2020 Holiday Shopping Retrospective Report: Milestones Made In A Year That Almost Wasn’t

It was the best of times. It was the worst of times. Or vice versa. Either way, it was the 2020 winter gifting season, more closely watched and commented upon than perhaps any before.

PYMNTS’ Holiday Shopping Retrospective Report: Merchant Insights for 2021 and Beyond, done in collaboration with and supported by PayPal, breaks down the major trends emerging from the first-ever digital-first holiday gifting season.

“The holiday season is the most important time of the year for many retailers, not just because of the opportunity it affords them to finish the year in the black,” per the report. “The season tends to both magnify existing consumer purchasing trends and strengthen them going forward. This means the practices and attitudes our research revealed will have lasting importance for merchants in the months ahead — and for the coming holiday season.”

eCommerce’s Digital Plumbing Did Its Job Well

eCommerce’s Digital Plumbing Did Its Job Well

Based on a Census-balanced survey of nearly 2,100 U.S. consumers, the new Holiday Shopping Retrospective Report focuses mostly on the impact on eCommerce. For one thing, digital infrastructure performed admirably, which brings the “seamlessness” we all seek.

“Our research shows that the eCommerce ecosystem was far from collapsing under the strain of unprecedented demand, as some warned in the weeks leading up to the holiday season: It not only held up, but also delivered a better shopping experience than in the previous season.”

More than one-third of consumers said online ordering for home delivery has improved over 2019 — that’s quadruple the percentage who found the new digital pathways harder to follow. That aligns with greater satisfaction with digital experiences in 2020, as “one of the notable characteristics of online shopping this past season was its digital-first nature. Consumers started their shopping journeys online and often ended up completing their purchases there, relying on services like curbside pickup,” per the report.

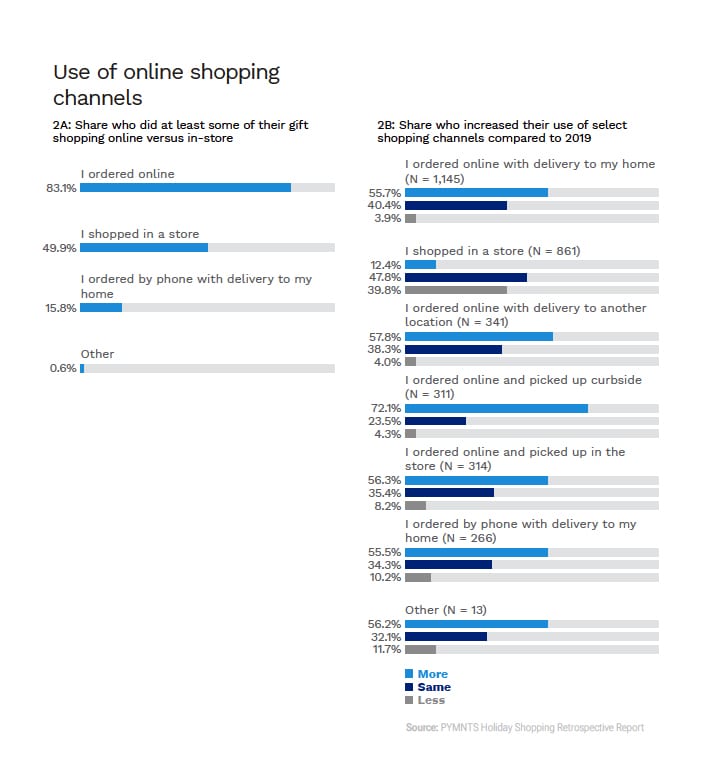

Resilience is good, as PYMNTS found that 83 percent of consumers overall went online to make (possibly all) of their holiday purchases — towering above the 50 percent who said they shopped in stores. Roughly 41 percent of consumers “shifted from physical to digital shopping channels during the holiday season, and curbside pickup showed the greatest growth.”

2020 Holiday Payments Stars

2020 Holiday Payments Stars

A star of the 2020 gifting season was mobile. According to the new Holiday Shopping Retrospective Report, about 55 percent used mobile devices more in 2020 than the previous year — a pattern running across demographic groups,” although it is strongest among younger and higher-income consumers,” per these new findings. When considering other factors — like the extended holiday season itself — it starts to make sense how a year of economic ruin, disruptions and distraction ended on a high sales note.

Payments choice made itself known as a force too, with buy now, pay later (BNPL) apps and other alternative credit offers popping up like mushrooms and grabbing share of wallet. “Credit and debit cards remain the dominant payment methods, used by 46 percent and 44 percent of consumers during the 2020 holiday shopping season, respectively. A notably large portion of shoppers — 40 percent — used digital wallets, and PayPal was by far the most popular digital wallet option, used by 29 percent of consumers, per the new report.

And, as previously noted, digital wallets are having their moment, with 54 percent of consumers using them more in 2020, “leading PayPal and Amazon Pay usage to grow by 53 percent and 64 percent, respectively.”

Payment methods ranging from BNPL POS credit to contactless QR codes made strides, with the Holiday Shopping Retrospective Report noting that 62 percent of consumers increased their QR usage, and 47 percent went for BNPL options. “Twenty-five percent of BNPL users used PayPal Credit, making it the most popular offering. Merchant-offered cards followed at 18 percent, and Afterpay came next at 16 percent.”