‘Buy Now, Get Now’ and ‘Buy Now, Get Later’ Add New Dimensions to Bring-It-To-Me Economy

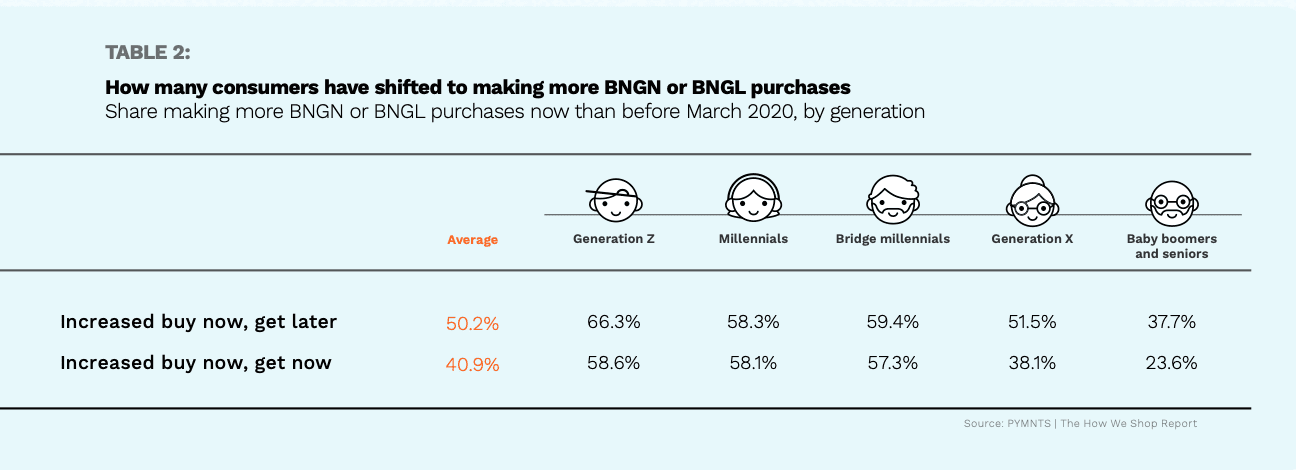

Into the alphabet soup of digital experiences come buy now, get now (BNGN) and buy now, get later (BNGL) — each with its own nuanced appeal, and each occupying its own place in the shifting mix of retail strategies being invented or perfected during the digital shift.

How We Shop: Brick-And-Mortar’s Role In The Bring-It-To-Me Economy, a PYMNTS and Carat from Fiserv collaboration, a survey of over 5,260 shoppers, researchers parsed responses to help define the role these handy omnichannel shopping modalities are fulfilling today.

Per the study, “Shopping has become an ‘on-demand’ activity. Consumers now can choose where to shop based on when they need the product: right now, with any one of the ‘buy now, get now’ (BNGN) options retailers offer, or they can ‘buy now, get later’ (BNGL) for items that need not arrive for a day or two.”

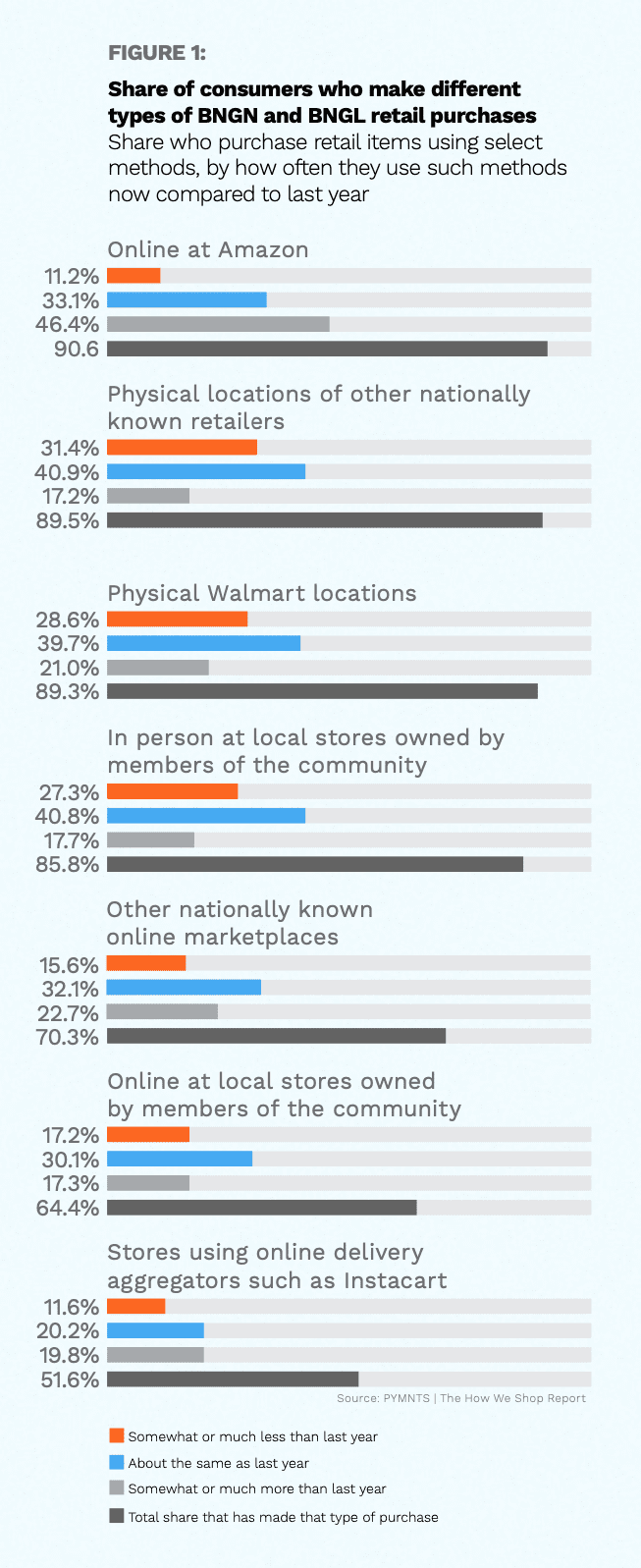

What researchers found is that 91 percent of consumers regularly make BNGL purchases on Amazon, for example, with 70 percent selecting this after-purchase pickup option on other major marketplaces, as “shopping on digital marketplaces such as these allows consumers to buy items at their leisure, automating shopping experiences and freeing up their calendars.”

Meanwhile, “Brick-and-mortar stores still are king when it comes to buy now, get now shopping. Eighty-nine percent of consumers report making BNGN purchases at Walmart stores, and 90 percent make them at physical locations of nationally known retailers.”

Also, 52 percent of consumers making BNGN purchases use delivery aggregators such as Instacart, ShopRunner or Shipt, researchers found.

See: How We Shop: Brick-And-Mortar’s Role In The Bring-It-To-Me Economy

Timely Purchases Pervade

Time is highly valued in the bring-it-to-me economy as the new research bears out, finding that 93 percent of all consumers regularly make both BNGN and BNGL retail purchases.

“The most common type of BNGN retail purchases consumers make occur at either Walmart or brick-and-mortar stores of other nationally known retailers,” with 89 percent of consumers making BNGN purchases from physical Walmart locations, and 90 percent making BNGN purchases from brick-and-mortar stores of other nationally known retail brands.

That stacks up against the 86 percent of consumers “who make BNGN purchases from locally-owned brick-and-mortar stores in their communities.”

While millennials and bridge millennials evince a growing fondness for delivery aggregators, the new How We Shop study notes that “they make even more of their BNGL purchases on digital marketplaces. Ninety-four percent of millennials make BNGL purchases on Amazon, while 83 percent make them on other nationally known digital marketplaces, which might include Etsy, eBay or Mercari. Among bridge millennials, 95 percent make BNGL purchases on Amazon and 84 percent make them on other digital marketplaces.”

Payments Preference and the Physical Store Opportunity

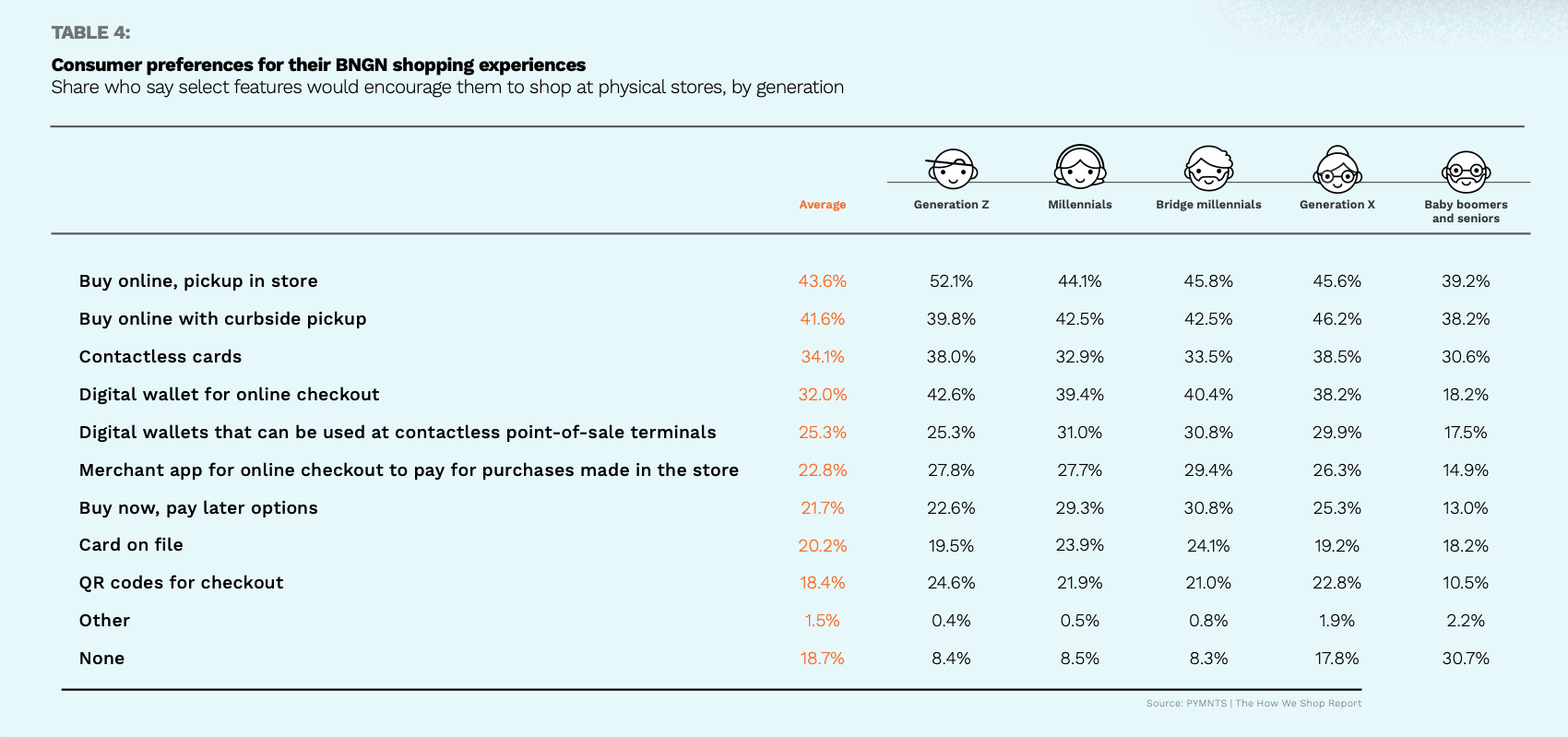

As for payments preferences of BNGN and BNGL shoppers, they align with much of what we’ve learned about consumer behavior during the pandemic and digital shift, but with some variations showing.

For example, the study states that “BNGL shoppers are just as likely to use digital wallets as they are to use debit cards to make purchases online. Fifty-eight percent of them regularly pay for their BNGL purchases via digital wallet, and 11 percent use BNPL options to do so. Fifty-three percent of shoppers pay for BNGL purchases using digital wallets, and 9.2 percent of shoppers pay for such purchases using BNPL options.”

For physical stores wanting to get foot traffic back up there, “Providing digital wallets, app-enabled payments and BNPL options at the brick-and-mortar point of sale can go a long way toward encouraging these digital-first shoppers to make BNGN purchases,” per the new study, which found that 31 percent shares of both millennials and bridge millennials “would be encouraged to make more BNGN purchases if they could pay in store via digital wallet at the brick-and-mortar point of sale … as would 30 percent of Gen X consumers.”

Additionally, the ability to check out and pay for BNGN retail products via app “would encourage 28 percent of millennials and 29 percent of bridge millennials to make more in-store purchases.”