Banks and FinTechs Say Receipt Data Powers More Personalized Rewards

Financial institutions (FIs), FinTechs and merchants have set their sights on integrating item-level receipt data into their operations in the next three years. By doing so, FIs aim to increase customer engagement by delivering personalized digital experiences, while merchants want to streamline the purchasing experience and create new sources of sales revenue.

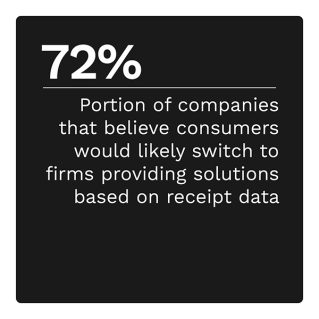

Although using receipt data has great potential for firms, we found a bit of a self-fulfilling prophecy: The firms most prepared to use this data are also the most likely to fully recognize its potential. There is a lot to lose if companies wait to invest in this area: 72% of companies surveyed believe consumers would be at least somewhat likely to switch to firms that provide solutions based on item-level receipt data. No matter their data readiness level, firms recognize that the merchants and consumers they serve can benefit from investment in strategic innovations using item-level receipt data.

No matter their data readiness level, firms recognize that the merchants and consumers they serve can benefit from investment in strategic innovations using item-level receipt data.

These are just some of the findings of “Meeting the Need for Item-Level Receipt Data: Next Steps in Receipt Data Adoption,” a PYMNTS and Banyan collaboration, which examines the factors influencing firms’ decisions on innovation strategies. We surveyed 351 executives representing FIs with at least $5 billion in assets and FinTechs with at least one million active monthly users between June 30, 2022, and July 27, 2022, to explore the importance of incorporating receipt data into operations throughout the next three years and what benefits these investments can bring to organizations and the consumers they serve.

More key findings from the study include the following:

More key findings from the study include the following:

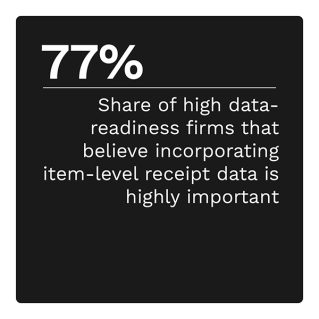

Incorporating item-level receipt data into operations in the next three years is essential for most firms, and high data-readiness firms are most likely to recognize this reality.

We found that 80% of firms consider it at least somewhat important to incorporate item-level receipt data into their organizations throughout the next three years, and 45% consider it very or extremely important. Integrating item-level receipt data will enable firms to offer new capabilities, such as more relevant rewards and deals, to help drive customer engagement. Among high data-readiness firms, 77% consider incorporating item-level receipt data to be very or extremely important, whereas just 13% of low-readiness firms think the same.

A firm’s technical infrastructure and availability of technologies influence its plans for incorporating receipt data.

Among all firms, 65% consider technical infrastructure and 62% believe available technology to be very or extremely important factors for their strategic innovations in using receipt data.  Meanwhile, 81% of high data-readiness firms consider technical infrastructure very or extremely important for planning strategic innovations, while 87% say the same about technological availability. Firms highly interested in using receipt data to tailor loyalty programs and shopping offers are especially likely to recognize technology preparedness as an important enabler of strategic innovations.

Meanwhile, 81% of high data-readiness firms consider technical infrastructure very or extremely important for planning strategic innovations, while 87% say the same about technological availability. Firms highly interested in using receipt data to tailor loyalty programs and shopping offers are especially likely to recognize technology preparedness as an important enabler of strategic innovations.

Four in 10 firms think using receipt data improves customers’ experiences, while six in 10 firms believe it improves consumers’ understanding of their spending behaviors.

While 43% of all firms expect that innovations in using item-level receipt data will enable their organization to improve customer experience, 46% believe it will provide consumers with a more efficient experience, especially involving questions about transactions or disputes. Firms aiming to improve consumers’ understanding of their spending behaviors are the most likely to expect that using receipt data will empower their organization to enhance the customer experience, at 59%.

Download the report o learn more about how integration of receipt data can improve the FI and FinTech customer experience.