Study: Nearly Half of US Consumers Are Already Holiday Shopping

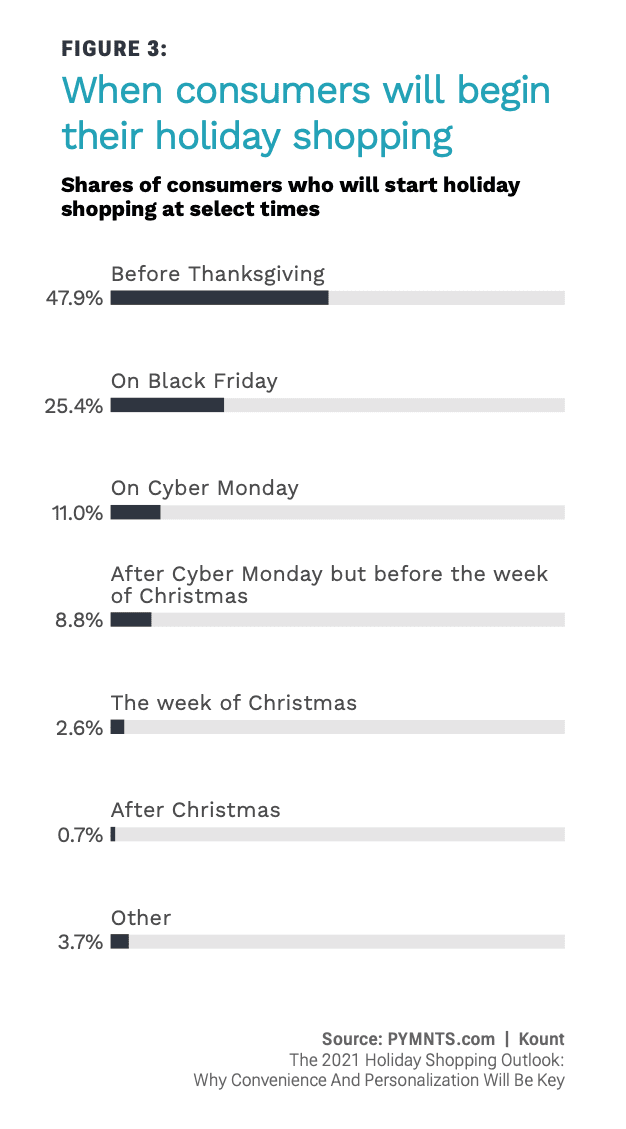

Santa has yet to ride down 34th Street in the Macy’s Thanksgiving Day Parade and the turkey has yet to be carved, but nearly 50% of consumers say they’ve already started making holiday gift purchases amid inventory shortages and rising prices.

In the 2021 Holiday Shopping Outlook study, a PYMNTS and Kount collaboration, researchers found that only 25% of consumers are waiting until Black Friday to start holiday shopping and only 11% are waiting until Cyber Monday, with 48% making purchases before Thanksgiving.

See the study: The 2021 Holiday Shopping Outlook: Why Convenience And Personalization Will Be Key

Another 9% say they’ll wait until after Cyber Monday but before the week of Christmas to start shopping, while the most daring of shoppers will leave it to the last minute, with 3% starting the week of Christmas.

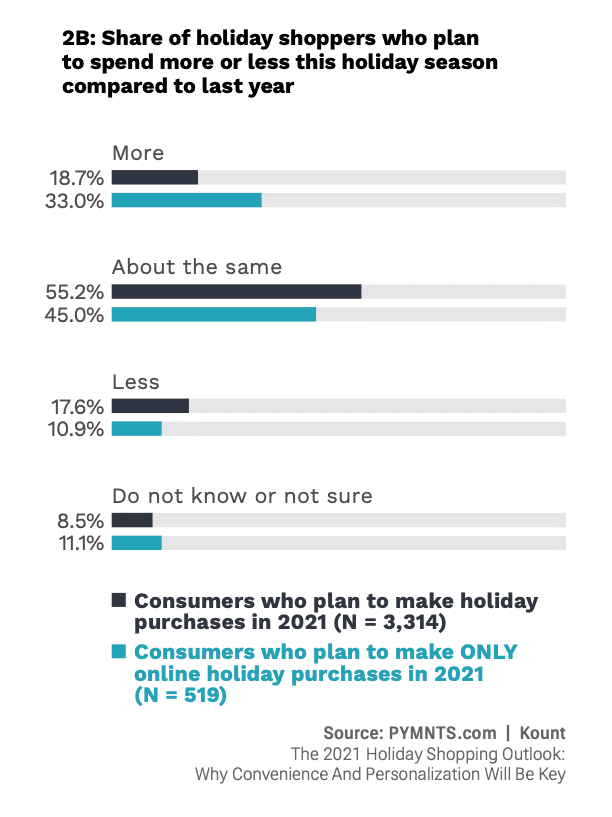

For the most part, consumers plan to spend about the same amount on gifts this year as they did last year, at 55% of overall consumers, though 19% say they’ll be spending more. Among those making only online holiday purchases — which accounts for nearly 15% of shoppers — one-third plan to spend more and 45% plan to spend amount the same amount.

Nearly 18% of all holiday shoppers and 11% of digital-only shoppers plan to spend less this year than last year, with 9% and 11%, respectively, telling researchers they’re unsure of their spending plans.

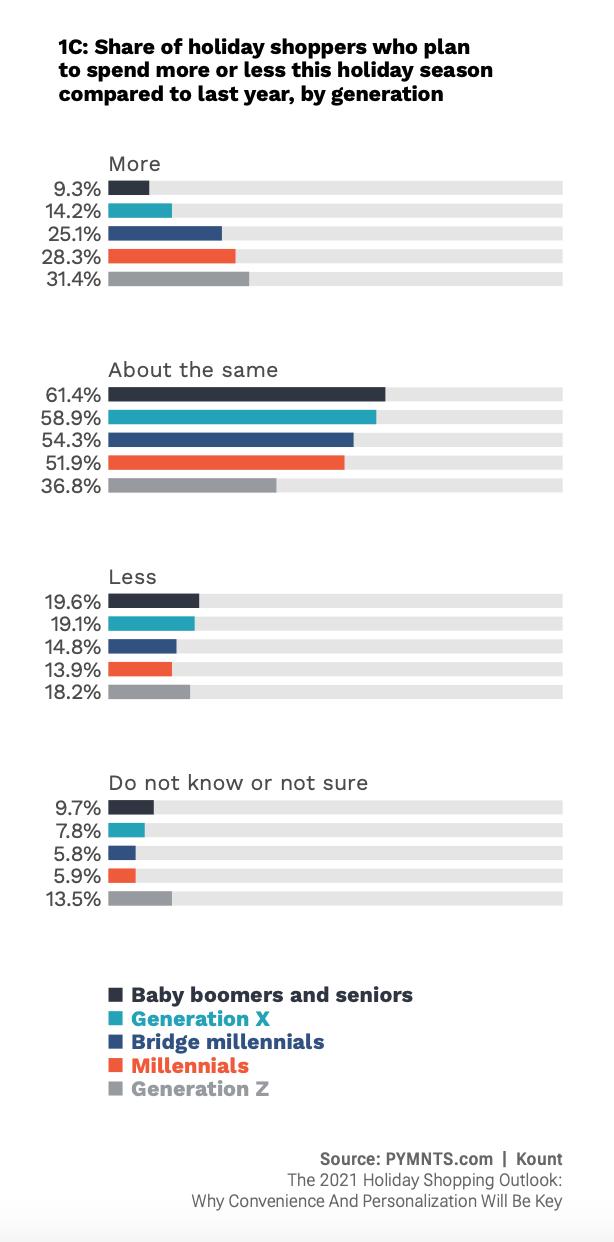

With Generation Z starting to come into more disposable income, it may come as no surprise that they’re the most likely to be spending more, at 31%. Baby boomers and seniors are the most likely to be spending about the same or less than last year, at 81% of the cohort, though Gen X is not far behind at 78%.

Consumer Preferences

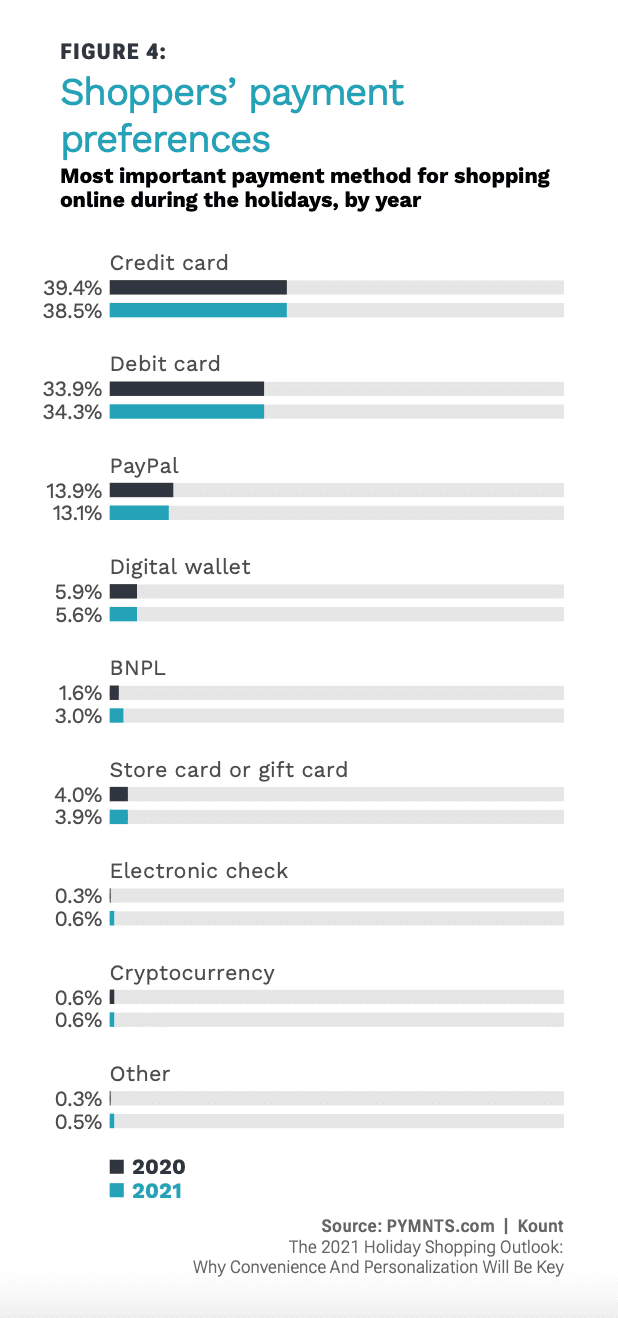

Despite the surge in interest for buy now, pay later (BNPL) services over the past year, only 3% of consumers say it’s the most important payment method for shopping online during the holidays, up from 1.6% who said it was most important last year.

Shoppers’ preferred payment methods remain credit cards, which 39% of consumers said was most important both last year and this year, and debit cards, which 34% said is most important. PayPal’s importance in consumers’ minds dropped slightly this year, to 13%, while digital wallets remained just under 6%.

Read more: NEW DATA: Nearly 90% of US Consumers Plan Online Holiday Purchases in 2021 — 13% More Than in 2020

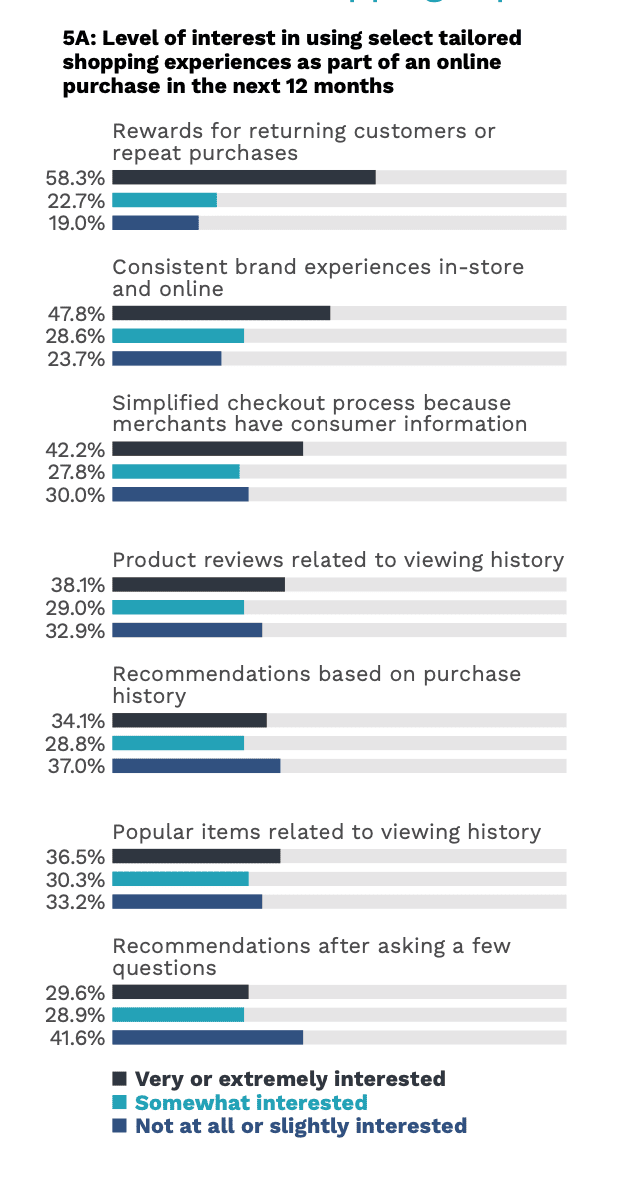

Consumers are also looking to shop with retailers they know can provide a seamless and consistent experience. Almost half of shoppers say they’re very or extremely interested in brands that can provide a consistent experience in-store and online, and 42% say the same for a simplified checkout process because a merchant has saved their information.

Additionally, 58% say over the next 12 months, they would be very or extremely interested in merchants that provide rewards for returning customers or repeat purchases.