22% of Mid-Sized Firms Anticipate Reduced Payments Fraud With AP/AR Automation

With advancements in artificial intelligence and robotics, firms are banking on automation not just to boost efficiency but also to bolster their resilience in navigating market uncertainties, especially in handling critical financial functions like accounts payable (AP) and accounts receivable (AR).

Technological progress holds the promise of substantial improvements, offering a lifeline for businesses striving not just to survive but to flourish despite economic headwinds.

In “Accounts Payable and Receivable Trends: What’s Next in Automation,” PYMNTS Intelligence used insights from a survey of over 400 executives to assess the investments that mid-sized businesses have made or plan to make to automate their AP and AR processes and the anticipated benefits they can derive from these advancements.

Findings detailed in the report revealed that mid-sized firms are increasingly turning to automation to streamline their AP and AR processes, with a growing emphasis on efficiency, accuracy and scalability.

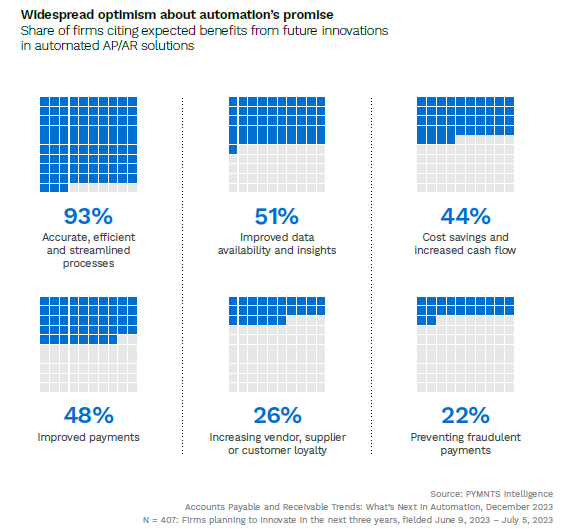

Specifically, 90% of mid-sized firms — those generating between $3.5 million and $15 million in annual revenue — planning to automate their AP and AR processes expect to achieve more accurate, efficient and streamlined operations.

Additionally, automation reduces the time and labor involved in processing transactions, leading to greater savings and increased cash flow for 44% of these firms. By minimizing the need for manual intervention, automation also helps cut labor costs and reduce errors.

Further data analysis showed that 51% of these mid-sized firms anticipate improved data analysis and trends because of automation, which provides real-time visibility into financial data. This enhanced data availability empowers better cash flow management and more accurate financial forecasting, enabling informed decisions and driving growth.

Another key advantage of automation is its role in preventing fraudulent payments. Twenty-two percent of mid-sized firms anticipate a marked improvement in preventing fraudulent payments through the automation of their AP or AR processes, highlighting the importance of automation in safeguarding financial transactions and shielding businesses from potential fraud risks.

Separate research by PYMNTS Intelligence found that 1 in 3 FinTech and Big Tech firms identify the rising complexity of fraud schemes as a significant hurdle in combating fraudulent activities. Automation and newer technologies emerge as promising solutions to address and mitigate these increasingly intricate fraud challenges.

Automation not only benefits internal processes but also improves relationships with suppliers and customers. Mid-sized firms anticipate better supplier and customer relationships through prompt payment processing, potentially leading to better terms and enhanced satisfaction. Embracing full AP automation can further enhance vendor relationships, leading to improved negotiation terms and supply chain stability.

Automation is crucial for mid-sized firms navigating economic headwinds, especially since businesses that have not automated any processes anticipate slower growth. This suggests that automation plays a role in scaling business operations and enabling expansion even amid challenging economic conditions.

Against this backdrop, firms hesitating to fully embrace this transformative technology stand at a crossroads; unlocking its full potential is no longer an option but an imperative for sustained growth and resilience in the face of evolving economic dynamics.

For all PYMNTS Digital Transformation and B2B coverage, subscribe to the daily Digital Transformation and B2B Newsletters.