PayFacs Expect Half of Their 2024 Revenues to Come From Value-Added Services

In today’s fast-paced digital world, companies across various industries are recognizing the importance of improving customers’ payments experiences.

Many firms are turning to embedded payments, efficient and high-functioning payment solutions integrated into platforms, as a solution to enhance user satisfaction and create new revenue streams. The integration is not limited to one-click payments and can encompass security, compliance and additional consumer services.

The PYMNTS Intelligence study “Platform Business Survey: The Rise of Embedded Payments,” revealed that nearly half of payment facilitators believe that 51% of their revenue in 2024 will come from embedded finance products and value-added services, such as chargeback dispute management and multifactor authentication.

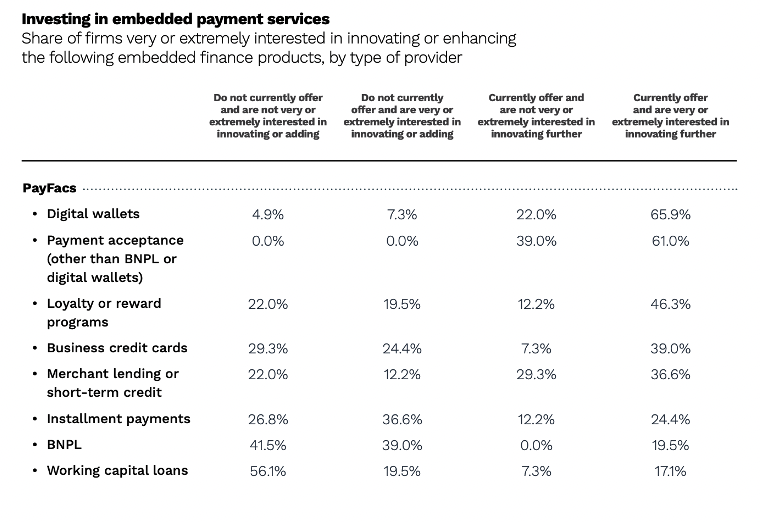

More than one-third of PayFacs are particularly interested in offering installment payments and buy now, pay later plans despite not currently offering them specifically. Additionally, nearly 1 in 5 PayFacs that do not currently offer loyalty or rewards programs plan to do so.

The potential of these embedded products goes beyond payment facilitation. Luke Latham, general manager of Australia and New Zealand at Airwallex, emphasized in an interview with PYMNTS posted in December that PayFacs, software platforms and retail marketplaces are well-suited to integrate financial services and products into their regular user experience due to their close relationships with their customers.

“If you think about an eCommerce marketplace interested in providing credit or loans to their customers, they already have visibility of all the payment flows, which is essential to embedding a robust risk management framework to make that product viable and which positions them to play a leading role in the next phase of the evolution of embedded finance,” Latham said.

Advanced artificial intelligence and data analytics are expected to play a role in the evolution of embedded finance in the coming years. Latham predicted that platforms will use these technologies to offer increasingly personalized financial products, services and recommendations to their users.

“I think platforms will integrate even more specialized financial services tailored to specific industries and customize their user experience around that,” he said.

How will firms incorporate these products and services into their payment platforms? The consensus for now seems to be that partnering is often the most efficient and cost-effective way to enter the embedded finance space when compared to buying or building.

“To the extent that [partnering on embedded finance] becomes infinitely successful, then businesses have the ability to build themselves out of that partnership,” CellPoint Digital Global Head of Product Tom Randklev told PYMNTS in an interview posted in December.

As the industry continues to evolve, the integration of specialized financial services and personalized user experiences will further drive the growth of embedded finance, benefiting both businesses and customers alike.