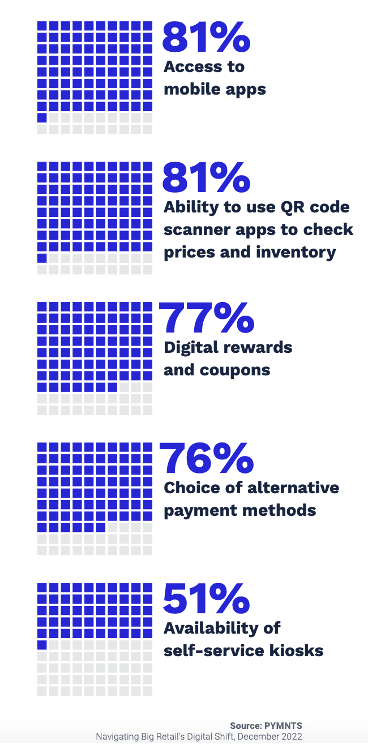

Consumers have five digital shopping features on their wish list that they want from stores.

The question, however, is whether retailers will fulfill that wish, and in turn provide the type of experience that keeps customers coming back and spending more.

According to findings in PYMNTS and ACI’s new report, “Navigating Big Retail’s Digital Shift,” these emergent features can successfully add continuous value to consumers throughout their shopping journey by removing frustration points and friction areas.

Not surprisingly, access to mobile apps (81%) landed on top of the list, but perhaps more unexpected was the equally strong demand for multi-functional QR Code usage which also registered at 81%.

Roughly three-quarters of respondents named digital rewards and coupons (77%) and choice of alternative payments methods (76%) as features consumers now expect to see when they shop in-store, with just about half (51%) mentioning self-service kiosks for a speedy checkout.

It’s worth noting that the top five solutions are all, in some way, tied to in-app experiences, real-time payments, self-service options like scan and go or kiosks, loyalty rewards like digital coupons and prepaid card acceptance, as well as alternative payment options like buy now, pay later (BNPL) and digital wallets.

Additionally, 70% of retail executives surveyed by PYMNTS believe that preferences for “specific conveniences” may result in consumers favoring one merchant over another, making it mission critical for merchants to provide key feature in-store that act as drivers for shopper loyalty.

Merchants Meet Modern Expectations

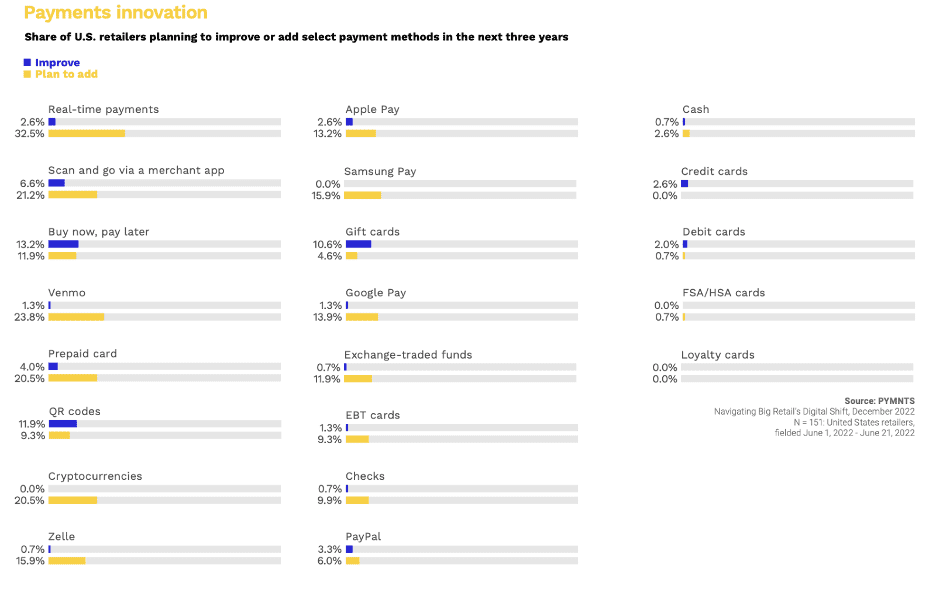

Offering the right array of payment choices is key to customer retention and business growth. Over half of retailers in both the U.S. and U.K. either currently accept real-time payments or plan to soon. A powerful and innovative tool, leveraging real-time payments can help merchants design transactions that meet, and even exceed, growing consumer expectations around convenience and speed.

Removing in-store friction for customers via merchant-based scan-and-go solutions as well as other self-service tools like checkout kiosks were reported as a strong priority for U.S. and U.K. businesses looking to improve their in-store payment experience.

Retailers increasingly believe that mobile-first and tech-powered solutions allowing customers to handle checkout on their own through frictionless digital payments experiences are essential to retaining customers.

Ongoing Digital Transformation

In fact, PYMNTS research finds that over 66% of retailers are shifting resources toward more convenient payment options and a broader range of payment choices.

This digital transformation is ongoing, and arguably still in its early stages of adoption across today’s commerce landscape. In the U.S., 30% of retailers surveyed believe they “lack the right mix of digital tools” to meet the experience their customers have come to expect, while across the pond in the U.K. that number jumps up slightly to 37% of retailers.

Providing customers with the means for a connected payment experience simultaneously creates opportunities for merchants to further personalize the checkout journey and enables businesses to tailor their recommendations and offer personalized rewards, coupons, and discounts that encourage greater loyalty and engagement across their overall brand ecosystems.

The ability to shop using QR codes provides a two-way flow of valuable information and gives merchants shopping data around product selection and shelf engagement.

Most retailers surveyed by PYMNTS have leveraged or plan to use omnichannel customer data, including purchasing trends, to gain further insights on improving their customer experiences.

Those merchants looking to capture next-generation spend by implementing new features should focus most on aspects surrounding the utility, context and value-add of these payment solutions for their consumers.

It is essential for retailers to remove friction from the in-store purchase journey at certain key customer touchpoints, such as checkout.

Better payment choices, be it the acceptance of digital assets and cryptocurrencies, or a more standard mobile wallet acceptance like Samsung or Apple Pay, even traditionally alternative options like prepaid cards, can help merchants retain and attract customers who are looking for these options when they shop. Customers who don’t have credit or debit cards likely already find it hard enough to shop, and by accepting prepaid cards or other options, merchants can tap into this audience.

As a general rule, in-store priorities should always match the wants of a merchant’s core audience.

Merchants considering integrating these innovations should remember that their applications must respond to a demonstrable need, such as shorter lines or better payments choice, as certain consumer segments may not be ready or comfortable to use innovations like scan-and-go, much less want to pay with cryptocurrencies.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.