Thinking Small Might Be Retail’s New Big Trend

Merchants are embracing smaller footprints in a greater effort to cut costs and renew customer focus.

Marking a significant shift in retailer strategy, major stores determined to adapt to the reality of today’s economic landscape are overhauling their brick-and-mortar approach. The move is being spearheaded by Macy’s, which is branching out from the traditional mall format in favor of the smaller strip mall format after investors voiced concerns of department stores becoming obsolete. In response, the company is leaving behind declining malls for smaller locations, dubbed Market by Macy’s. In these storefronts, the retailer will feature a more curated inventory than in their larger locations, focusing on apparel, shoes, handbags and beauty items with prices reflecting the smaller scale.

Macy’s isn’t the only household name adopting this strategy. Nordstrom announced it would be opening nine new Rack stores even as it closes its larger locations and leans into deep discounts. With its long-established physical footprint, the recently reopened NYC mainstay, Century 21, is instead streamlining its inventory away from less profitable offerings. Foot Locker is also abandoning malls as the shoe retailer struggles to find the right mix of omnichannel offerings for its customers. Even historically huge stores such as IKEA and Big Lots are getting into the trend.

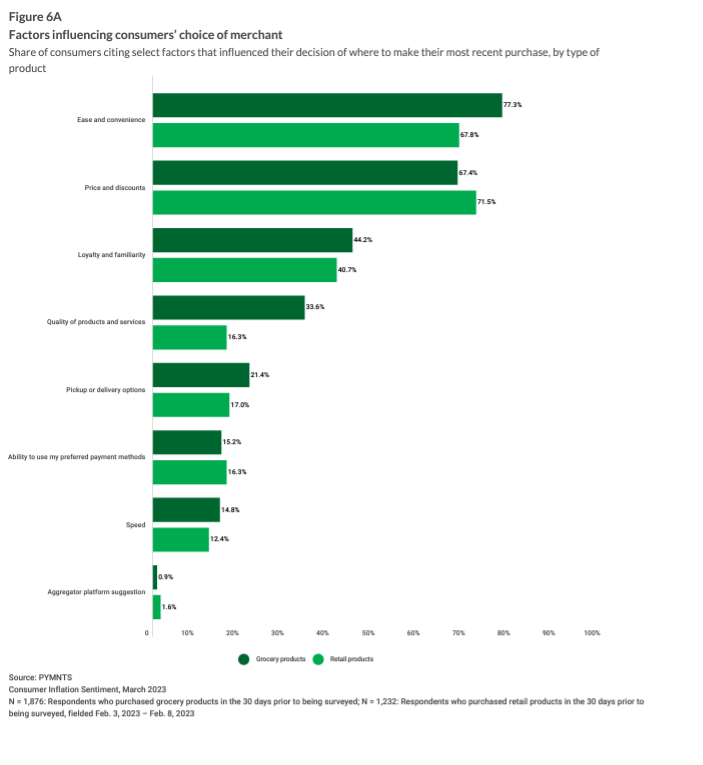

And as illustrated in the March PYMNTS “Consumer Inflation Sentiment” report, these retailers may be on to something.

It is pretty clear that consumers continue to cherish convenience and ease along with discounts and more affordable prices — factors that smaller merchants may be better able to appeal to. While those responses may not seem revelatory on the surface, it is also notable that so many retailers are making these moves to reflect this consumer behavior instead of expecting shopper habits to bounce back after some uncertain normal presumably returns.

With a main focus of slimming down in order to reduce overhead, retailers are meeting their customers where they are. Instead of expecting shoppers to come pouring through their doors as was common during the golden era of malls, this more realistic approach to current shopper habits may put these forward-thinking brands ahead of the competitive curve.

After all, even when prices do start to better meet wages again, there’s still eCommerce and cross-border merchants to compete with. With their refocused efforts, brands such as IKEA and Nordstrom may find themselves better positioned to meet whatever economic future lies ahead.