62% of Large Banks Report Increases in Financial Crime

Fraud’s rise has touched the majority of businesses and financial institutions (FIs) — and many are struggling to find ways to address the increasing sophistication of criminal attacks.

While our researchers learned that FIs that use AI-powered anti-fraud and anti-crime solutions experienced lower levels of loss to fraud and crime, PYMNTS’ survey also revealed that complex regulatory requirements challenge 66% of executive respondents. Even though 95% of anti-money laundering (AML) executives highly prioritize innovation, difficulties integrating new solutions to their existing systems inhibit 85% of executives.

“The State of Fraud And Financial Crime In the U.S.,” a PYMNTS and Featurespace collaboration, examines how fraud and other financial crimes impact FIs and explores how they fight back against increasingly sophisticated attacks. The report is based on a survey of 200 executives working at financial institutions with assets of at least $5 billion conducted between April 29 and June 3.

A fear of Solution Complexity Limits Innovation

Research shows that FIs implementing modern anti-fraud and anti-crime solutions avoid the higher financial loss experienced by those using legacy methods. Still, some FIs are hesitant to modernize their approach. Worse, because criminals are ramping up the intensity and scale of their financial attacks and, in some cases targeting customers directly, many FIs, even those with comprehensive anti-fraud and AML strategies, may struggle to avoid pervasive losses without a modern tech solution.

While the imperative for modernization would seem to compel FIs to adjust their approach to defending their organization quickly, many prefer to use legacy technology despite the risk.

According to the report, the most modern forms of financial crime, which include scams presenting as authorized payments or new money-laundering methods, often elude traditional protections. Data shows, however, that organizations can successfully thwart these strikes by using real-time data and analytics powered by machine learning (ML).

According to the report, the most modern forms of financial crime, which include scams presenting as authorized payments or new money-laundering methods, often elude traditional protections. Data shows, however, that organizations can successfully thwart these strikes by using real-time data and analytics powered by machine learning (ML).

We found that the executives surveyed who did not adopt modern AML and anti-fraud strategies did so not because there were no available technical solutions that they could integrate with their existing tech stacks or strategies but because they were convinced that doing so would be too difficult.

Smaller FIs Suffer the Greatest Harm

Smaller FIs tend to bear the brunt of fraud and other financial crime attacks, according to the report. This makes them not only the most subject to losses but also the most likely to experience financial harm — which, by nature of their size, they are the least capable of absorbing.

We found that 62% of all FIs experienced an increase in financial crime, and an even greater share of smaller FIs — those with between $5 billion and $25 billion in assets — experienced such an increase. Smaller FIs were also most likely to have faced an increase in the dollar value of fraudulent transactions.

Other findings include:

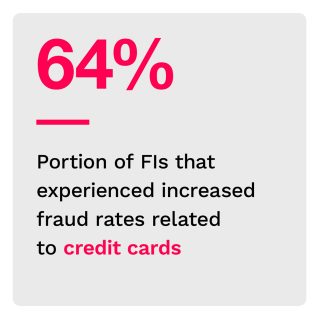

• Fraud rates increase for all payment methods, especially credit cards.

Nearly two-thirds of FIs reported an increase in fraud attacks using credit cards. This occurred in tandem with an overall increase in fraud for most FIs: 32% of firms saw an increase in fraud rates related to payments made with Venmo, and 51% of firms saw an increase in fraud rates related to payments made with Zelle.

• Criminals’ approaches are becoming more sophisticated, and most FIs consider this a problem.

Our research showed that most FIs saw criminals increasingly using sophisticated methods to target their organizations and clients as a significant problem in their efforts to fight financial crime. Approximately one-quarter of the largest FIs by asset size consider this the most important challenge they face.

• AI- and ML-based solutions are proving to be effective.

FIs that employ ML- and AI- or cloud-based platforms to limit fraud attacks had the smallest shares of transactions that led to fraud losses among respondents to our survey. This underscores the rise in interest among FIs seeking to integrate ML and AI-based anti-fraud solutions into their tech stack.

To learn more about how FIs are fighting fraud and financial crime, download the report.