The Data Point: Amazon Takes 25% of Hard Goods Share as Walmart Eats 18% of Food and Beverage

Clash of the titans. It’s an apt descriptor for the battle between America’s two retail giants which has come to symbolize the tug-of-war between in-store and eCommerce sales.

For the latest in our long-running coverage of the Amazon versus Walmart battle for retail primacy, “The Ongoing Battle for Consumer Retail Spend: Amazon Versus Walmart Q1 2022: The Grocery Wild Card” we focus on two findings illustrating the relative strengths of each based on two battleground categories: hard goods like appliances, and the food and drink we store in them.

Get the study: Amazon Versus Walmart Q1 2022 – The Grocery Wild Card

“The world in which Walmart and Amazon launched has changed many times over, and business strategies are evolving to match not only profit benchmarks but the changing global marketplace,” the study stated. “As Walmart adopts new consumer experience features designed to match and even exceed Amazon’s strengths, and the latter maintains and even grows its market share in many categories through efficiency and product availability, competition w

ill only become more intense — and consumers will benefit regardless of the victor.”

The following data points give a sense of where the epic rivals respectively shined in the first quarter.

- Amazon takes 24.5% of appliance and electronics market share versus Walmart’s 5.1%.

On the rise since pre-pandemic days, Amazon’s dominance of hard goods like electronics and appliances keeps surging past that of Walmart, as consumers grow more accustomed to making big-ticket purchases online of items that once required in-person inspection.

“Amazon holds more than four times the appliance and electronics market share of its closest competitor, Walmart, with all signs of continued growth in the category,” according to the report.

“Even during the early stages of the pandemic, Amazon’s control of the appliance and electronics market surged,” the report stated. “It rose from 21% in 2019 to 25% in 2020, while Walmart’s market share remained flat at 5.7%. Though both saw a dip in market share in 2021, Amazon’s market share was nearly five times that of Walmart’s.”

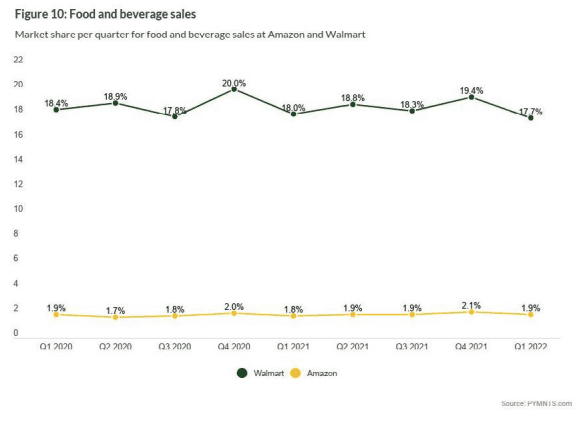

- Walmart’s 17.7% of food and beverage share trounces Amazon’s 1.9% share.

Walmart’s strong suit versus its Big Tech opponent is food and drink, where the Bentonville behemoth still holds a massive lead that Amazon is chipping away at, with far to go.

Easily besting Amazon in food and beverage, others pose more of a threat.

“Walmart’s food and beverage dominance is substantial but at risk: Walmart’s 18% segment share is slipping steadily,” the study stated. “Amazon currently holds a 1.9% share, which includes Amazon’s sales via Whole Foods Market. However, it has other formidable challengers in the space like Target and Costco, offering low-cost general merchandise, rapid delivery and convenient local retail outlets.”

See the study: Amazon Versus Walmart Q1 2022 – The Grocery Wild Card