Brandless: Procter & Gamble For A Digital Generation?

Amazon, Walmart, Uber and others have been shaking up how people get their groceries by expanding their pickup and delivery services. Meanwhile, other services let customers leapfrog the buying process altogether: Meal kits have claimed a large chunk of the dollars that previously went to supermarkets, saving people the time and trouble of finding the right ingredients.

But in the changing grocery landscape, not much thought has gone into changing what’s on store shelves. Whether those shelves are physical or virtual, it’s still the same brands everywhere you go.

To save money, customers still have to shop at discounters like Walmart and Lidl or buy in bulk at places like BJ’s wholesale club. For better quality, they still have to turn to organic grocers like Whole Foods. If they want both, well, good luck: Good food and good prices seem to be mutually exclusive, though Trader Joe’s does a respectable job of combining the two. Clipping coupons, hunting for generic brands or buying only when products are on sale can net some savings, but these strategies still force consumers to play on the supermarkets’ field.

The playing field has changed, and so too must the players.

With $50 million in funding, there’s a new team staking out its home court. Serial entrepreneurs Tina Sharkey and Ido Leffler think they’ve got the next Procter & Gamble with their eCommerce grocery startup Brandless, an online platform where everything is off-brand, and it all costs $3 or less.

Procter & Gamble (P&G) was created in 1837 by two brothers-in-law who made soap and candles. The company later created an inexpensive floating soap (Ivory) and then a shortening made of vegetable oils rather than animal fats (Crisco). These products succeeded because they were better than the competition at a lower price point.

From there, the consumer packaged goods (CPG) company (by now a century old) diversified into home staples with Tide laundry detergent, Crest toothpaste, Charmin toilet paper, Downy fabric softener and, in 1961, the revolutionary disposable Pampers diaper. P&G’s retail growth continued through the 1990s and the 2000s as the CPG giant snapped up Folgers Coffee, Old Spice, Pantene, Iams, Gillette and others.

But in 2014, the company announced news that it was streamlining. It dropped 100 brands, retaining just 65 of its most profitable ones. It divested from Vick’s VapoSteam and 43 stagnant beauty brands in 2015 and transferred Duracell to Berkshire Hathaway in 2016.

What’s the problem? According to Fortune, zero growth.

“A lot of industries have come apart and been sewn together in new and different ways,” Sharkey told NewCo Shift in February — two and a half years into the Brandless research process, though still five months before the startup would launch July 11. “If you look in the Midwest, if you look at the industrial core of America, CPG is a gigantic business that has not changed in 100 years.”

Ever since the financial crisis in 2008, when shopping, consumers haven’t been looking for name brands; they’ve been looking for deals. So growth by acquisition won’t help Procter & Gamble. Neither will CEO David Taylor’s plan to cut $10 billion in expenses; it’s grasping at water when the company should be building a reservoir. What P&G needs, says Fortune, are new products and spinoffs from its existing portfolio. It needs a better ROI on its research and development initiatives. It needs to get daring.

That’s what Brandless has been doing. Over the last three years, it has been rigorously vetting, tasting and sampling hundreds of formulations to create products that satisfy modern needs and values: simple, non-GMO, organic, fair trade, kosher, gluten-free and/or no sugar added. It packages them to limit waste and labels them for maximum transparency.

Better than the competition at a lower price point … now where have we seen that strategy before?

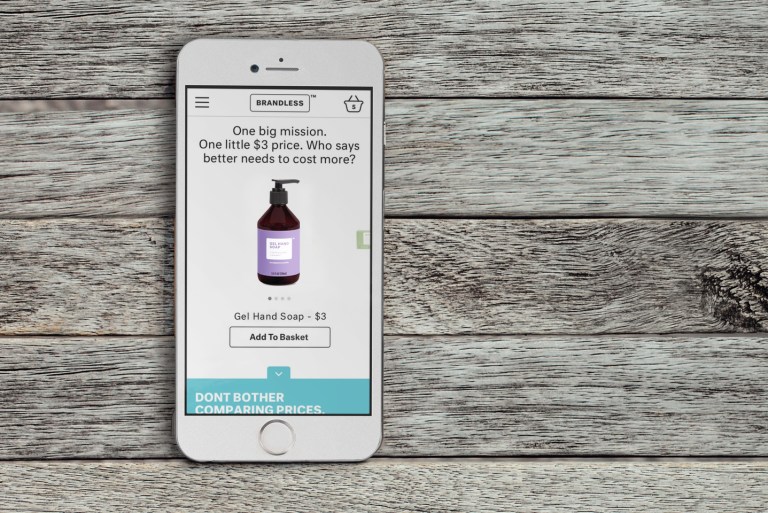

Brandless’ retail repertoire now includes food products (canned goods, snacks, sauces, coffee), housewares (can openers, corkscrews, kitchen knives), cleaning supplies (dish soap, all-purpose cleaners, health and beauty products, toothpaste, hand soap), and office supplies. Basically: the basics. The goal is to save customers from having to stock up on staples at the grocery store ever again.

Offering a smaller shopping selection — so far, just a couple of hundred essential items — helps keep costs even lower, but the biggest savings factor comes from the elimination of the “Brand Tax.” Ditching the brand labels and selling direct to consumers on a democratized platform enables Brandless to price products at an average of 40 percent less than competitors.

What’s going to set Brandless apart, according to TechCrunch, is the relationship it’s building with consumers, especially millennials. Traditionally, CPG brands sell products to stores, so the end consumer has a relationship with the middle man rather than with the brand itself. Yet with so many distribution channels — Facebook, Twitter, Instagram and YouTube, just to name the mainstream ones — it only makes sense for brands to build an audience and search for customers online via the eCommerce route.

“No longer can you build a brand the way they were built once before,” said Sharkey. “Building that emotional connection between you and a product doesn’t happen anymore, because we turn the cameras on ourselves. We’re building in ourselves and we’re talking to each other. Now, [branding is] just when a friend helps a friend.”