Rather Than Build In-House Most US and UK Convenience Stores Outsource Payment Innovation

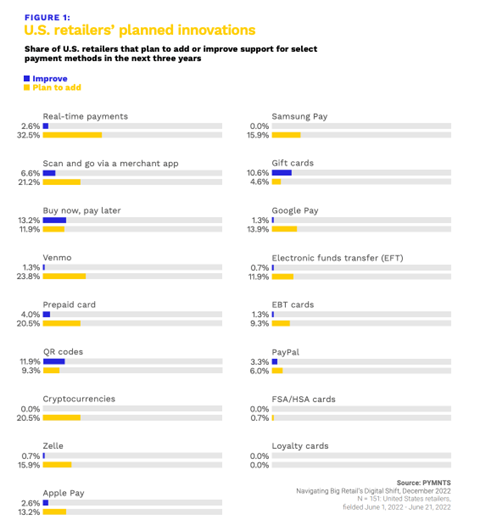

What payment methods are being explored by retailers in the grocery, pharmacy and convenience store arenas? It depends, as these retailers have different needs that digital payments must play to.

Analyzing this question in “The Instant Payments Transformation Guide: Grocery, Pharmacy and Convenience Retailers,” a PYMNTS and ACI Worldwide collaboration, we surveyed retailers in the U.S. and the U.K., finding some variation in their payment system priorities.

Looking at “Big Grocery” chains of 50 stores or more, the study notes that “payment choice is essential, as consumers may choose to utilize debit cards, credit cards, buy now, pay later (BNPL) services or a mix based on their budget priorities. It may be no surprise, then, that 55% of grocery retailers are innovating available payment methods, according to a recent PYMNTS survey. At a time when saving money is being prioritized, retailers would be wise to focus on user experience features that impact shoppers’ bottom lines.”

Data tracking and fraud prevention figure prominently as well.

In the pharmacy and convenience store sector, our research found that these stores “may find themselves in more intense competition with each other and online services, as the segment has become characterized by brands offering similar products and look-alike services.”

Increased competition is accelerating payment innovation as convenience stores and pharmacies lead in the planned adoption of real-time payments. “This innovation makes checkout and refunds faster for consumers and more closely mimics the online experience; it also increases liquidity for retailers, a benefit for any type of merchant,” per the study.

Meanwhile, non-grocery retailers “prioritize loyalty programs, refunds, and consumer data analytics — but these retailers are doing so at higher rates, suggesting that customer experience, payment choice and convenience have heightened importance in the segment. Non-grocery retailers are the most likely to invest in developing loyalty programs, refunds and data analytics in-house.”

While some may take the build-over-buy route, most don’t want the headaches. Per the study, retailers unable to develop solutions for payments experience friction can integrate third-party solutions into their innovation strategy. Our most recent survey found that 51% of U.S. and 63% of U.K. retailers will outsource all aspects of payment method innovations. Certain segments were much more inclined to find an external solution: 73% of convenience stores and pharmacies will outsource payments innovation, compared to 57% of non-grocery retailers.

Get your copy: The Instant Payments Transformation Guide: Grocery, Pharmacy and Convenience Retailers