Rewards Programs Are the Top Reason Consumers Use Store Cards

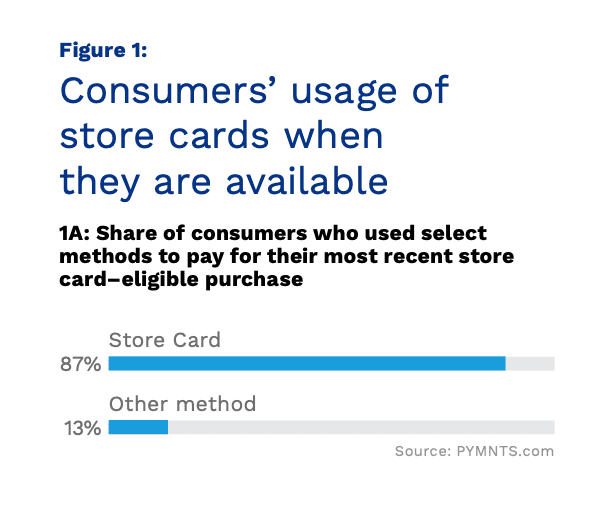

When consumers shop with merchants with which they have store cards, they tend to pay with those cards.

In fact, consumers use store cards to pay for store card-eligible purchases 87% of the time, according to “The Truth About BNPL And Store Cards,” a PYMNTS and PayPal collaboration based on a survey of 2,161 U.S. consumers.

Get the report: The Truth About BNPL And Store Cards

Only 13% of consumers use another method when store cards are available.

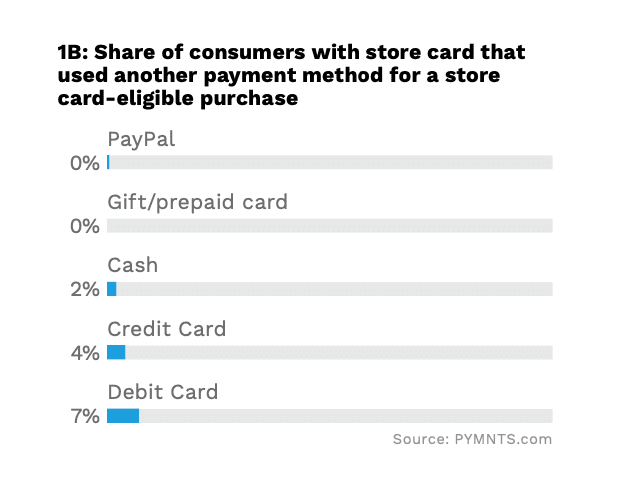

When shoppers opt not to use their store cards for eligible purchases, they principally pay using either debit or credit cards. PYMNTS’ research found that 7% of store card holders used debit cards to make their most recent store card-eligible purchases, and 4% used credit cards.

Just 2% of these shoppers used cash, and less than 1% used PayPal.

Shoppers rarely, if ever, use buy now, pay later (BNPL) options to pay for store card-eligible purchases.

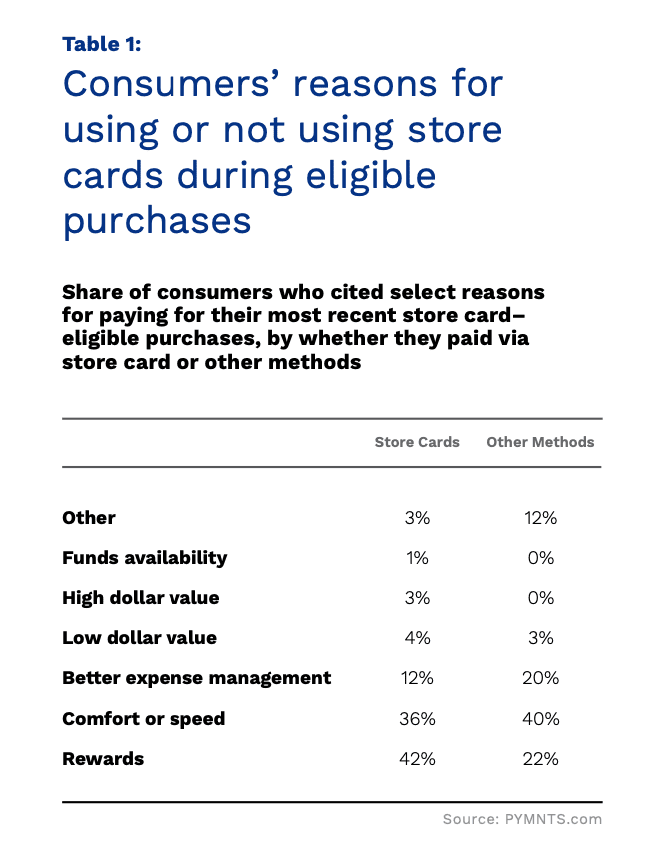

Store card holders say there are a few benefits of using store cards to pay when they can. Topping the list are rewards and comfort or speed — these benefits are cited by 42% and 36% respectively of the consumers who paid for their most recent store card-eligible purchases via store card.

Twelve percent of the store card holders say better expense management is their reason for using store cards during eligible purchases.

Less common considerations include whether their purchases were priced at a low or high dollar value, whether they had funds needed to make a given purchase and other factors when deciding how to pay. These reasons for using a store card are cited by 4% or fewer of store card holders.