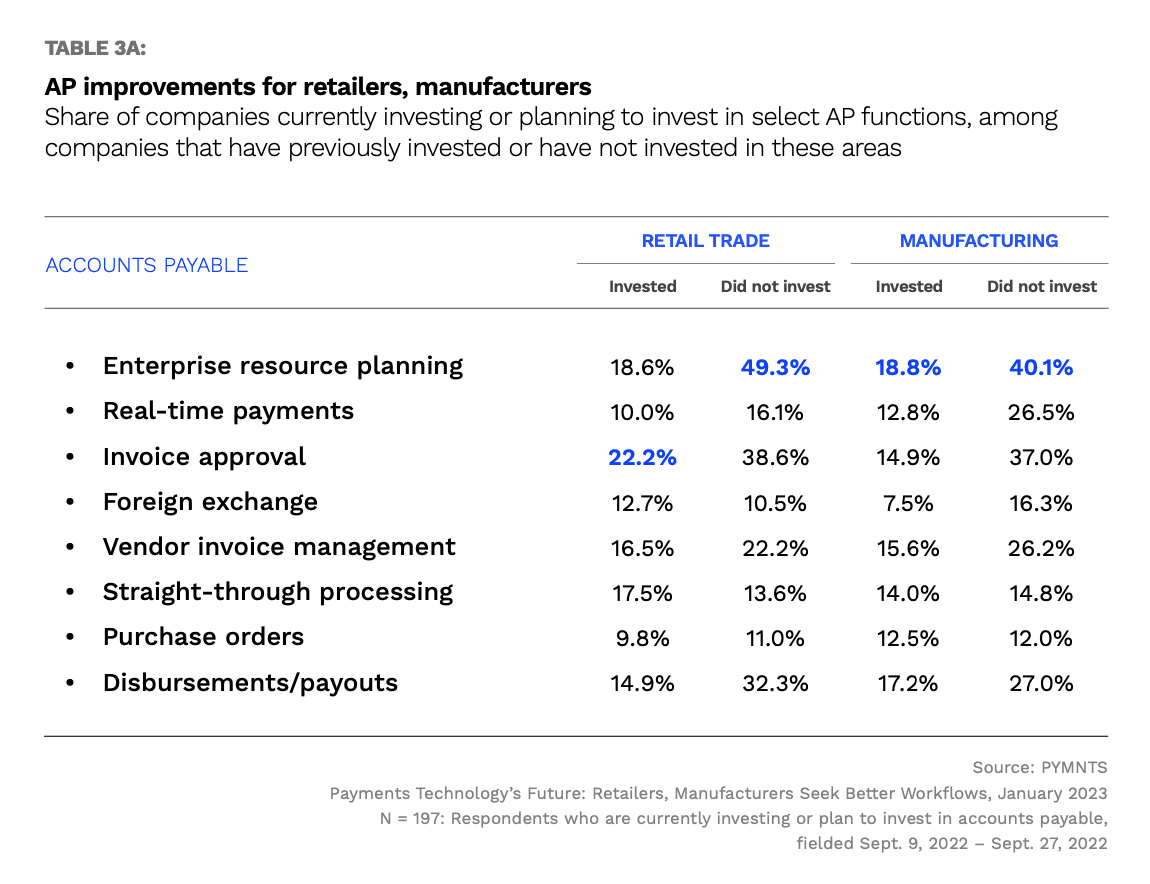

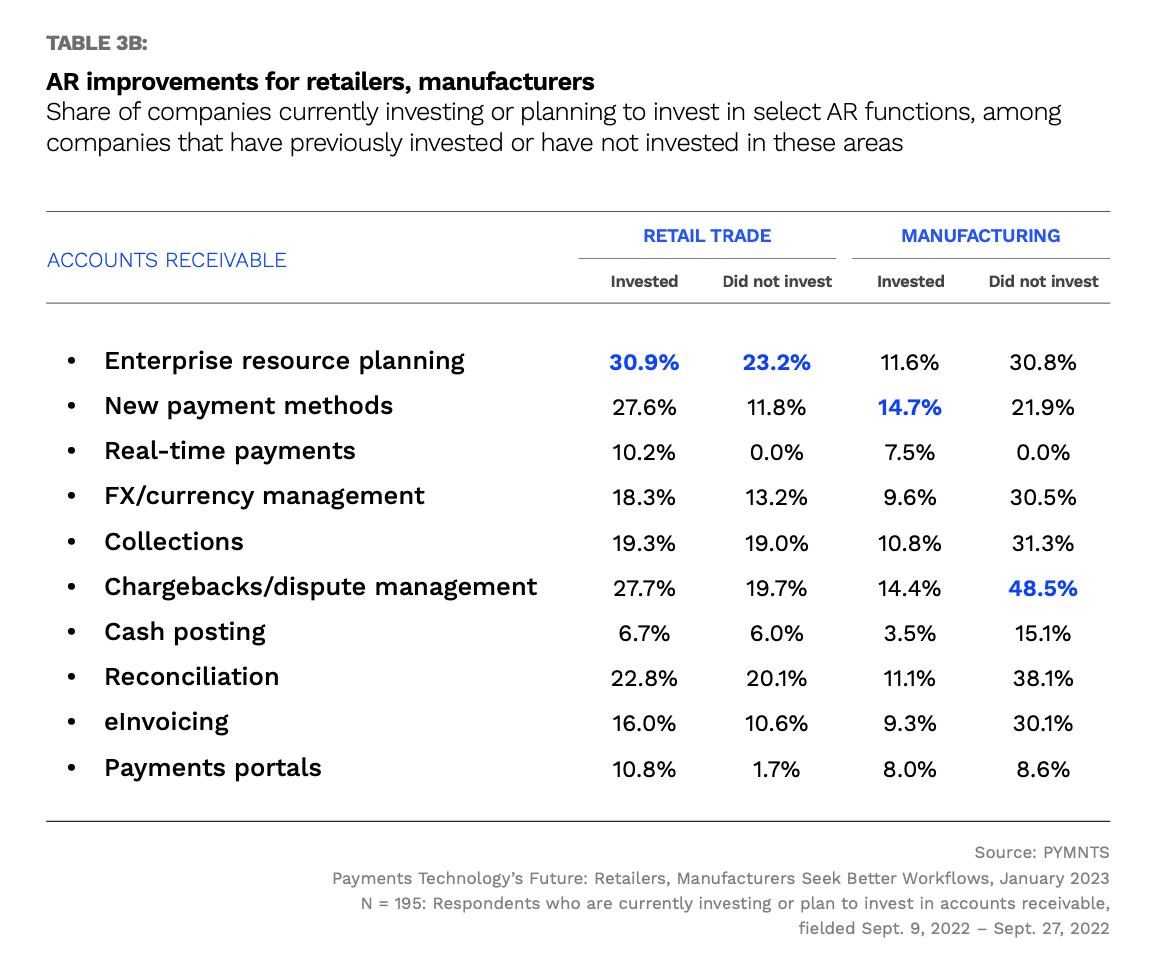

On both the AP and AR sides of the cash flow coin, we find investment in real-time payments has been somewhat lower down on the totem pole, at least in terms of spending priorities. The charts below show that only 10% of retailers and a bit less than 13% of manufacturers have made investments in AP-related real-time payments; the intent to do so increases for CFOs in both sectors … but certainly not toward anything resembling a majority. The same holds true for accounts receivable functions.

There’s only a limited amount of capital to go around as these CFOs seek to modernize operations — and it may be the case that, at least for a bit, the need for speed will take a back seat.