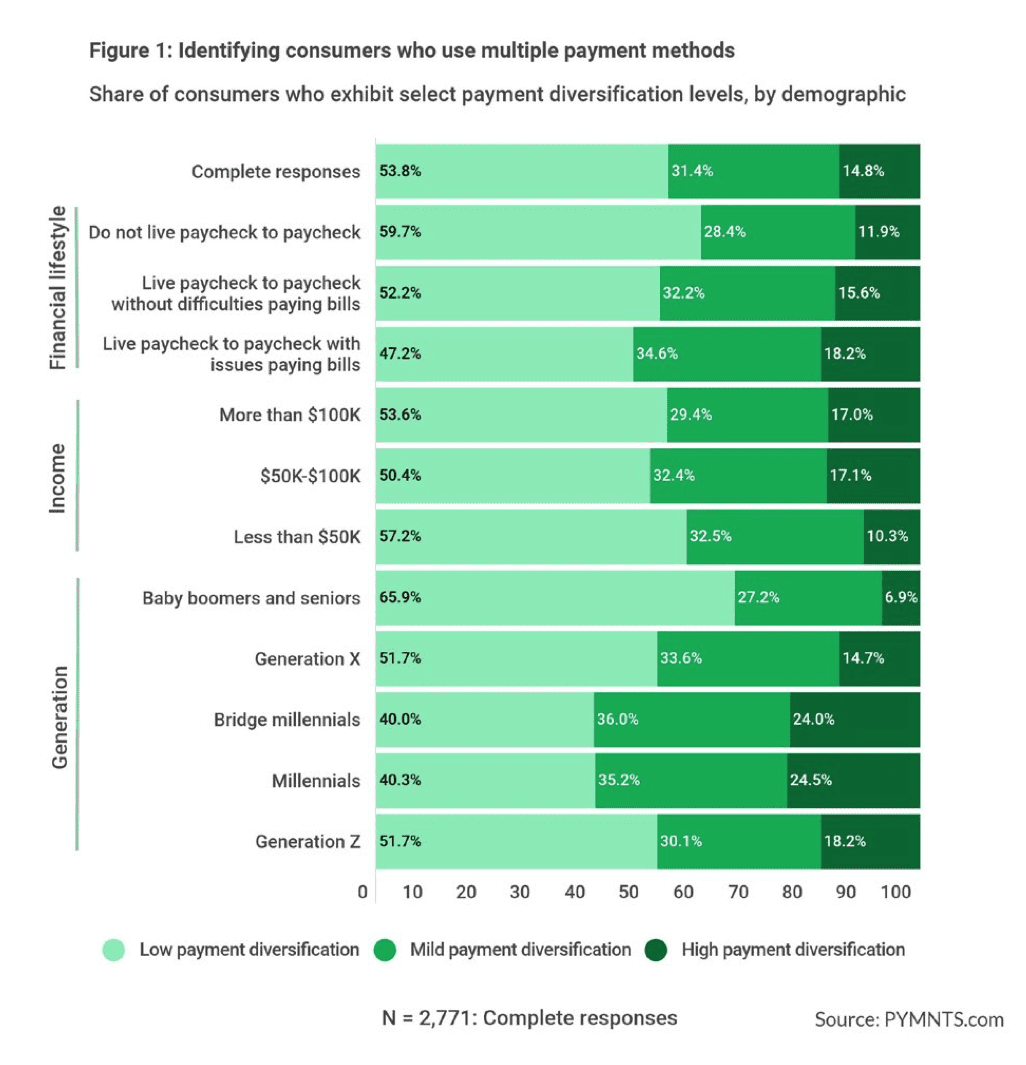

When consumers are willing to employ multiple payment methods, PYMNTS describes that as exhibiting high payment diversification (HPD).

HPD consumers use at least three payment methods, with at least two being nontraditional methods, such as digital wallets, cryptocurrency or buy now, pay later (BNPL).

About 15% of consumers have high payment diversification, according to “Digital Economy Payments,” a PYMNTS report based on a survey of 2,771 U.S. consumers.

Get the report: Digital Economy Payments

The percentage changes among consumers in different demographic groups.

The generation most likely to exhibit HPD is millennials — 25% of whom are HPD consumers — with bridge millennials close behind at 24%.

Advertisement: Scroll to Continue

By income, the two highest income earners are about equally likely to be HPD consumers. About 17% of both those with annual incomes greater than $100,000 and those with incomes between $50,000 and $100,000 exhibit HPD.

By financial lifestyle, consumers who live paycheck to paycheck with issues paying bills are most likely to be in the HPD category, with 18% of such consumers using at least three payment methods.

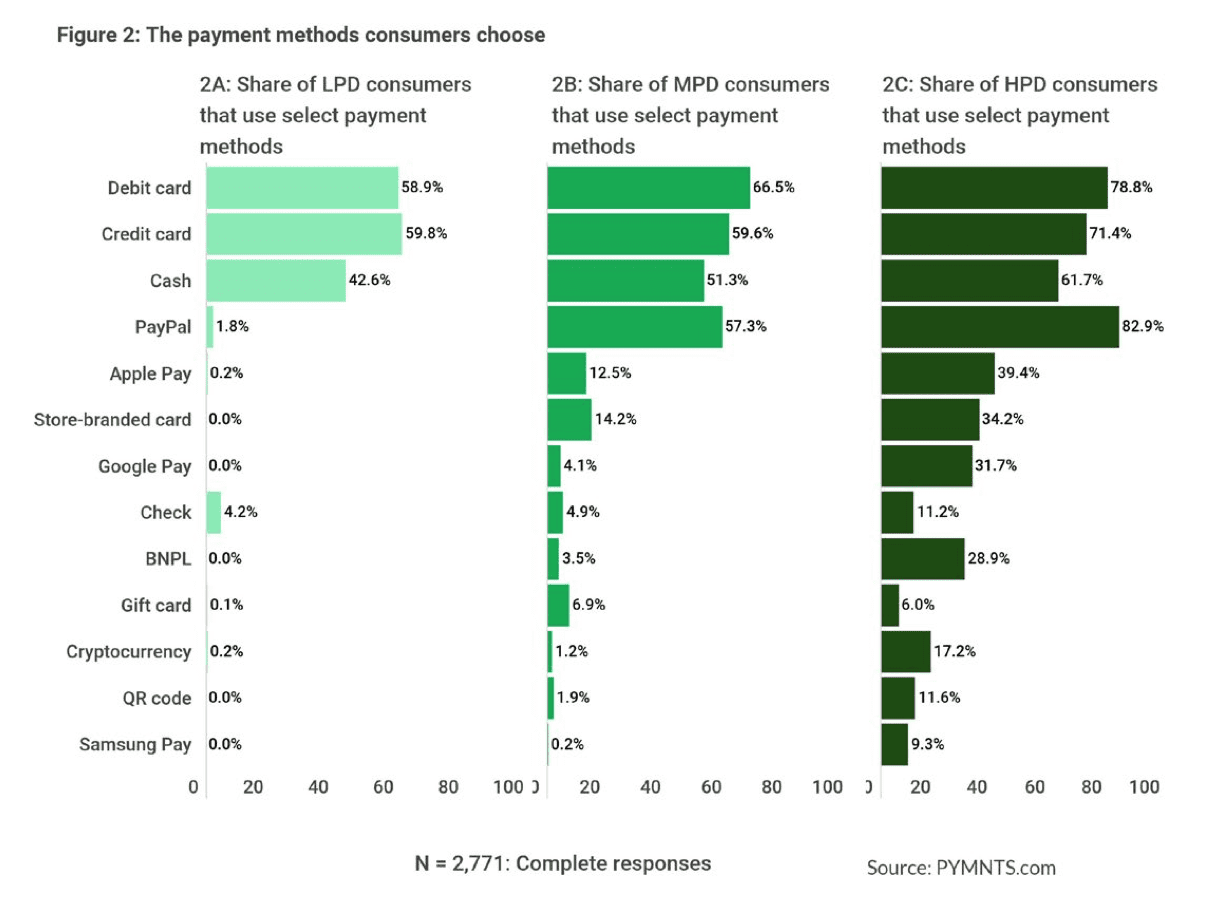

HPD consumers tend to use traditional payment methods — debit cards, credit cards and cash — just as other consumers do

In addition to these tried-and-true methods, though, HPD consumers also favor more innovative methods that have come to the fore during the digital payments era — PayPal, Apple Pay, Google Pay and BNPL.

The payment methods that consumers with high payment diversification use most are PayPal, debit card, credit card and cash. Those are used by 83%, 79%, 71% and 62%, respectively, of HPD consumers.

The next most used payment methods include Apple Pay, a store-branded card, Google Pay and BNPL. Those are used by 39%, 34%, 32% and 29%, respectively.

Overall, HPD consumers use an average of 4.8 payment methods each month.