New Report Finds Embedded Payments Now Table Stakes for Software Companies

Improving customer experience has become a market trend across industries. Companies strive to improve payments and cater their businesses to customer bases that value easy buying experiences enabled by the latest technologies. In doing so, businesses also strive to find ways to access markets quicker, allowing them to increase market share through planned growth. Embedded payments address these needs and interests.

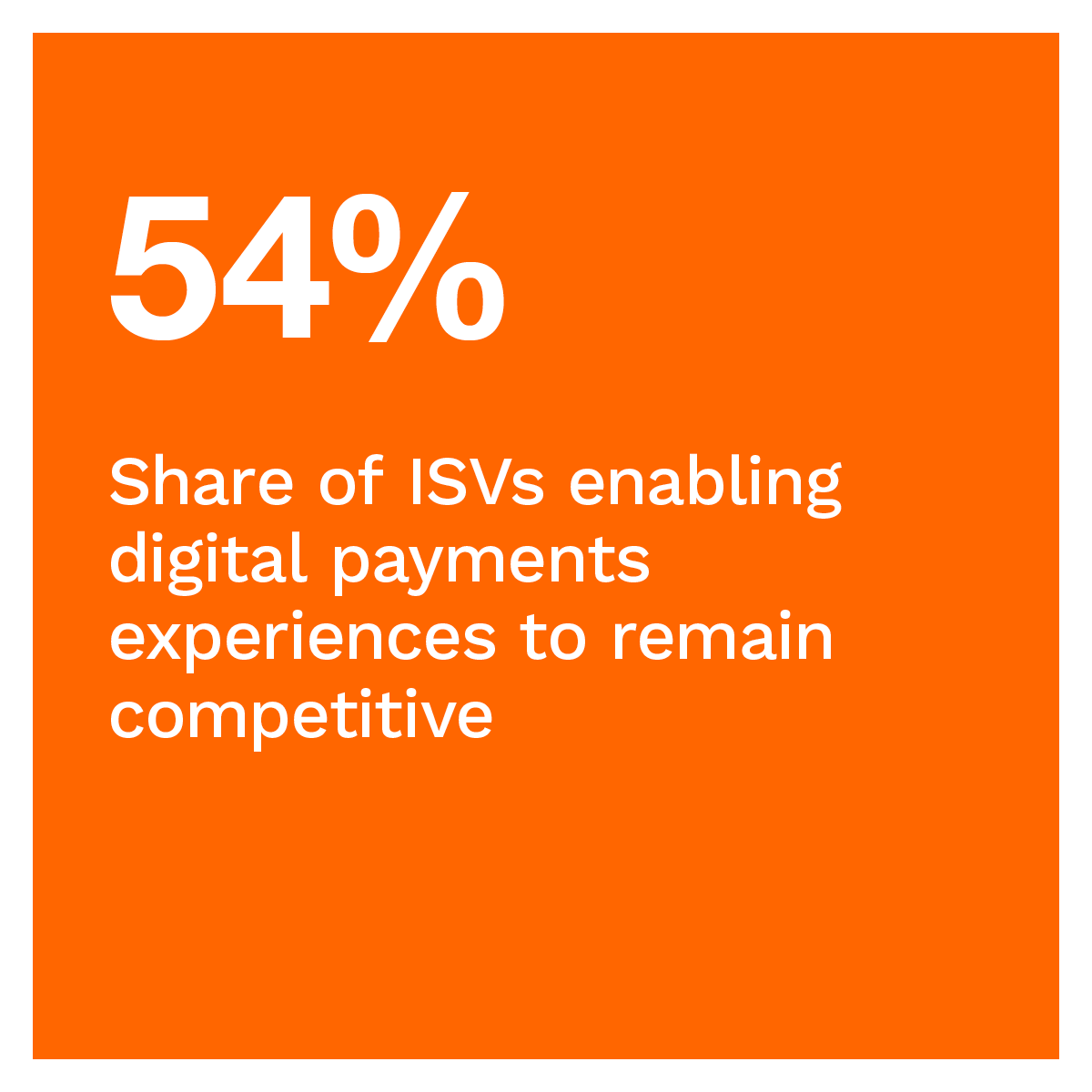

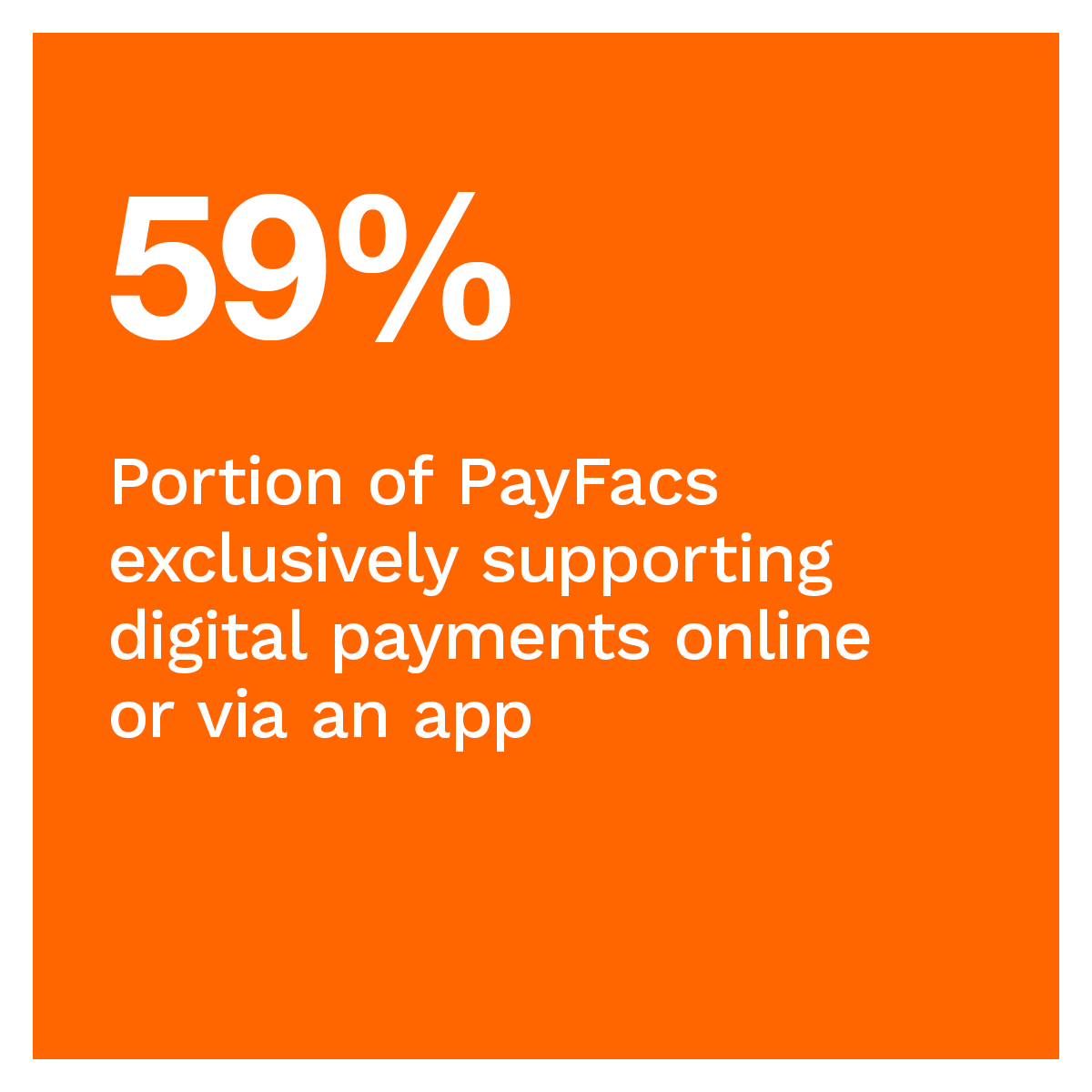

The drive to improve the customer payment experience involves the efforts of three market participants that serve as payment facilitation providers: marketplaces, payment facilitators (PayFacs) and independent software vendors (ISVs). These providers have unique characteristics that make them stand out in their respective market niches.

These are just some of the findings detailed in “Platform Business Survey: The Rise of Embedded Payments,” a PYMNTS Intelligence and Carat from Fiserv collaboration. This report explores the characteristics, sentiments, and behaviors of PayFacs, marketplaces and ISVs. We surveyed 282 executives between May 10 and Aug. 25 to determine how they facilitate payment processes for their customers.

Other findings from the report include:

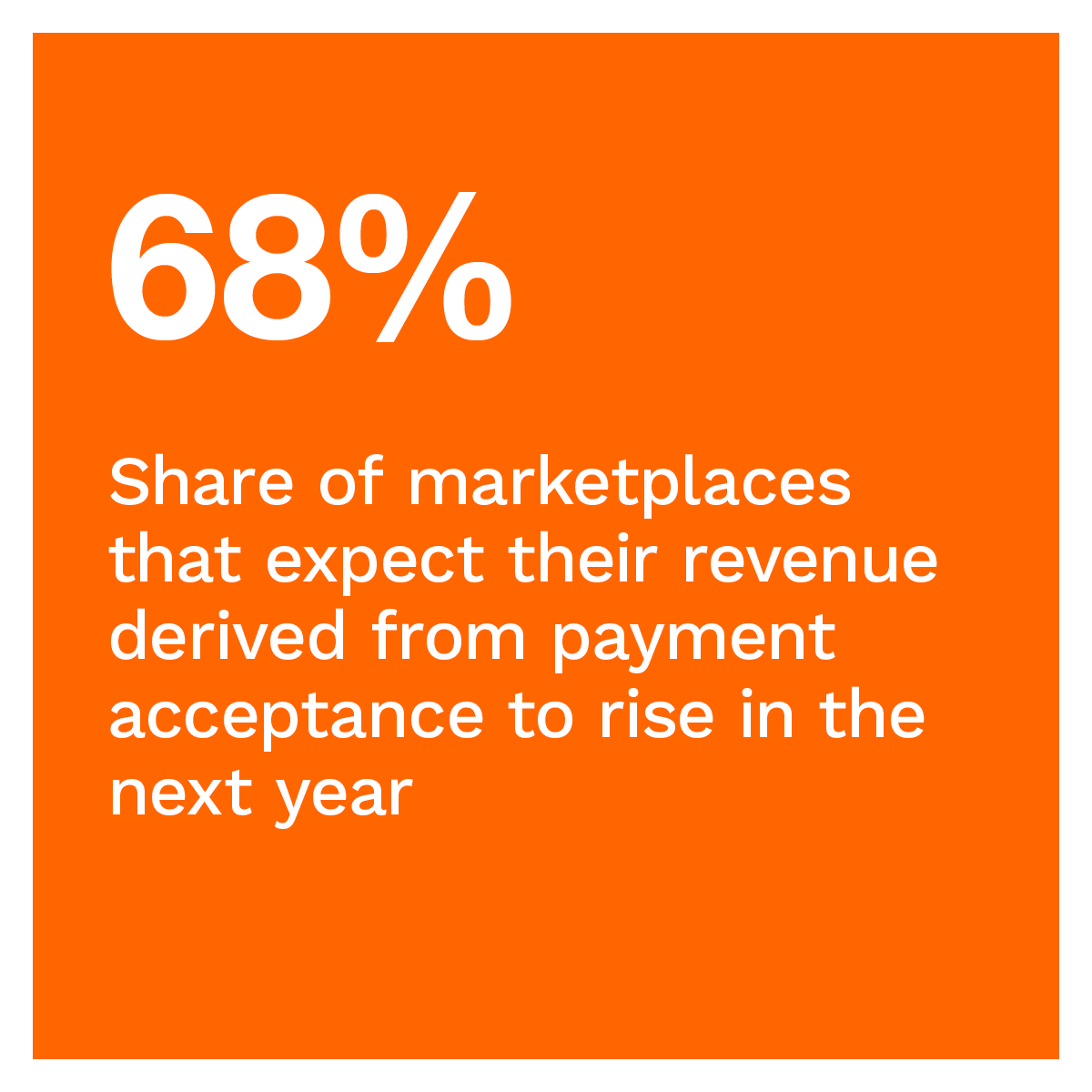

ISVs and marketplaces view payments as additional revenue sources, with two-thirds planning to add or enhance embedded payments in the next year.

The ability of companies to create new sources of revenue is paramount, and payment features are increasingly entering the spotlight as one way to do so. Data shows that 65% of ISVs and marketplaces not currently offering payment capabilities plan to add embedded financial products for payment acceptance next year. They would join the approximately three-fourths of ISVs and marketplaces already offering payment capabilities and plan on enhancing their embedded financial products within the next year.

The ability of companies to create new sources of revenue is paramount, and payment features are increasingly entering the spotlight as one way to do so. Data shows that 65% of ISVs and marketplaces not currently offering payment capabilities plan to add embedded financial products for payment acceptance next year. They would join the approximately three-fourths of ISVs and marketplaces already offering payment capabilities and plan on enhancing their embedded financial products within the next year.

PayFacs estimate that value-added services, such as installment payments and invoicing, will account for half of their projected revenue next year.

PayFacs believe that if they enable embedded finance products and value-added services, such as chargeback dispute management, 51% of their revenue will come from these sources next year. This increase in the projected revenue share will be particularly important for PayFacs serving wholesale trade or logistics companies — they project that the revenue share coming from value-added services will be roughly 55%.

Marketplaces and ISVs say economic uncertainty will be the main challenge next year. PayFacs say workforce-related challenges will be their most pressing issue.

ISVs and marketplaces are concerned about economic uncertainty, especially with fears of a potential recession in the next 12 months: 30% of ISVs and marketplaces identify this as the biggest obstacle to their success. PayFacs, on the other hand, point to workforce challenges and inflation as top concerns. Data shows that 17% of PayFacs experienced difficulties hiring qualified employees and reported it as a top operational obstacle. The same share reports persistent rising prices due to inflation as their biggest challenge.

Payments digitization is a natural progression in improving the customer experience when it comes to payments. The experience payment providers deliver to their customers may determine their market viability and medium- and long-term growth prospects. Download the report to learn more about how payment providers are offering embedded payments to address their customers’ needs.