Nearly 1 in 6 Consumers Switched Payment Methods in the Past Year

Consumers are happiest when they don’t have to think about how a payment is made, just that it gets done. And they are willing to try new payment methods to get those results.

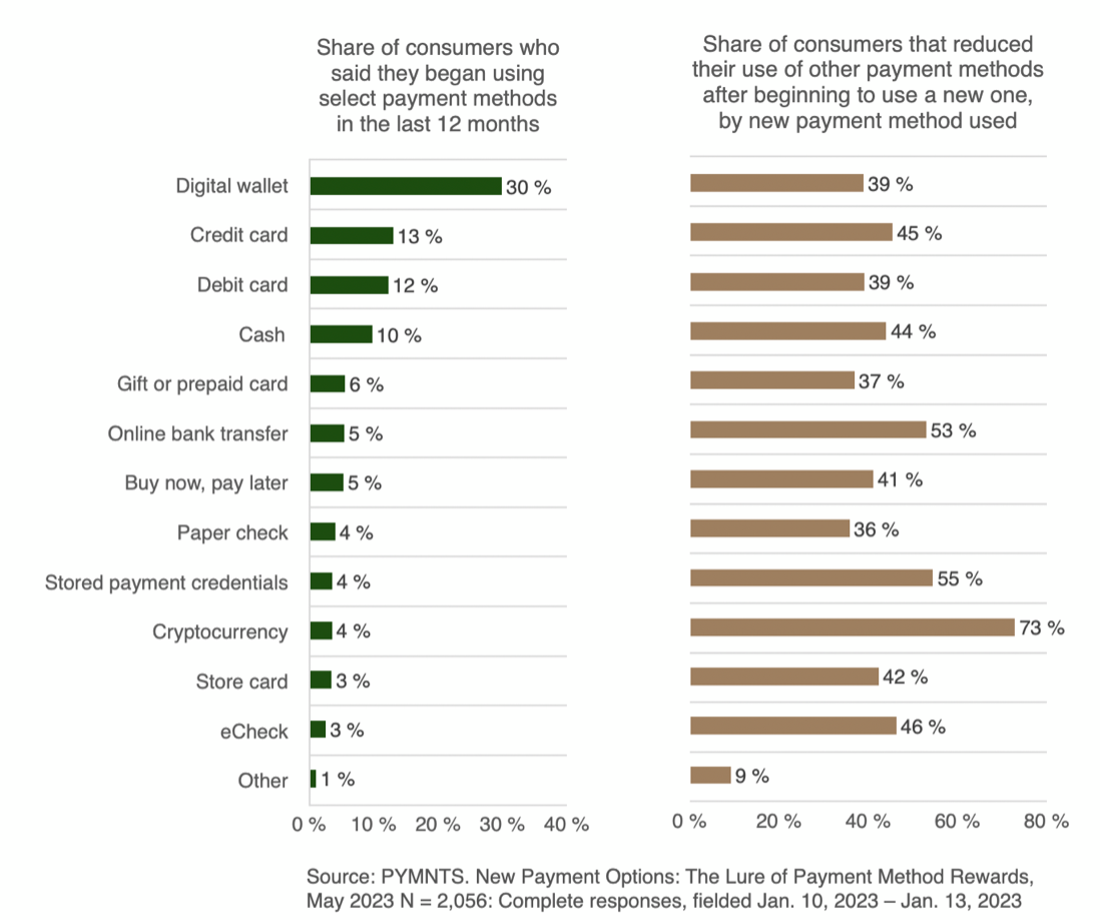

PYMNTS Intelligence data shows that half of U.S. consumers tried using a new payment method in the past year, and 16% switched to a new one. Ease and convenience are the most important reasons consumers cite when choosing a method for online purchases and recurring bill payments. Digital wallets apparently do the trick for many, as that was the preferred payment method to use for the first time. This occurred in 30% of cases, which means that 3 out of 5 U.S. consumers who tried a new payment method in the last year did so with digital wallets.

These are some of the insights drawn from “The New Payment Options: Building Stronger Customer Ties with Pay by Bank Transfer,” a PYMNTS Intelligence study done in collaboration with Nuvei that examines consumers’ willingness to use various payment methods for recurring bill payments and online purchases.

Digital wallets offer the ability to be used on multiple devices, the app is usually user-friendly, easy to navigate and allows customers to track their payments. Thus, this system is the most preferred option by consumers when trying a new payment method. Moreover, 4 out of 10 consumers who tried this method reduced the use of other payment methods after beginning to use this one.

Of the various digital wallet providers, PayPal is the preferred platform, with 17% of respondents opting for this system for their online purchases. Appley Pay follows far behind at 4%, while Google Pay is third in the ranking at 2%.

Credit and debit cards follow digital wallets as a preferred payment to begin using, with 12% and 11% of respondents, respectively. Unlike digital wallets, consumers cite security and rewards as the main reasons to pay with cards.

When opting for one payment method over another, consumer choice can be influenced in both directions. For instance, data shows that nearly 1 in 5 consumers reduced their use of online bank transfers because they found another payment method that offered them better rewards. Similarly, 1 in 4 respondents decreased their usage of digital wallets for the same reason. This means that one single factor like rewards can determine the consumer to shift from one payment option to another with an equivalent customer service, just for the extra benefits the issuers offer.

The results of the study indicate that digital wallets have good prospects ahead. Two-thirds of U.S. consumers are interested in trying a new payment method in the next year, while 43% plan to use digital wallets for the first time this year.