93% of Truck Drivers Want Instant Payments

Truck drivers help keep the supply chain functioning, but the turnover rate is high in the industry — a reality that can have ripple effects across the entire U.S. economy.

PYMNTS Intelligence’s “Generation Instant: How Truckers Use Instant Payments to Support Their Lifestyles” revealed that one key contributor to the high turnover is that, in many cases, drivers are expected to supply their own trucks and cover out-of-pocket costs like fuel and maintenance, leaving them stuck in idle waiting to get reimbursed.

But instant payments could offer some relief.

The report, which is based on surveys with more than 7,800 consumers, found that 2 in 5 truck drivers now use instant payments to collect their income and earnings, and 17% of those prefer it over other payment methods. Given the option, 93% of truckers would use instant payments to receive their earnings.

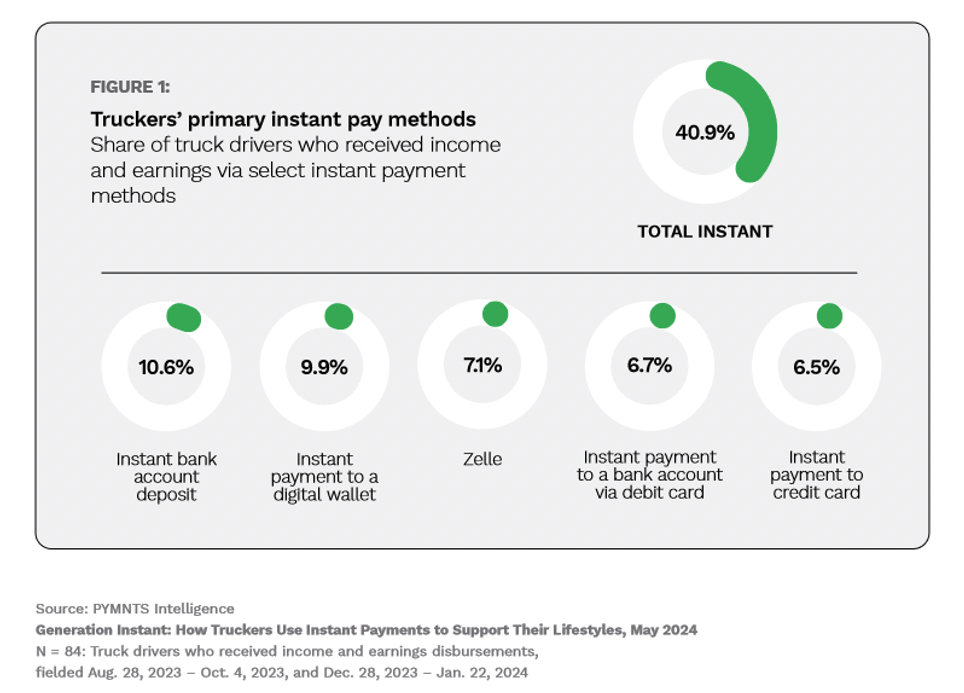

Surveyed truckers cited quick access to money and convenience as key factors driving their preference for instant payments, with nearly half of them saying immediate access to funds helps them manage their finances. This explains why they are more apt to receive their income and earnings via instant methods than the average consumer. Forty-one percent of truckers get paid through instant payment methods, more than the corresponding 34% of all consumers.

Instant payment via bank account deposits is the most popular instant option among truck drivers, making up 11% of all income payments, followed by instant to digital wallet, at 10% of all payments. Zelle, push to debit, and push to credit each account for approximately 7% of truckers’ instant payment methods.

Instant payment via bank account deposits is the most popular instant option among truck drivers, making up 11% of all income payments, followed by instant to digital wallet, at 10% of all payments. Zelle, push to debit, and push to credit each account for approximately 7% of truckers’ instant payment methods.

Data on companies paying truckers showed that 24% of all payments made to drivers were made via Zelle, as it is an accessible way to process nonrecurring payments to drivers. Sender data also showed instant payment use is rising. Thirty-six percent of ad hoc payments made by payers in the transportation and trucking industry to drivers were sent instantly, up from 29% last quarter.

This enthusiasm for instant payments — on the part of truckers and the companies that pay them — is understandable given the out-of-pocket costs many drivers are asked to carry. The fact that instant payments can be received remotely likely adds to their appeal since truckers spend so much time on the road.

Deploying instant payments to ensure truck drivers get paid quickly and efficiently not only offers the potential to improve their job satisfaction but could also help reduce turnover rates and, along the way, help fortify the country’s supply chain.