Amazon and Walmart Market Share Battle Crossed New Lines In 2022

The epic battle for wallet share between Amazon and Walmart entered uncharted waters in 2022.

Tracking the action in the PYMNTS Amazon Versus Walmart report series, the year began with big news: the eCommerce titan bested the Bentonville behemoth for the first time in history, ushering in a new competitive dynamic between online and in-store sales.

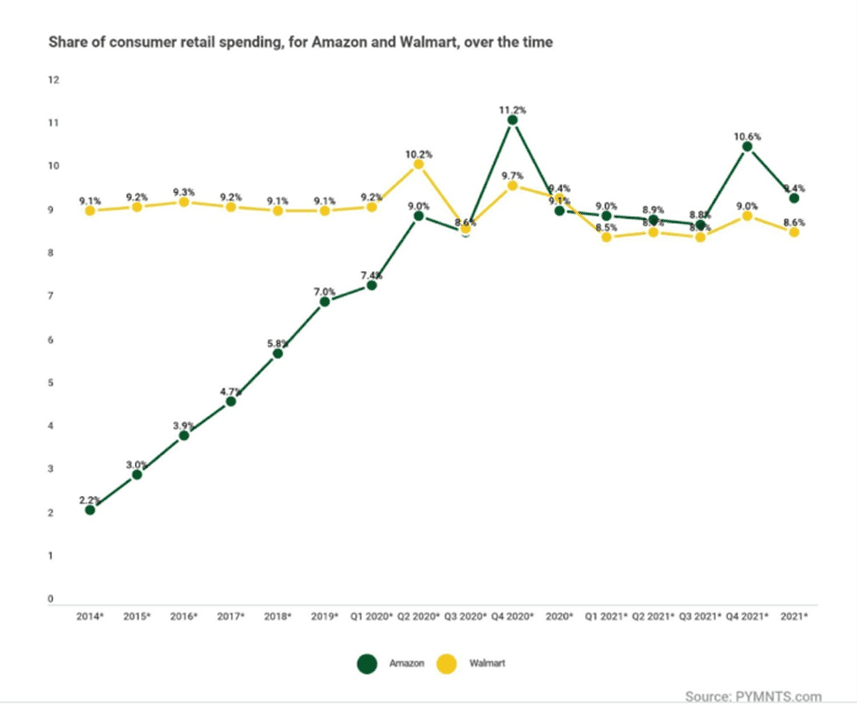

In March, we reported that after a 10-year battle, “data from PYMNTS confirm that Amazon ended 2021 with a larger share of U.S. retail spending than rival Walmart. Thanks to a burst of fourth-quarter activity, the Seattle-based eCommerce leader now claims a 9.4% share of retail buying in 2021 versus the 8.6% portion held by the nation’s top operator of physical stores.”

We observed at the time that “Amazon didn’t pull ahead as much as Walmart slipped behind,” as Walmart lost the slim 0.3% lead it still held over Amazon in 2020. Pandemic-driven eCommerce usage wiped that out effortlessly, giving Amazon its long-sought lead in share.

Get the Report: The Battle for Consumer Retail Spend: Amazon Versus Walmart Q1 2022: The Grocery Wild Card

Regarding categories where the combatants exchanged positions, our research found that Walmart remained dominant in Food & Beverage “with an exponential 18.6% share compared to its rival’s 1.9% slice of the grocery business.” However, Amazon reigned in three Clothing & Apparel, Sporting Goods, Hobby, Music & Books, and Furniture & Home Furnishings.

We noted in Q1 that “both retailers lost ground on the market share front in clothing last year as pure-play apparel rivals and other competitors grabbed a larger slice.” However, we characterized Amazon’s 8-percentage-point lead over Walmart as “formidable,” with Amazon and Walmart ending 2021 with shares of 14.6% and 6.5% in Clothing & Apparel, respectively.

Q2 Finds eCommerce and Physical More Competitive

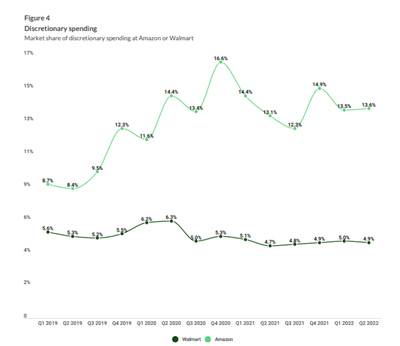

In our report, The Battle For Consumer Retail Spend: Amazon Versus Walmart Q2 2022 — The Discretionary Spend Play, we noted that “As of Q2 2022, Walmart’s share of consumer retail spending has slipped below its 2019 levels of 7.1%, yet the company still holds the lead in that area. Walmart saw a very slight increase in its share of total consumer spending, from 2.8% last quarter to 3% in Q2 2022.”

That closing of the competitive gap was chalked up to an easing of COVID restrictions and fears that saw consumers returning to brick-and-mortar stores — a boost for Walmart.

Amazon was (and is) the undisputed champ of online sales, with 45% of the market versus Walmart’s 5.4%. Again, we saw Amazon’s rule extend to sporting goods, hobby items, music and books (56%), electronics and appliances (54%), and health and personal care (43%).

Read more: The Battle For Consumer Retail Spend: Amazon Versus Walmart Q2 2022 — The Discretionary Spend Play

Third Quarter Surprises

By the third quarter of 2022, things had gotten interesting. And a little weird.

PYMNTS reported in November that “shares of Amazon are down nearly 20% since the Seattle-based retail and the cloud-service company reported disappointing Q3 earnings…at a time when Walmart’s stock is flat, leaving it with a $380 billion market cap that is roughly 2.5x smaller than the $930 billion valuation of Amazon. Zoom out to three months, and the distortion is even greater, with Amazon down 35% and the Arkansas-based retail giant up 8%.”

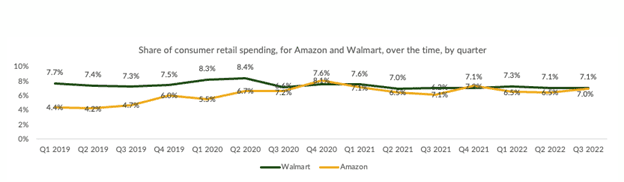

In a preview of striking data from the forthcoming Q3 Amazon Versus Walmart report, there’s this: in Q3 2022, Amazon accounts for 7.0% of Consumer retail spending, and Walmart 7.1%.

Get the Report: Amazon Versus Walmart Study Shows Who’s Winning Consumer Retail Spend