At this point, the lack of product selection amid an inflationary environment has a chicken-and-egg feel to it. As reported earlier this month by The Wall Street Journal, merchants and manufacturers across nearly all retail sectors have hit the brakes on new product lines and innovations. At first, this pause was likely due to the pressures of navigating a new economic and societal reality, yet it has continued as the sector adjusts to an economic slowdown and consumers’ deal-seeking behavior.

New product lines, as WSJ points out, can take months or years to fully bring to market. As businesses across industries shed excess expenses in recent months, cutting innovation investment (especially for unproven products) makes sense in the short term. However, the cost-saving strategy may be doing more harm than good in the long term, as a lack of new offerings gives consumers little inspiration to buy more than the essentials.

And essentials have been the priority as the cost of living continues to outpace wage growth, meaning that industries relying on discretionary spend are vulnerable. For example, spontaneous clothing purchases seem to be taking a backseat, as noted in PYMNTS’ collaboration with LendingClub, “The Paycheck-to-Paycheck Report: Year in Review.”

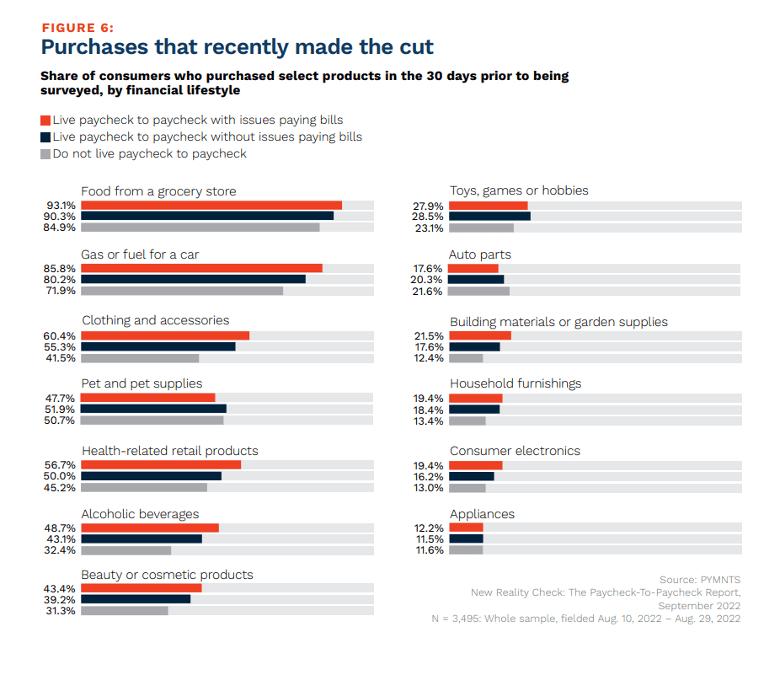

Clothing can fall into both discretionary and essential purchase categories, and the distribution of consumers who recently purchased clothing or accessories tells a story. The highest share in this late summer data does not reside among the most financially stable consumers but among the most precarious: those living paycheck to paycheck with issues paying bills, at 60%. Although it is speculation, one would expect those who do not live paycheck to paycheck to treat clothes as discretionary and those who struggle financial to consider clothes essential; the odds of these consumers making likely essential purchases vastly exceeded the corresponding shares of consumers making likely discretionary purchases. And although this data is from late August 2022, consumer sentiment is not massively changed, with many expecting a recession on the horizon.

Previous PYMNTS research suggests that in the current economic climate, once-loyal customers are turning into agnostic deal-chasers in the name of stretching limited incomes. Without new or innovative products, there may be little extra incentive for consumers to shift this cost-cutting behavior.

This is where the chicken-and-egg metaphor applies. Because sales are slow, merchants and retailers have an inventory overload, leading to markdowns and cost-cutting. This cost-cutting can lead to less product innovation, and in the case of Hanes and Champion, less inventory overall as most retailers and brands focus on meeting the consumer demand for essentials. While savings is the main factor, there may be a secondary driver of consumers not seeing new products, lines or trends to aspire or save to purchase as well. With less inventory and less choice, consumers may be less inclined to shop when they do have extra cash if there’s not much difference between what’s on the rack and what’s already in their closet.

Some retailers and brands have broken out of this cycle by innovating. American Eagle earned its second-highest revenue, for example, in Q4 2022, due to an expansion of its activewear line. The company’s $507 million gross profit increased approximately 4%, from $489 million during the same time the previous year. Other clothing and fashion brands have turned to the beauty sector to introduce new products. H&M recently announced its foray into the beauty industry with the release of a new skincare and body care line aimed at Gen Z customers, while Stella McCartney is launching a sustainable beauty line.

Is a lack of product choice purely to blame for the slump in retail clothing sales? No. But if consumers aren’t offered new products they want, rather than need, retailers may discover that essential clothes are all that shoppers buy.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.