Consumers Love Rewards-Driven Payment Methods — and Will Switch to Get Better Ones

Whether paying with a traditional credit card, stored payment credentials or cold hard cash, consumers love points and rewards.

Points and rewards programs connected to payment options offered by banks and other financial institutions (FIs) seem to be offerings as old as the payment options themselves. After all, when introducing a new consumer-facing product, there must be some incentive for customers to make the switch. Sometimes that is in the form of increased convenience, such as how digital wallets have caught on for online purchases. However, those convenience-driven chances at changing consumer behavior are few and far between; much more often, attractive reward offerings are financial.

Not that savings or other types of financially driven rewards or points programs are any less effective. After all, just ask the travel industry, which has seen success for decades with points-based credit cards. This driver for consumers making the switch applies to these “classic” payment options as well as to newer innovative products offered by FIs such as money-storing apps.

This age-old pattern holds true as well when it comes to customers making the switch toward online bank transfers as a payment method. This is detailed in PYMNTS’ collaboration with Nuvei, “New Payment Options: Building Stronger Customer Ties With Pay by Bank Transfer.”

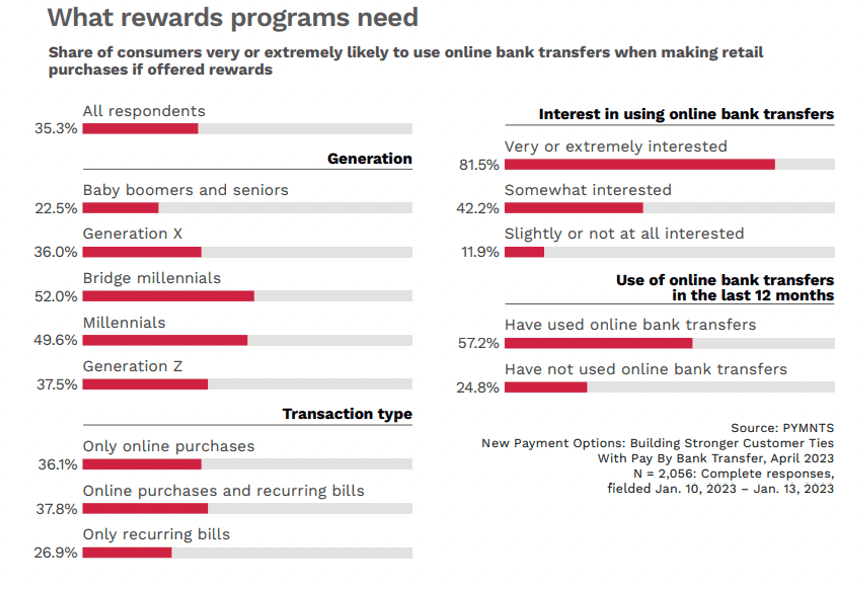

When it comes to online bank transfers, 38% of consumers surveyed who would be swayed by rewards offerings said they would be very or extremely likely to use the payment method for both online purchases and recurring bills if offered rewards.

FIs may explore a host of strategies if considering implementing a rewards or points program to incentivize online bank transfers as a payment option. The particulars may be best left to individual banks and other FIs, which could tailor their offerings to meet both their and their customers’ unique needs.

However, no matter which strategy an organization considers, they may want to keep in mind that a one-size-fits-all mentality may not go far with today’s data-driven consumer. An implementation method that could find the most success, for example, may involve personalizing their rewards offerings through the use of customer receipt data. This granular information allows forward-thinking FIs and FinTechs to customize their consumer-facing offerings, be it for a rewards program or hyper-personalized spending guidance.

Rewards and points programs may have a long history, but these incentives are anything but dusty for consumers. FIs considering rolling out a new payment method, be it online bank transfers or any other, may want to consider some sort of rewards rollout if they expect a successful switchover.