Consumers’ Call for Convenience Could Spark Self-Service Checkout Expansion

Non-grocer retailers can seize a renewed opportunity to satisfy customer demand by exploring self-checkout as new tech options come to market.

Since at least 2018, consumers have been clamoring for self-service technology when it comes to the retail in-store checkout experience. At the time, PYMNTS’ survey data revealed that 28% of U.S. consumers said they were more likely to shop at a non-grocer merchant if self-checkout was available and 20% were interested in completely self-service stores. Although there were some pandemic-inspired moves toward cashierless registers and touch-free tech by retail giants such as Walmart, widespread adoption of this tech never caught on. Then, legacy systems that in some cases are decades old and would take millions to modernize seemed to do just fine as shoppers returned to stores once widespread lockdowns were lifted.

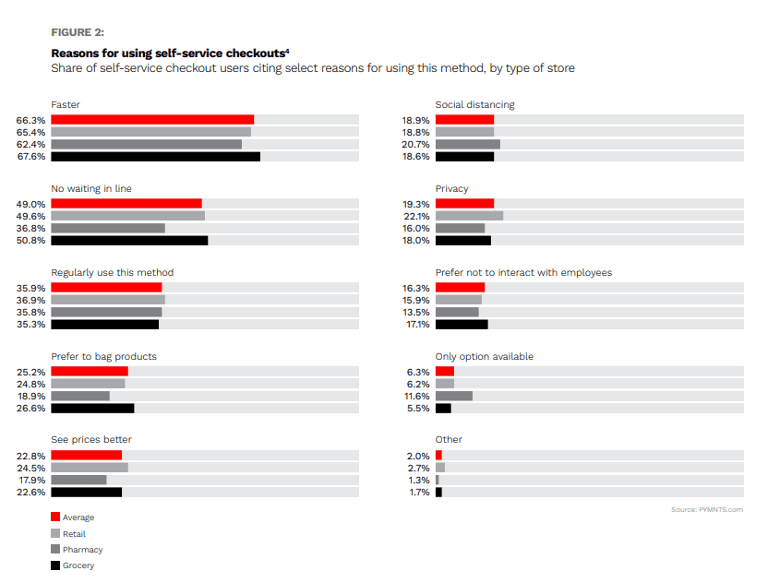

Customers are now choosier about where to spend their discretionary dollars. This customer want, along with other retail-related digital wishes, has continually increased over the past five years. The reasons driving this demand have also remained consistent, as demonstrated in the latest PYMNTS/LS Retail collaboration, “Innovating the Retail Checkout Experience.”

These drivers are consistent with additional PYMNTS findings on consumer motivations behind adopting retail-focused digital innovations overall: namely, convenience and ease-of-use. Given the current economic landscape, retailers may consider rethinking self-checkout options as a loyalty tool to increase the chances of return revenue with the added benefit of possible cost-cutting.

There is good news for the 21% of surveyed retailers considering implementing more modernized self-service checkout options such as scan-and-go systems over the next three years. More FinTechs and other digital partners than ever are focusing products on assisting merchants in bringing these innovations in-store. Blurring the lines of in-store experiences and eCommerce tools may make for a more frictionless customer experience, especially when it comes to checkout transactions.

Petur Sigurdsson, product director at LS Retail, spoke about this cross-channel approach during a PYMNTS interview. “Customers now expect a seamless experience across all the merchant’s touch points. The concept of unified commerce is really of essence here… Instead of trying to erase the feeling of crossing channels, we would rather ensure that all of the data and all of the features are available on all of the channels, thereby removing the perception of these disjointed silos.”

Similarly, NCR has been reaping the rewards from its mission to help “run the store, run the restaurant and run self-directed banking.” With retail-focused self-checkout software that includes mobile app pay and remote attendant tools, the company FY2022 filings noted self-checkout revenues were up $1 billion, representing a 3% year-on-year rise.

Biometrics, and especially facial recognition, have been driving more futuristic approaches to self-service checkout. Last month, Toshiba and PopID announced a partnership integrating PopID’s face-scanning biometric solution with Toshiba’s point-of-sale (POS) and self-checkout systems. Facial recognition has been gaining popularity in the MENA region, where use cases have risen amid soaring demand. That includes regional retailer Carrefour, which earlier this month rolled out facial recognition as a means of payment in its stores.

As self-service checkout options for retailers expands past kiosks, merchants may consider these innovations for both customer satisfaction and cost-cutting benefits. In this ultra-competitive consumer environment, it may be time to dig in and re-evaluate holding on to legacy systems such as traditional checkout methods.