70% of Restaurant SMBs Say Convenience Is Top Instant Payments Benefit

While instant payments might seem like an innovation that only big companies would embrace, these types of expenditures are gaining traction with many mom-and-pop eateries.

The PYMNTS Intelligence report “Small Business Real-Time Payments Barometer: Restaurants Edition” found that the number of restaurant small- to medium-sized businesses (SMBs) now sending instant payments surpasses those that send checks or use ACH payments to deliver their funds.

The report, which drew on survey data from 614 restaurant SMBs that generate $10 million or less in annual revenues, revealed that 40% of restaurant SMBs said instant payments are their most used payment method. Instant PayPal and debit cards are the two most common instant payment methods.

In the last year, 74% of the restaurants PYMNTS surveyed sent instant payments. Meanwhile, 48% sent credit card payments, 44% sent ACH transfers and 37% sent cash payments. However, the preferred instant methodologies varied among the restaurants, led by push-to-debit cards (41%), instant PayPal (40%) and Venmo (27%). Instant pay-by-bank came in a distant fourth, with only about 20% of restaurant SMBs sending their payments this way.

Regardless of the instant payment methodology used, 79% of restaurant SMBs that sent payments instantly said they were very or extremely satisfied with the results.

So — among restaurant SMBs that used instant payments last year — which benefits most contributed to their high levels of satisfaction?

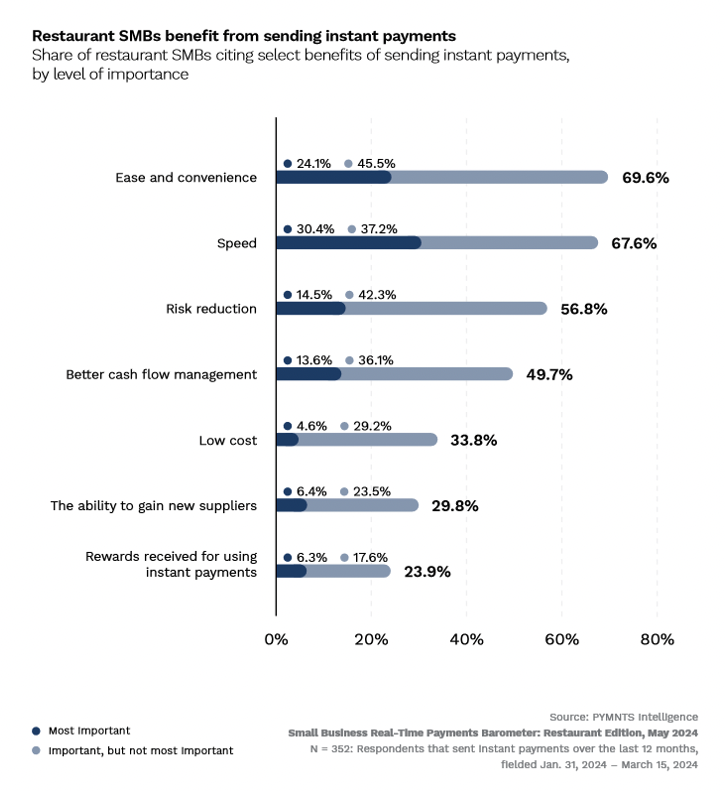

For 70% of respondents, the ease and convenience of instant payments topped the list, with 24% singling out speed and convenience as the most important factor. Sixty-eight percent, meanwhile, mentioned the sheer speed of delivery as a leading value proposition, with 30% saying speed was the most important benefit. Other key drivers included risk reduction, at 57%, and better cash flow management, at 50%.

For 70% of respondents, the ease and convenience of instant payments topped the list, with 24% singling out speed and convenience as the most important factor. Sixty-eight percent, meanwhile, mentioned the sheer speed of delivery as a leading value proposition, with 30% saying speed was the most important benefit. Other key drivers included risk reduction, at 57%, and better cash flow management, at 50%.

Twenty-four percent said receiving rewards in exchange for using instant payment rails contributed to their overall satisfaction. This is something instant payment providers may want to keep in mind when convincing other restaurant SMBs to use their services.

Providers should also note that among those restaurants that do not use instant payments, their most common reason was their perception that instant payments are difficult to use. Thirty-four percent that did not use instant payments in the last year cited this as an important reason. Meanwhile, 32% said instant payments carry an increased risk of fraud — a clear misperception according to the 57% who said risk reduction was a major contributor to their satisfaction with the service.

In these cases, the root issue is unfamiliarity with instant payments, and providers may well address this if they want to win over more restaurant SMBs.