27% of Retailers Want to Outsource Their Loyalty Programs

As consumers flock to the aisles, as they opt to move to in-store settings to get what they need, merchants need to keep them engaged, enough so that the browsing turns into buying.

A key way to do so is for merchants to create a personalized experience in the brick-and-mortar environment, where relevant offers are extended in real time. Offering new payments options also creates some stickiness in the customer relationship.

As detailed in “Big Retail’s Innovation Mandate: Convenience and Personalization,” a PYMNTS and ACI Worldwide collaboration, we found that technology remains a challenge in getting the data collected, analyzed and utilized that enables that personalization.

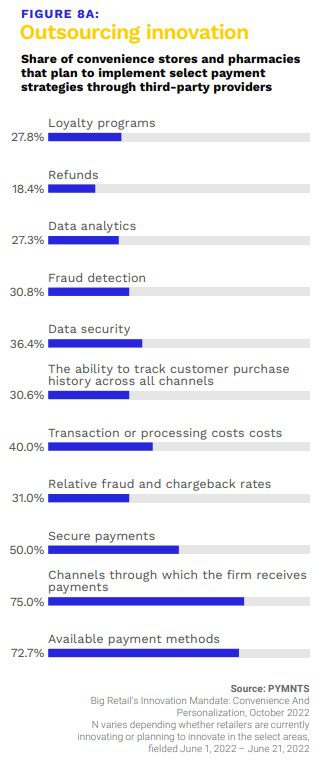

A significant percentage of the more than 300 merchants we surveyed are turning to third-party providers to implement select payment strategies. Respondents were based in U.S. or the U.K. with at least 50 store locations and annual revenues of at least $1 billion for U.S.-based companies or £100 million ($127 million).

Our research revealed a greenfield opportunity for outsourcing payments functions and innovations to outside parties. Only around half of retailers in the U.S. and the U.K. believe that they have the right mix of digital tools to serve their customers well. And ambitions loom large: 33% of U.S. retailers plan to add real-time payments as an option for their consumers in the near future.

But nearer term there are a variety of select payment innovations and strategies that are in the crosshairs, too. As seen in the two charts below, more than a quarter of general retailers plan to craft their loyalty programs through third-party providers, and a strikingly similar percentage of convenience stores and pharmacies seek to do the same.